Last Friday 3.28 million was the most important number.

That’s what my fellow Money Morning editor, Sam Volkering, had to say anyway. Here’s a refresher for you:

‘While you slept overnight the US released figures on weekly unemployment claims.

‘And the number was nothing short of astonishing. Not unexpected, yet still astonishing.

‘Also take note, this is the number of weekly jobless claims.

‘And that number was 3.28 million.’

It was a new record for US unemployment claims. Dwarfing the previous high of 695,000 claims back in 1982.

The first significant statistical indicator of just how bad this ‘corona’ recession will be.

But, as both Sam and I noted, the worst could be yet to come.

As much as it pains me to say it, we were right. In fact, the situation is direr than anyone expected…

In the span of a week another 6.65 million Americans have filed jobless claims.

US unemployment, after the worst spike in history, has effectively doubled in just seven days.

To say this is unprecedented is redundant. The reaction has been both swift and vicious, just like the spread of the virus itself.

So, with that in mind, I would be surprised if we’ve seen the bottom of the market just yet. Because we won’t know the full extent of this ‘crash’ until we have all the numbers.

Credit where it’s due

At this point, there is no arguing against it. There will be a recession.

The US, Australia, Europe…the entire global economy is going to take a major hit. An extraneous downturn that few saw coming.

Call it a ‘Black Swan’ if you want, but labels are pretty meaningless after the fact.

The real issue is that many of us were blindsided by this market downturn. Not all of us though…

Vern Gowdie has been calling the crash for some time now. Holding conviction in his analysis that the legendary bull run up until this year, was coming to an end.

Suffice to say, he called it.

If you’ve ever read any of Vern’s articles or seen him speak though, you’ll know he won’t be gloating. It’s not that he wants to see markets collapse like some permabear nihilist. Quite the opposite, actually.

Vern considers himself a realist. Someone who views markets objectively. And right now, he sees change on the horizon. I don’t have time to go into details, but luckily I don’t have to. You can hear his thoughts in full via a recent interview with Dan Denning. Check it out by clicking here.

As for my thoughts, well I agree with Vern…to an extent.

Clearly change is on the horizon. Not just for those that have lost their jobs, but for the entire financial world. But I don’t think it will be as chaotic as Vern expects.

Yes, jobs will be lost for good. Businesses will fail. The system will be reset.

But, the turnaround could be far quicker than many think.

Everything about this virus and subsequent collapse has been quick. A flash crash that could be leading to a flash recession. A short, sharp pain — but an optimistic long-term outlook.

Ripping the Band-Aid off

What we’re seeing in markets right now is a fight. A fight between the bulls and the bears to figure out how bad this virus will be.

Short term I think the ball is in the bears’ court. Until we see the rate of infection start to ease in the US and Australia, we won’t know how bad things will get. There is a chance this could spiral much further out of control.

However, all the evidence suggests that this virus can be contained. As it has been in China, South Korea, and Singapore. It just depends how long it takes us to do the same.

For Australia, that is likely to be an easier job than the US. We are in a much better situation to deal with this virus than the US. For now, anyway.

Because of this, once things do start to turn, they will turn quickly. That’s why we keep saying you need to be prepared.

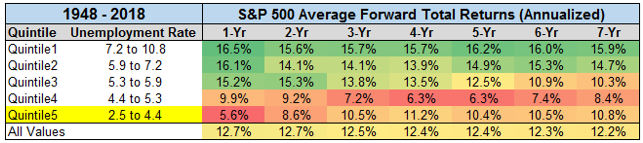

Take this data correlation from Seeking Alpha for example:

|

|

| Source: Seeking Alpha |

On the left you can see five different ranges of unemployment. Expanding from high unemployment at the top, to low unemployment at the bottom.

Meanwhile, on the right, you’ve got the average forward returns of the S&P 500. In other words, the average gains made in the S&P 500 after one year, all the way through to seven years.

And importantly, this data dates all the way back to 1948, up to 2018. A dataset that covers all kinds of booms and busts throughout the decades.

As you may have already noticed, there is an inverse relationship between unemployment and US forward stock returns. Suggesting that high employment leads to better future returns. Whereas a low unemployment rate, leads to worse returns.

The reason for this odd correlation?

Value.

During times of economic unease, such as high unemployment, valuations plummet. Investors aren’t willing to pay a higher premium for a stock when there is uncertainty.

But, when the economy is chugging along nicely, during times of low unemployment, valuations rise. Investors are now happy to pay more because there is less uncertainty.

In reality, markets and valuations are always uncertain. No matter how secure a company may seem, there is a chance they could collapse overnight. It’s not common, but it is possible.

The only thing changing is investor perceptions. Emotional responses of fear and greed that lead to market volatility.

Which is exactly where we find ourselves today. Right in the midst of the fear, and deservedly so.

Things are bad right now, and likely to get worse. For both the US and Australia. Especially when it comes to unemployment.

Long term though, it just might lead to an even bigger bull market. A record that would be worth breaking…

Regards,

Ryan Clarkson-Ledward,

Editor, Money Weekend

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments