It’d be an understatement to say that the last two years have been confusing.

Very little has made sense.

Governments and central banks have irreversibly wrecked the global economy by crippling the supply chains and jamming trillions of dollars into the system.

That’s like clogging your pipes with cement and then pumping water through them at high pressure.

Either the pump breaks or it’s the pipes. But you can be sure it’ll leave a big mess.

On one hand, the government stimulus meant that households and businesses were busy piling the extra liquidity into various asset markets. On the other, a decline in business activity meant that there are less goods and services circulating in the economy.

This has resulted in inflation at levels unseen for more than a generation. Cash was increasingly worthless unless one invested it somewhere. Thus, you saw markets rally hard in literally everything.

It was apparent that this couldn’t continue. Central banks initially talked down inflation for a couple of months last year, calling it ‘transitory’. Then they changed tack and said it’d last a bit longer as it seems that words fell on deaf ears. Their rhetoric became more ominous as it translated to a clearer message that interest rates would rise and the central banks would begin to reduce the currency supply.

The markets started to retreat last November. Those chasing the rally gradually saw that the bubble was sagging. Each sell-off was followed by a weaker rally.

In hindsight, you could see that November 2021 marked the top of the rally arising from the central planners stemming from the damage caused by the Wuhan virus-induced economic shutdown.

The Federal Reserve kicked off the rate rise cycle in March this year, accelerating its pace.

The era of easy cash is clearly over.

So are we heading for further declines?

For sure!

Bracing for impact

The Reserve Bank of Australia (RBA) has followed suit with other central banks in raising interest rates. The latest 0.5% rate rise on Tuesday brings the 24-Hour Cash Rate to 2.35%. The last time it was at this level was in 2015.

In a matter of five months, our interest rate rose from 0.1% to 2.35%. For many households with a mortgage, this would add thousands of dollars to their monthly mortgage payments.

Throw into the mix higher prices for daily needs, utility bills, and filling up the car.

The amount of disposable income that a household can set aside for savings and investments is clearly going to shrink.

Businesses are facing similar problems. The cost of doing business and paying salaries and wages is rising fast. The minimum wage has increased to $25 an hour recently, and even that isn’t enough to attract people to work. You may have noticed that many businesses are putting up signs telling customers to be patient as there is a shortage of staff to serve them.

This is a clear sign that the economy is teetering on the brink.

To make things worse, our government has also announced that it cannot afford handouts without causing the RBA to keep raising rates.

This could mean our stock market could see its gains from the stimulus-driven binge over the last two years wiped out in the coming months.

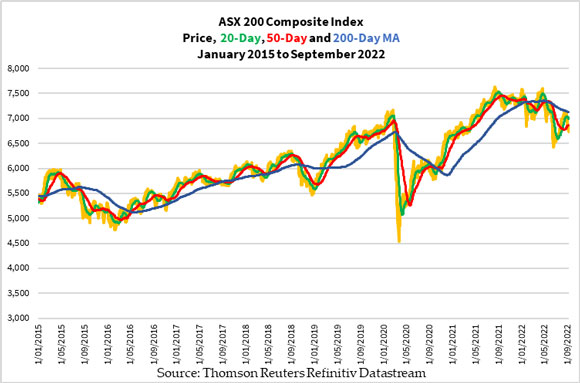

Let me show you the ASX 200 Composite Index [ASX:XJO] since 2016 in the figure below. I have also included the 20-day, 50-day, and 200-day moving average trend lines:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

You can see the markets have rallied strongly for more than 18 months after hitting a low in March 2020. Since its all-time highs in July 2021, it tried twice to break past that level and failed. The resulting dip has also taken it lower.

Take a look at the ASX 200 Index figure above again.

It was trading at 5,000–6,000 in 2015. Now it is in the 6,500–7,000 zone.

While one cannot simply use the interest rate history to deduce the fair value of the equity markets today, we can at least say that we aren’t close to the bottom of the market.

And should things get more difficult thanks to the central banks raising rates and governments standing back to let things fall, you don’t want to be caught in the plunge.

Finding your own lifeboat

Don’t expect anyone to bail the markets out this time.

Especially when those who reached out a helping hand did so to weigh you down further with debt or inflation.

And when you think about what the World Economic Forum has been saying about The Great Reset (I warned about it here) and how central banks want to introduce their own digital currency to track what you do, you should start joining the dots.

They lured the world in with massive amounts of debt over the last decade. Now imagine if they collapse the markets in one fell swoop, causing people to lose everything that they had worked for. A central bank digital currency that plugs itself into their system of tracked payments, a health passport, and personalised carbon footprint could mean the end of liberty as we know it.

Sounds unbelievable?

They’re not really hiding it. They just make it sound hip and trendy for you in terms of saving the planet, defeating the evils of capitalism, and living in a shared economy.

Anyway, if this worries you and you want to plan ahead, we have a solution for you. You’ll hear more about it in the coming days.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia