Analysis of complex systems dynamics begins with the principle that minute changes in inputs result in catastrophic changes in outputs due to exponential recursive functions. Here’s a good example of how sensitive the supply chain is to the smallest changes in input. It comes from Daniel Stanton, one of the world’s leading authorities on supply chain management. He describes a phenomenon called the ‘Bullwhip Effect’:

‘A customer comes in to buy a widget, which turns out to be the last widget in the store, so the store needs to order more inventory from its wholesaler. But the wholesaler doesn’t sell individual widgets; it sells widgets in cases of 100 units. Now the store has to buy a full case — 100 widgets — even though it sold only one. If that case was the last one in the warehouse, the wholesaler will replenish its inventory by ordering more widgets from the factory. The factory, however, sells widgets in batches of 100 cases, so the wholesaler has to buy 100 cases of 100 widgets each. The wholesaler just bought 10,000 widgets even though it sold only 100.

‘How many widgets did the factory sell? 10,000. How many did the wholesaler sell? 100. And how many did the customer buy? Yep: 1. A small demand signal at the end of the supply chain became amplified at every step, creating a Bullwhip Effect on inventory. The store may never sell another widget, so it would still be stuck with 100 widgets in inventory…All that inventory costs money for everyone in the supply chain without adding any value.’

Of course, there are remedies for the Bullwhip Effect. Factories and wholesalers can sell in smaller batches. All parties in the supply chain can get better at forecasting so they can place orders before inventory runs so low. The store, the wholesaler, and the factory can improve communications to help do a better job of managing inventories.

Still, the Bullwhip Effect is real. The point of describing it is not to critique supply chain participants, but to illustrate the acute sensitivity of global supply chains to the most minute perturbations.

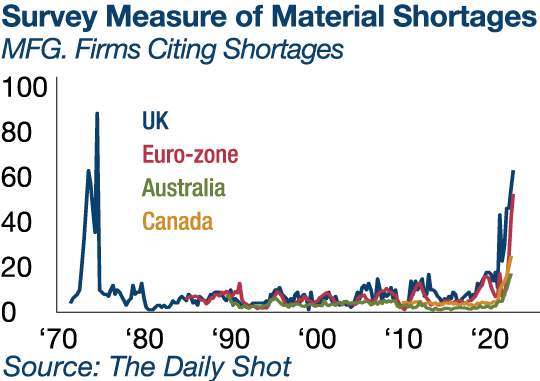

How extensive is the supply chain crisis today? The chart below provides a partial answer by showing the percentage of manufacturing firms reporting shortages of materials and equipment in the UK, eurozone, Australia, and Canada.

In the past year that percentage has spiked from a range of 5–15%, to a new range of 25% (Australia) to 63% (the UK). This is far higher than the range of the past 40 years and the highest since the Arab oil embargo of the mid-1970s:

|

|

| Source: The Daily Shot |

The US$400 million lightning strike

Supply chains also have embedded risks that often aren’t understood or properly managed by supply chain participants. One example is ‘the US$400 million lightning strike’ from the book Resilient Enterprise by MIT Professor Yossi Sheffi, as described by Daniel Stanton:

‘Two cell phone companies bought their processor chips from the same manufacturing plant in New Mexico. One day, the manufacturing plant was struck by lightning, which started a small fire in the facility. One of the phone companies realised how serious this problem was and immediately started sourcing ships from other suppliers. The other phone company assumed that the chip facility would be repaired quickly, so it waited.

‘When the repairs took longer than expected, the phone company that chose to wait wasn’t able to get the parts it needed and had to shut down its entire supply chain. The lightning strike had a modest financial impact on the suppliers, but it cost the unprepared customer $400 million in lost revenue.’

The first company engaged in rapid response. The second company engaged in wishful thinking. The fire that shut the manufacturing plant might only have cost a few hundred thousand dollars to repair. But the damage to the second phone company was US$400 million in lost sales. Again, this demonstrates the exponential impact of small changes in large, complex systems. Understanding how complex systems operate is the first step in the efficient risk management of supply chains.

The global supply chains were created, and the cost savings were realised, but now the hidden costs are being revealed. Global supply chains are extremely vulnerable to even minor disruptions. Major disruptions have occurred, and those supply chains are in disarray. The main question for consumers and investors is whether these disruptions will get worse…and I’ll give my answer to that in my next edition of The Daily Reckoning Australia.

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.