Another 50-basis point hike in the cash rate and the market in Melbourne and Sydney is ice-cold.

The median price in Sydney is down –1.6% over June and -2.8% for the quarter.

In Melbourne it’s down -1.1% for June and -1.8% for the quarter.

However, the median hides a lot compared to what’s happening on the ground.

The top end of the market is getting hammered.

I’ve had dealings with two vendors over recent weeks.

One apartment owner in Sydney and one townhouse owner in Melbourne — in the $1.5–2 million price range.

They’ve had to reduce prices by 10–15% compared to what they could have expected just 8–9 months ago.

It’s a painful process for sellers.

Still, there’s little choice in the current economic environment.

Slash the price or expect the properties to linger on the market for potentially months.

Nothing is going to change in the short term in these two capitals — through to the beginning of 2023.

The price tag is too high.

After two years of 20%-plus annual median price growth — it’s the slump they had to have.

Money is going to continue to flow to the cheaper states and territories — advantaging investors who aren’t location-dependent.

And with rents rising significantly, there’s no shortage of them circulating like hawks, looking for an easy kill.

On 4 May, the Australian Financial Review reported:

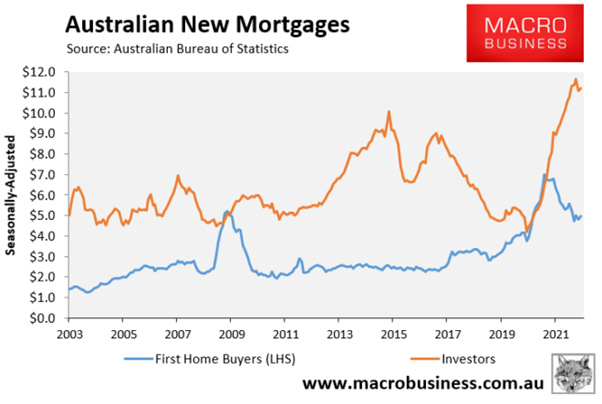

‘New data showing home loan commitments to investor buyers jumped 12.7 per cent from February, the fastest increase since July 2003, to a seasonally adjusted monthly total of $7.8 billion, were “enormous” numbers and challenged the picture of a market solely driven by owner-occupiers, JP Morgan economist Tom Kennedy said.’

The latest ABS data for May shows investor mortgage commitments are now up more than $11 billion — growing 23.7% year-on-year.

First home buyers have been crowded out.

Take a look:

|

|

| Source: macrobusiness.com.au |

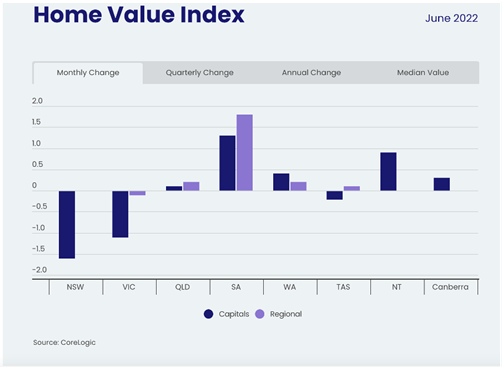

It’s easy to see where some of the money is going as well.

South Australia is one of the only states defying the current trend — rising more than 1% through June.

Perth is also pushing forward, with a 0.4% increase for the month.

|

|

| Source: CoreLogic |

South Australia is the cheapest state for real estate and is consistently labelled as ‘undervalued’.

Right now, the future looks bright.

The South Australian Government announced a record four-year infrastructure spend of $17.9 billion in its 2021–22 state budget.

The rally in commodity prices has benefitted regional towns exposed to the Olympic Dam mine.

The capital city vacancy rate sits at a record low 0.3% — the tightest in Australia.

Rental increases of up to 20% upon a renewed lease are not uncommon.

On the back of this, the Greens are proposing a bill to freeze rents for two years:

‘Rent prices would only be able to be increased every two years under a new Bill proposed by the Greens aimed to ease the “out of control” rental crisis in South Australia.

‘Greens MLC Robert Simms will introduce the Bill to parliament next Wednesday which will see rents capped so landlords are only able to increase prices in line with inflation.’

The proposal has been slammed by the Property Council, of course.

They’re falling back on that old chestnut of ‘increase supply to lower prices’ argument:

‘There are no benefits in market intervention for property owners and investors who take great risks to purchase, own and provide homes for renters,

‘Policy thought bubbles don’t help anyone — this approach is all stick and no carrot and it’s everything we shouldn’t be doing for our housing market.

‘Instead of focusing on rent caps we should be more focused on increasing the supply of housing across South Australia.’

If you listened to my interview with Dr Cameron Murray a week or so ago, you’ll understand how utterly flawed this concept is.

Still, for those that understand the longer market cycle, right now looks like a great time to get in where the gains are flowing and advantage through to 2026.

Sincerely,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia