Today we take a look at three small-cap miners, including the Middle Island Resources Ltd [ASX:MDI] share price.

What a weird night it has been in overseas markets.

The market has certainly conjured up events I would never have dreamed could happen.

West Texas Crude futures traded in the negatives overnight, getting close to -US$40 per barrel.

Meaning traders were paying people to take oil off their hands.

Meanwhile, the gold price has been steadily increasing.

Over the past month we’ve seen a 13.58% increase.

The steady march of gold has been good news for some of Australia’s small-cap miners.

Among a handful of explorers on the up today, three are of particular interest.

Gold (blue) and June gold futures (orange) vs. June WTI futures over the last 12 months

Source: Trading View

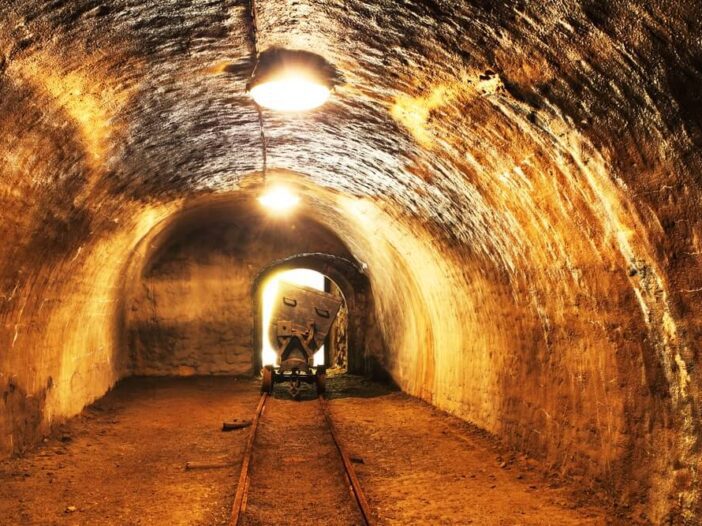

Small-caps striking gold

Middle Island Resources, a Perth based gold exploration company, is up 33.33% to trade at 1.6 cents per share.

The $21.18 million explorer announced this morning a second new gold deposit defined at its Sandstone project in Western Australia after significant drill results.

The news comes only a week after MDI announced bonanza gold intercepts and a 500,000-ounce resource for the Two Mile Hill deposit at the Sandstone project.

Today’s results come from the McIntyre prospect that lies just southwest to the Two Mile Hill Deposit.

Results from the McIntyre prospect show low-grade gold concentration at shallow depths.

Although, this follows close on the heels of significant intercepts of just south at the McClaren prospect, which has indicated extremely high-grade fines of 90.6 grams of gold per tonne.

Discover how some investors are preserving their wealth with gold and even making a profit, as the economy tanks. Download your FREE report by clicking here.

Metalstech Ltd [ASX:MTC], which is typically involved in lithium and cobalt exploration, acquired 100% of the Sturec Gold Project in Slovakia back in November of 2019.

Their share price has steamed ahead by ~27% this morning to trade at 16.5 cents per share.

MTC has stirred up excitement as it announced it would target previously discovered high-grade mineralisation zones.

The Sturec Gold Project has historically produced over 1.5 million ounces of gold and 6.7 million ounces of silver.

The zone MTC has announced for phase one of its drilling program was previously explored by ARC Minerals Ltd [LON:ARCM] back in 2011.

Initial results included impressive intercepts of 23.6 and 16.5 grams of gold per tonne.

Last, but not least, is a miner that has only returned to regular trading back on July of 2019 after a long hiatus.

Resources & Energy Group [ASX:REZ] is a mineral resources explorer, developer and producer, holding mining and exploration tenements in Western Australia and Queensland.

The company’s shares are up 25% this morning, trading at 1.5 cents per share.

While REZ’s news is far more speculative than the previous two, investors seem to be optimistic about initial drilling results at the East Menzies Gold Project in Western Australia.

REZ announced significant gold trends in a historically high-grade gold area.

The adjacent Kore prospect identified mineralisation of 7.1 and 29.2 grams per tonne at relatively shallow depths.

However, it is worth noting that REZ has not physically identified any gold resource.

Initial drilling has only inferred the presence of a ‘gold anomaly’.

Further drilling is needed to confirm the extent and grade of the gold mineralisation.

If you think it’s time to make a gold play but are unsure of the best way to do so, check out our free report on an easy way to invest in gold.

It’s as simple as buying a book on Amazon.

Kind regards,

Lachlann Tierney,

For The Daily Reckoning Australia