Are you feeling fatigued over all the different narratives of the world facing an extinction-level event?

Let me warn you that it’s entering turbo mode.

Years ago, there was a wild claim about some Planet X that was approaching Earth and could wreak havoc on our planet.

And earlier this month, US Treasury Secretary, Janet Yellen, warned us about ‘X Date’ — the day the US Government hits its debt limit and can’t pay off its loans. This could lead to a market implosion, should Congress fail to raise the debt ceiling (based on her perfect prognosis of course!).

Now we’ve got news from the World Health Organisation (WHO) about Disease X, whose chief Dr Tedros Ghebreyesus claims is deadlier than the Wuhan virus.

Interestingly, this purported ‘Disease X’ is a term assigned in 2018 to a shortlist of diseases that could cause a severe global epidemic. So, they don’t know what it is, but it could be deadly when it hits.

Check it out here.

At the rates we’re going, get ready for the arrival of X-men from outer space!

Just what on earth is happening?

Five years ago, those who believed that the sky was falling, the markets would crash, and mankind was facing an existential crisis were ridiculed as ‘doomers’ and relegated to the fringe of society.

I’m confident that many today would give anything to turn back the clock to 2018. The problems that we faced back then seem more manageable than those looming over us. And the world resembled something more inhabitable than now!

Back then, the world was chugging along. There were many problems plaguing the world — armed conflicts between and within nations, social problems including corruption, wealth inequality, crime, food shortages, and rising costs of living stood in the way of prosperity and development.

You may still remember that the biggest news stories back then were the investigations over President Trump’s campaign colluding with Russia to steal the 2016 election.

Much of those events pale in significance to the existential threats to mankind since 2020.

Clearly the dynamics of the global order — geopolitically, economically, socially, and ideologically — have since turned upside down. Furthermore, those entrusted to address these — governments, international organisations, corporations, academic think tanks, and non-profit groups — aren’t trying to solve problems.

Instead, you might even say they’ve thrown fuel to the fire.

Think about how many Western governments are pushing hard to increase the cost of living through laws restricting fossil fuels and putting farmers out of business to meet climate targets. Farmer protests are now spreading around the world (think the EU, Canada and South Asia) as they realise the dreadful prospect of losing their livelihood over fertiliser bans and potential land seizures.

Not to mention the gauntlet of company executives at Anheuser-Busch, Disney and Nike and many others that are torpedoing their market value with ill-thought-out, haphazard attempts at supporting transgenderism and other radical political messages. These companies have invariably faced massive backlash, causing a sharp drop in sales revenue and profits.

There’s a level of absurdity so profound that many are feeling their heads spin.

It seems these companies are not factoring in the possibility of the public negatively responding to such campaigns before committing to them. They assume such appeals to morality and radical activism are the best for profits. And stupidly, there is no contingency plan for when this is not the case.

Elite capture — the source of corruption

Those who follow Jim Rickards’ work would be familiar with the phrase ‘elite capture’. It’s a military strategy practised for many centuries. It involves capturing your opponent’s leading figures and then using them to destroy themselves.

But how do you achieve this? What can you do to make someone do your bidding by sabotaging their own?

The key is to exploit the weakness of the intended target by using economic and psychological lures, collect the evidence and then use that to blackmail and manipulate the target.

This week, we’ve seen a high-profile example courtesy of Bill Gates.

The Wall Street Journal released a bombshell article revealing that convicted paedophile and hedge fund manager, Jeffrey Epstein, knew that Russian bridge player, Mila Antonova, had an affair with Bill Gates many years ago. Antonova was sponsored by Epstein, and therefore, he could exploit this affair to pressure Gates to donate to his business venture. Epstein also hired several bankers to tailor a market pitch to persuade Gates to support this.

Why is this important?

This is a smoking gun to show you the playbook of how to turn the world upside down if you’ve got enough cash and connections.

You’ve seen in the last few years how much of what the mainstream media has reported turned out to be misleading and deceptive.

And we’ve seen that there’re many people involved in this deception — heads of state, government officials, experts, celebrities, etc. These are people whom many hold in high esteem because they project competence either by way of qualifications and/or influence.

You think they’d know better than to jump headfirst into supporting various narratives and viewpoints without a full understanding, but they have.

Is someone pulling their strings?

At this stage, I can assure you that Bill Gates isn’t the only ‘target’ that fell for this nefarious plan. There’ll be more exposure to come.

Finding safety as the system decays

Just as corporations that infuriate their customer base and the general public are now haemorrhaging value, a corrupt system that’s being exposed will crumble as people abandon it.

There may still be a lot of cash flowing in this system to give the illusion that it’s running strong. After all, haven’t the doomers run out of breath saying it’s all over?

Let me put it this way.

If you don’t know how crooked the system is and you continue to play the game, the fault is on those running the system.

If you know the system’s crooked and you take no precautions, then the blame falls on you.

You don’t need to take everything out of the markets and head for the hills.

But have you got a backup plan and some wealth out of the system?

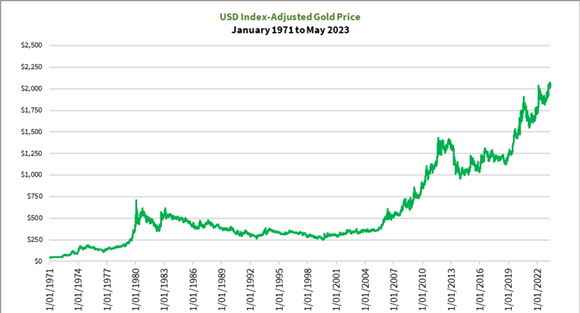

Central banks know that this system is past its use-by date and have been buying gold at record levels since last year. And I believe they’re not about to stop as inflation isn’t slowing down.

Gold may’ve made new records recently, but I believe that there’s a lot more room to run. Check out the long-term history of the price of gold after adjusting for the value of the US dollar by way of the US Dollar Index [DXY]:

|

|

| Source: Thomson Reuters Refintiv Datastream |

It’s clear that gold is on an upwards trajectory, reflecting how the decay of the system is gaining speed.

If you want to find out how to move some of your wealth into safety with gold and gold related investments, check out The Australian Gold Report.

And take that ‘X’ out of ‘existential threat’ while you’re at it!

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia