Christmas has come early for crypto sceptics.

The cryptoverse is the gift that just keeps on giving.

In the 6 December 2022 issue of The Daily Reckoning Australia, I wrote:

‘Here’s another all-but certainty…SBF is going to testify…but not of his own free will.

‘US Congresswoman Maxine Waters tweet was a friendly invitation to participate. The next one won’t be.

‘If Ken Lay (Enron), Bernie Madoff and Elizabeth Holmes (Theranos) are any indication of what awaits blatant fraudsters, SBF is destined to appear before a US Congressional Hearing in an orange suit and handcuffs.’

As reported by Bloomberg on 14 December 2022, Sam Bankman-Fried (SBF), if found guilty of his alleged crimes, could be looking at a period of incarceration almost matching the late Bernie Madoff’s:

|

|

| Source: Bloomberg |

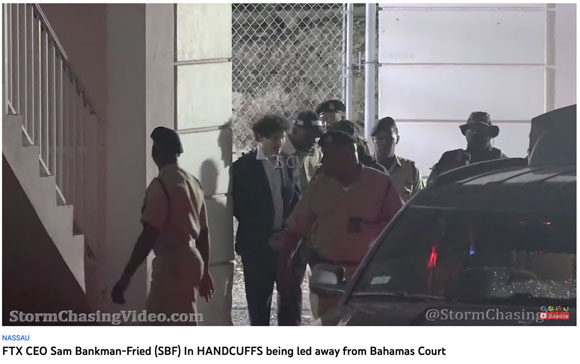

Courtesy of YouTube, SBF’s appearance before the Bahamas judiciary was sans orange suit, but he was handcuffed:

|

|

| Source: YouTube |

2023 is going to be an entirely different proposition for SBF.

Sam is going from his Bahamas penthouse to a US jailhouse.

Binance ‘auditor’ is outta here

The Daily Reckoning Australia issue I penned last week looked at:

‘When an audit is not really an audit

‘On 10 December 2022, The Wall Street Journal headline shone the spotlight on Binance’s lack of transparency:

|

|

| Source: WSJ |

‘To quote (emphasis added)…

“Binance recently made a commitment to transparency, but it has a long way to go before it discloses enough meaningful information to give investors’ confidence in its future, accounting and financial specialists say.”

‘In an attempt to calm investor nerves, Binance engaged the services of mid-tier global accounting firm Mazars, to conduct an “audit” of its books.

‘This is why accounting and financial specialists are a little dubious about Binance’s attempt at transparency.

‘According to the WSJ article:

“Mazars said it performed its work using ‘agreed-upon procedures’ requested by Binance and that ‘we make no representation regarding the appropriateness’ of the procedures.”

‘Binance has not yet realised the days of treating crypto investors like mushrooms is over.

‘Binance request for a blinkered view of its financial position falls just a little (make that a lot) short of accepted international standards.

‘This sham audit only served to create even greater doubt over the solvency of Binance.’

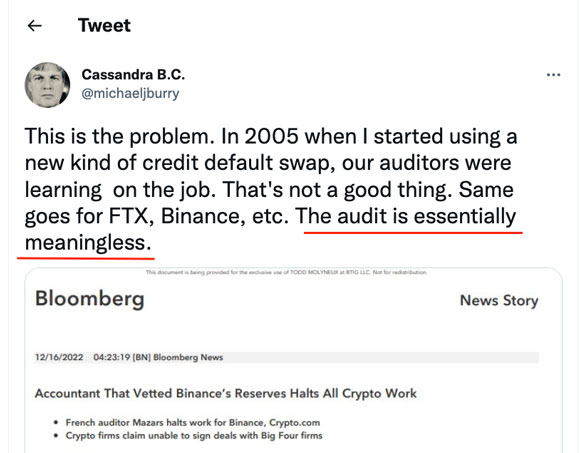

On 17 December 2022, Michael Burry (of The Big Short fame) tweeted:

|

|

| Source: Twitter |

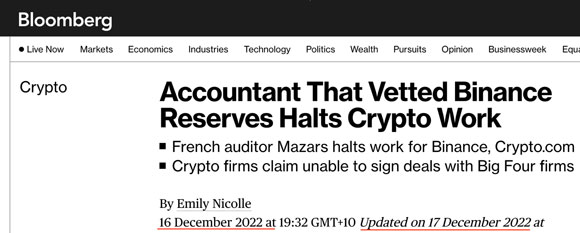

Michael Burry’s tweet was in response to this Bloomberg article published on 16 December 2022:

|

|

| Source: Bloomberg |

Mazars has turned tail and bolted for the hills.

See ya suckers.

Whadda ya reckon the accountants know, but the crypto-faithful are too blind to see?

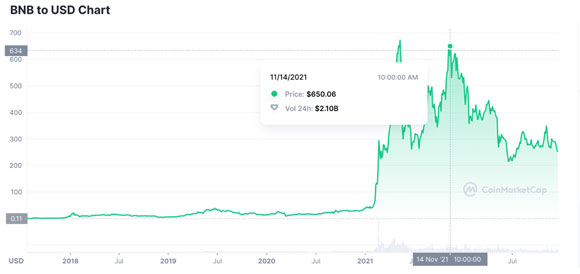

None of this is good news for the Binance ‘Magic Bean’ token…BNB.

From its November 2021 high of US$650, the Binance Bean is down more than 60%…with, I suspect, much more downside to come:

|

|

| Source: CoinMarketCap |

With all attention focused on the unfolding disasters (of their own making) in the cryptoverse, scant regard is being paid to the problems besetting the US banking sector.

Are US banks on the cusp of tanking?

The deepening problems confronting US banks has been a topic of discussion in recent issues of The Gowdie Advisory and The Gowdie Letter.

Here’s an edited extract from the 15 December 2022 issue of The Gowdie Advisory:

‘When will the veil on US banks drop?

“…the S&P 500 reached its lowest closing price of 2009 on March 9. Concerns about the solvency of major U.S. banks and the integrity of the U.S. financial system triggered heavy selling pressure throughout late 2008 and early 2009.”

Benzinga

‘What turned Wall Street around in March 2009? Was it the stimulus packages of QE and TARP finally kicking in? No. Was it the Fed cutting rates to zero? No.

‘It was this:

|

|

| Source: SEC |

‘Wall Street had been given the heads-up on US Congress applying pressure to the US Financial Accounting Standards Board (FASB) to amend its Fair Value Accounting practice.

‘No longer would US banks be required to “mark” the assets on their books “to market”.

‘Instead, the rule on “mark-to-market” would be amended to…

“FASB says the objective of [the new] mark-to-market accounting is to set a price that would be received by a bank in an “orderly” transaction in the current, inactive market. It says an “orderly” transaction for accounting purposes does not include the forced liquidation or a distressed sale of an asset.”

‘Prior to the accounting rule change, the toxic loans on the books of US banks were valued at whatever price the market was prepared to offer.

‘For example, US$1 of subprime debt might have been trading at 10 US cents.

‘After the amended rule was passed, the bank could decide “on the proviso we hold the debt to maturity and normal market conditions resume, we think that US$1 of toxic debt is worth at least US80 cents or more.”

‘Hey presto, with the pressure of US Congress on the FASB, the once insolvent institution (due to the longstanding mark-to-market accounting principle) was suddenly solvent.

‘And that’s what turned the S&P 500 Index around on 9 March 2009.

‘Hopefully, this background helps you appreciate the gravity of this report from The Institutional Risk Analyst.

‘According to its numbers, under the old accounting standard, the US banking sector is insolvent to the tune of…US$1 trillion:

|

|

| Source: The Institutional Risk Analyst |

‘These are some selected extracts from the report (emphasis added):

“November 28, 2022 | Watching the Buy Side Pivot Platoon rev up for a new surge of asset allocation into large cap bank stocks, we remind readers of The Institutional Risk Analyst that US depositories currently are not particularly cheap, in nominal or real terms. In fact, in a stressed scenario, the liabilities of banks exceed the value of the assets by over $1 trillion, the classic definition of insolvency.

“Once you adjust reported book value for the asset price inflation & now deflation of the QE/QT roller coaster ride, it is fair to ask: Just where is the value? If we told you that the capitalization of the [banking] industry was negative by over $1 trillion at the end of Q2 2022, would you still buy bank stocks for your clients?”

‘And this is the result of the tangled web the Fed has spun:

“Thanks to QE and now QT, all sorts of assets have become negative return propositions for banks and nonbanks alike. If the coupon pays less than the funding costs, you’re losing money. Just ask Jerome Powell about the return on the Fed’s SOMA [System Open Market Account] portfolio.”

‘On that last point, if the Fed applied ‘mark-to-market’ accounting to its US$8-plus trillion bond portfolio, Seeking Alpha reported on 1 December 2022:

“The Fed’s unrealized SOMA losses grew to -$1.1 trillion in the third quarter [of 2022].”

‘If we continue with the findings of The Institutional Risk Analyst report:

“…the [US banking] industry is already insolvent in Q2 2022 with the adjustment to the loan portfolio, which may be significantly underwater by next year. GAAP [Generally Accepted Accounting Practices] allows owners of assets held to maturity to ignore mark-to-market losses so long as they have the capacity and the intent to do so.

“So, do you sell the 2% and 3% coupon loans and securities at a loss and buy some 8% and 9% loans coupons? Yes you do, eventually. This is how M2M [Mark-to-Market] becomes available for sale (AFS) ‘gradually, then suddenly’ to recall Ernest Hemingway’s 1926 novel, The Sun Also Rises.”

‘In conclusion, the report advised…

“Don’t hold your breath waiting for Fed Chairman Jerome Powell to address the issue of bank solvency at the next FOMC press conference. First QE and now QT has injected such excessive levels of volatility into the prices of assets — all assets — that the value of capital has been compromised. Suffice to say that if the FOMC [Federal Open Market Committee]continues to raise interest rates above current levels, then we think that the issue of bank solvency may be front-and-center by next summer [June 2023].”

‘The Fed’s 14 December 2022 media release, provides an insight into the Fed’s intent on interest rates:

|

|

| Source: US Federal Reserve |

‘Ongoing interest rate increases will put more strain on the balance sheets of US banks.’

The 19 December 2022 issue of The Gowdie Letter touched on the prospect of history possibly repeating itself:

‘Since [28 November 2022, when] “The Institutional Risk Analyst” ran the ruler over the financials of the US banking sector — using the accepted pre-2009 accounting rules — and found US banks were insolvent to the tune of US$1 trillion (that’s trillion with a T), the State Street S&P Bank ETF – KBE — has fallen much harder than the broader S&P 500 Index:

|

|

| Source: Yahoo! Finance |

‘Perhaps it’s just a coincidence concerns over the solvency of US banks in 2007, saw the banking sector (KBE) start to disconnect from the S&P 500 a few months BEFORE the S&P hit its peak.

‘As I said, it might be just a coincidence OR it could be a case of history rhyming.

‘Hmmm…’

|

|

| Source: Yahoo! Finance |

Be alert.

US banks have the potential to be…the sleeper that could rattle markets in early 2023.

Have a happy and safe Christmas and may 2023 be healthy, wealthy, and wise for you.

Until next year!

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia