One of the things I like about Fat Tail Media and Port Phillip Publishing is that every editor has different ideas and opinions and they are free to write about them.

I think it’s one of the most valuable things about our service. Listening to different perspectives to your own is crucial when you are looking to accumulate and preserve wealth.

It’s why in the last few days you may have noticed that we’ve given centre stage to a message from Catherine Cashmore and Callum Newman on all our free e-letters.

It’s something we don’t do often, but we thought important as they have a completely different view of what could happen to property in the next years from mostly everyone else out there.

If you are interested in finding out more, Catherine’s new e-book The Mid-Cycle Almanac: Your Investing Playbook For 2020-2026 is now available for download.

From today, we are back to our regular e-letter schedule.

So, let’s get to it.

**

Market expert Shae Russell predicts five knock-on effects of the recent market crash that could be even bigger threats to the average investor’s wealth than the crash itself. Click here to learn more.

**

By the time Santiago Nasar was eating breakfast, the entire town of Manaure in Colombia knew the Vicario twins were planning to kill him that day…everyone except him.

Santiago hadn’t slept much the night before he died. He had stayed up for Bayardo San Roman and Angela Vicario’s marriage, celebrating.

There was something else Santiago didn’t know. A couple hours after the wedding ended, the groom had returned the bride back to her family.

Bayardo was upset.

Not because Angela didn’t love him. After all, it was an arranged marriage. Bayardo cancelled the marriage because he had discovered that he wasn’t Angela’s first.

Under pressure from her family to give up the man who had taken away her honour, Angela pointed the finger at Santiago.

Was he the actual culprit? No one really knows for sure. But the Vicario twins spent the night telling everyone they were going to kill Santiago to avenge their sister.

Santiago died the next day right in front of his house, as the whole town watched.

And while everyone knew beforehand what was going to happen, no one did anything to stop it. No one even warned Santiago.

Believe it or not, Santiago’s tale is based on a true story.

‘There had never been a death more foretold,’ wrote Colombian author Gabriel Garcia Marquez, as he retold the story in his novel, Chronicle of a Death Foretold.

The main question the book looks at answering is why everyone knew what was about to happen but no one did anything.

I’ve been thinking about this story lately.

There are talks of a global recession coming everywhere. It’s easy to see why.

Take Melbourne, one of the largest cities in Australia. It is a shadow of what it used to be with the lockdown.

The city is quiet. Offices, cafes, and restaurants are empty. Theatres and cinemas are closed, sports are cancelled, and there are very few students around. Tourists are gone.

It’s a similar picture around cities all over the world.

The Age reports this week:

‘Job advertisements collapsed at their fastest rate on record through April, prompting concerns unemployment could spike even higher than expected. The Reserve Bank and Treasury officials have said unemployment is expected to hit 10 per cent in the June quarter.

‘The closely watched ANZ measure of job ads fell by 53 per cent through last month. It was almost five times the rate of collapse as the previous record of 11 per cent set during the depths of the global financial crisis in January 2009. […]

‘ANZ said ads fell progressively through the month, with the bank noting this confirmed the view that the downturn in activity was hitting businesses and the labour market at an unprecedented speed.’

[conversion type=”in_post”]

A disconnect between the economy and stock markets

Economic indicators are plummeting and no one is producing anything, but global share markets remain unfazed. There is a real disconnect between the real economy and the stock markets.

It’s because different to Santiago’s story above, central banks are throwing everything they can at it to stop the fallout.

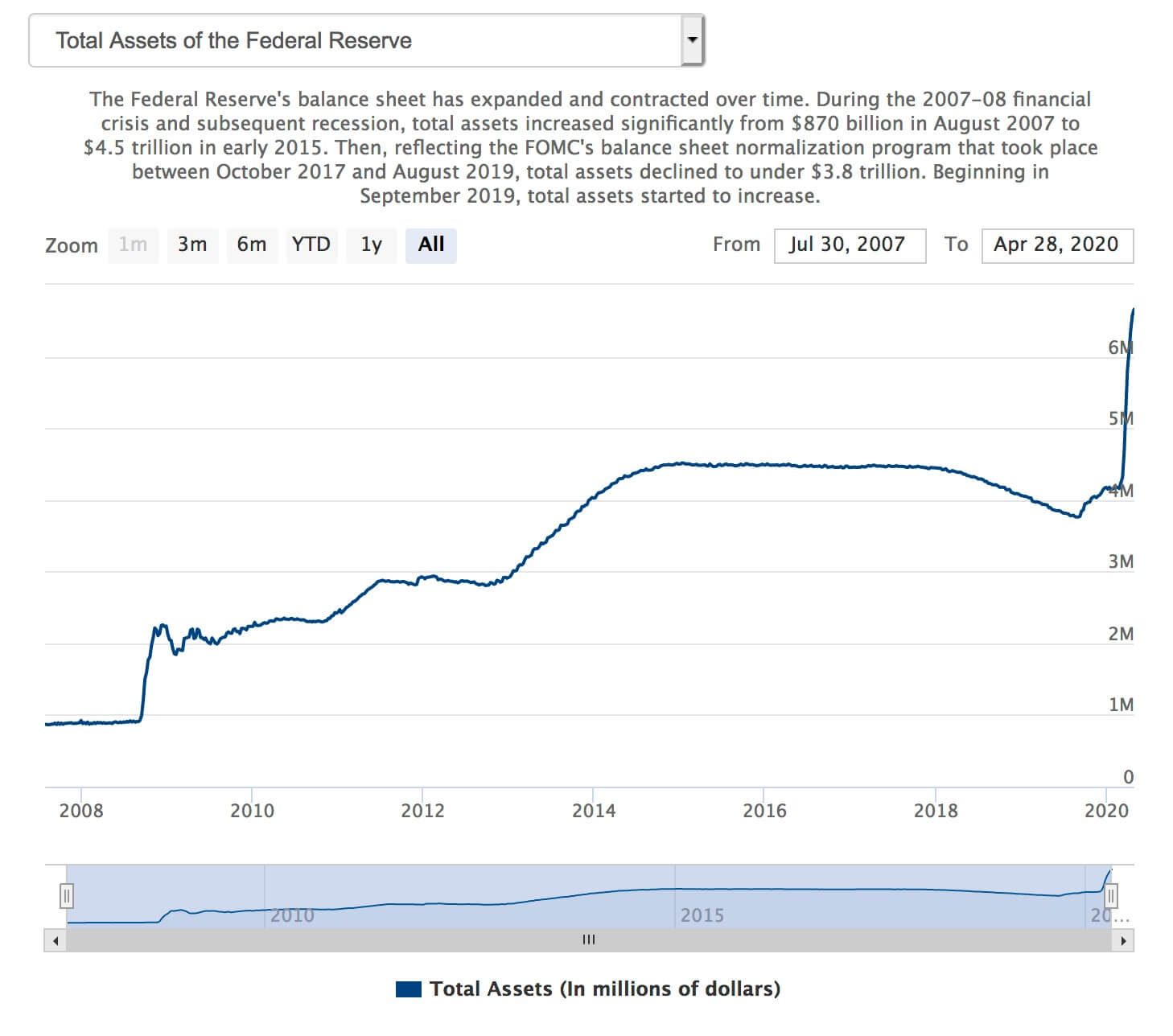

In 2008, the US Federal Reserve started quantitative easing to add money into the economy and lower the cost of borrowing. They increased their balance sheet from US$870 billion in 2007 to US$4.5 trillion by 2015, as you can see below. Back then, it was the property market that was in trouble and needed propping up.

|

|

| Source: Federal Reserve |

They tried a brief return back to normal before stepping it up a notch to support even more sectors of the economy.

From Business Insider:

‘In a matter of weeks, the steadily expanding US economy slipped into its worst recession in nearly a century. Tens of millions of Americans lost their jobs, spending froze, and credit health tanked. While the Fed’s response began with its traditional financial-crisis playbook — pushing interest rates to the floor and buying Treasurys and mortgage-backed securities — a shift was brewing.

‘Then, on March 23, the monetary authority’s role changed. The Fed announced it would begin buying corporate bonds for the first time in its 107-year history, offering aid for cash-strapped businesses large and small. That facility marked a paradigm shift to the central bank’s code and separated the Fed from its originally intended role in the US economy. […]

‘To combat the coronavirus downturn the central bank expanded its toolbox once more. The Fed’s corporate bond purchases were initially exclusive to investment-grade debt before an expansion incorporated so-called fallen angels, companies that recently slipped from high-quality ratings to junk status.

‘In the days following the Fed’s March 23 announcement, corporate bonds retraced sharp declines. The stock market enjoyed an indirect boost, as investors viewed the policy as a strong backstop for risk assets.’

We are in the middle of one of the greatest economic experiments in history. One that could cost a lot more than US$4.5 trillion…and nobody is really sure how all of this will end up.

‘There’s never been a recession more foretold.’

Now, from the people I’ve been speaking with there is a sense out there that with central banks stepping up to the plate the worst is pretty much over. That this will be a short-term thing and the recession will blow over in a couple of months and then everything will return to normal.

In fact, some are even thinking there should be a lot of deals out there already.

From Bloomberg this week:

‘With a record $137 billion of cash piled up at his Berkshire Hathaway Inc., Buffett fielded questions over the weekend from shareholders who wanted to know why he hadn’t acted as companies clamored for liquidity amid the pandemic-related shutdowns. This crisis is different, Buffett said.

‘“We have not done anything because we don’t see anything that attractive to do,” Buffett said at his annual shareholder meeting, which was held by webcast. The deals in 2008 and 2009 weren’t done to make “a statement to the world,” he said. “They seemed intelligent things to do and markets were such that we didn’t really have much competition.” […]

‘“There was a period right before the Fed acted, we were starting to get calls,” Buffett said at Saturday’s meeting. “They weren’t attractive calls, but we were getting calls. And the companies we were getting calls from, after the Fed acted, a number of them were able to get money in the public market frankly at terms we wouldn’t have given.”’

So far, central banks are keeping us afloat.

But I’d strap in for the long haul, it’s likely ‘normal’ isn’t coming back any time soon.

Central banks are throwing everything at it. It remains to be seen if they will be able to stop this. In my opinion, at the forefront of investors’ minds should be looking at what they can do to preserve what they’ve got in the long term.

Get rid of debt and focus and on increasing liquidity.

| Best, |

|

| Selva Freigedo, |

PS: Learn why a recession in Australia is coming and three steps to ‘recession-proof’ your wealth. Click here to download your free report.

Comments