Dear Reader,

This article from Reuters caught my attention:

If you’re not aware, Codelco is the state-owned Chilean copper miner and a major producer of the red metal.

But why the heck is Saudia Arabia, the world’s largest exporter of crude oil, cosying up to the world’s biggest copper producer?

Unfolding Story: The Saudi Pivot is Underway

This development highlights Saudi Arabia’s effort to diversify its oil-dominated economy.

Even if oil demand doesn’t collapse in the years ahead (from competing renewables), diversifying its oil economy wouldn’t be a bad idea:

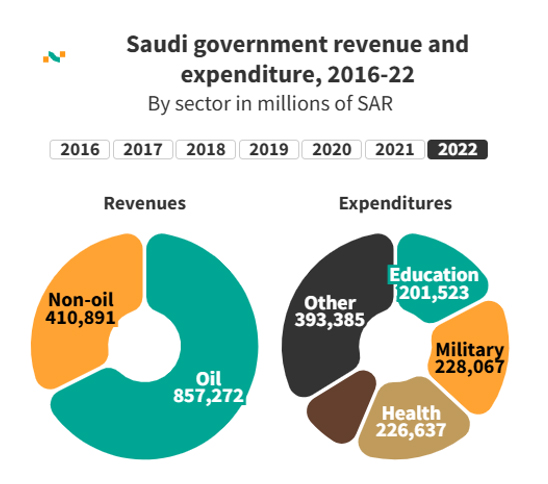

| |

| Source: Saudi Central Bank |

As you can see in the pie chart to the left, direct oil sales (green) make up about two-thirds of the country’s total revenue!

And that doesn’t include all the spill-over income that exists thanks to its oil-focussed economy: finance, engineering and the like.

Mining Memo’s Take

Saudi Arabia has a closing window of opportunity to tap into its oil wealth and develop new industries before those riches ‘potentially’ run dry as renewables take further market share.

But for decades, Saudi royalty has been addicted to mega-yachts, luxury and hanging out with Hollywood celebrities.

But for the first time (in a long time), a royal leader has come to power with a will to give some direction to a country that has grown fat by pumping endless volumes of oil.

Crown Prince Mohammed bin Salman is a realist who understands these riches won’t last forever.

Yet Salaman has wasted years (and billions) flirting with far-flung ‘visionary’ projects, like NEOM, a futuristic city on the Red Sea coast, in a bid to attract tourists.

Numerous epic failures.

But there has been one industry emerging as a realistic replacement for Saudi oil… Mining.

The country already holds a pool of oil-trained geologists, engineers, and technicians that can be re-skilled for ‘hard-rock’ mining.

And on all accounts, Salaman seems to be finally recognising this, doubling down the country’s efforts to focus on mining projects.

That was on full show this week at the Future Minerals Forum in Riyadh, Saudi Arabia.

In only its fourth year, this important mining event has already pumped about $30 billion into the hands of international mining firms pitching to Saudi royals.

And that’s the key opportunity here…

Saudi oil money is rapidly becoming a source of new liquidity for global mining. And that has the potential to grow exponentially in the years to come. From producers to explorers.

But there’s another angle to this story too…

International miners attempting to capture mining leases WITHIN Saudi Arabia.

Vast tracts of arid landscape, once exclusively the focus of oil, are set to be re-opened for mineral exploration.

A new frontier is opening up!

And that’s an opportunity worth examining. I expect we’ll see plenty of new ASX plays looking to get in on this emerging land grab!

Stay tuned for more.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments