The tasting menu read as follows:

- Pork Bahn Mi

- Pork Char Siu Buns

- Pork Dan Dan Noodles

- Pork Katsu

- Pork Shumai

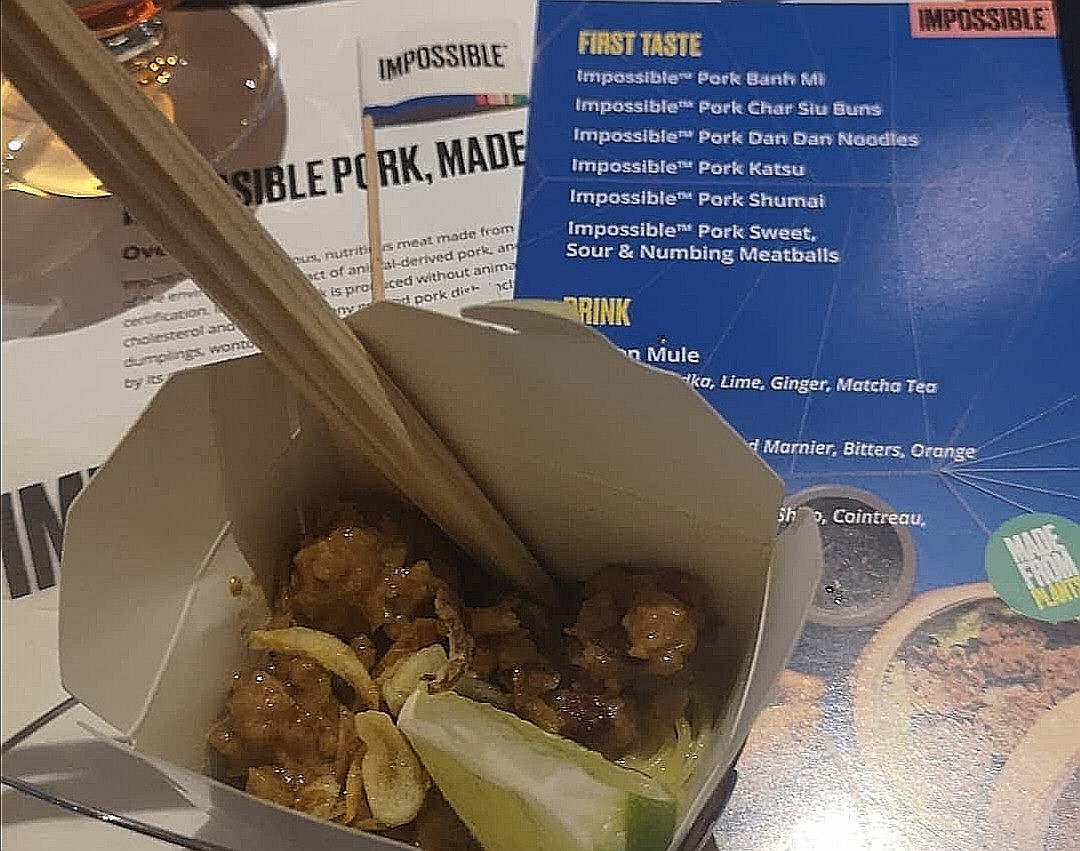

- Pork Sweet, Sour & Numbing Meatballs

It was quite the menu. And yes, I had a bit of everything on there. The verdict? Absolutely delicious.

It was some of the best tasting Vietnamese food I’ve ever had. But this wasn’t your typical tasting menu.

It was at a special invite-only media event at CES. The event was run by a company called Impossible Foods. And the thing about the tasting menu was not a single bit of pork was in any of the food.

That’s right, every one of those ‘Pork’ menu items didn’t have a single molecule of pig in them. This was the debut and the first public tasting in the world of Impossible Food’s latest ‘pork’ products made solely from plant-based ingredients.

|

|

| Source: Editor’s own photo |

This ‘meatless meat’ was astonishing. I honestly couldn’t tell you the difference in taste and texture from real pork. I passed comment to a fellow attendee that maybe this is the greatest practical joke of all time and it really was pork, that’s how good it tasted.

And I even commented to some friends of mine afterwards that I was ‘converted’. I would happily cook these Impossible Pork products at home and be quite satisfied with the taste and texture.

Impossible Foods are one of the world’s leading meat-substitute companies. You probably saw in 2019 the insane IPO and rollercoaster of Beyond Meat Inc [NASDAQ:BYND]. Well, Impossible Foods is a competitor, and while currently private, there’s talk of an IPO coming in 2020 as well.

I spoke to some friends about this, and some of them still dismissed this meat substitute trend as a ‘fad’. I think that’s naïve. And I called them out on it.

Until you taste these products you simply don’t understand how good they are. They have the potential to sit on supermarket shelves with the same levels of choice and abundance as regular meat.

The upside of course is that no piggies are hurt in the making of any pork products from the likes of Impossible Foods or Beyond Meat.

I think there’s huge long-term potential in these companies and I think we’ll see even more of them hit the markets over the next couple of years.

The tasting menu was the completion of another busy and insightful day at CES. And this is all before the big exhibitor conference even starts true and proper.

[conversion type=”in_post”]

Touching every industry on Earth

One of the more interesting sessions I attended yesterday was all about the global economic impact of artificial intelligence.

Speaking about the theme, Ritika Gunnar, Vice President of Data and AI Expert Labs and Learning from IBM, said over the next decade it’s expected the economic impact of AI will be more than US$16 trillion.

Just take a moment to think about the significance of that…

An additional US$16 trillion of economic impact from just AI alone. That is truly transformational change. And it’s one of the biggest signals you can have of the opportunity that AI throws up for investors.

There’s not a single industry on Earth that’s not going to be touched by AI in some shape or form. The challenging part is trying to identify the investments that will tap into that US$16 trillion and deliver profits.

This might come in the form of companies building the hardware like neural networks to power the next decade’s AI. It might come in the form of software and analytics to process and make all the AI data useful.

It might come in the connectivity companies that enable the AI data to move from place to place to be useful. Or it might come in existing companies that are taking AI to deliver cost-cutting and growth.

The underlying opportunity of autonomy

It’s an area of opportunity we continue to focus on, and identify opportunities in ASX-listed small-caps. Another area of opportunity we see is around the shift in autonomous vehicles.

It’s worth noting that now, when we talk about autonomous vehicles, it’s not just about cars. It’s also about aerial vehicles. That means drones and yes, soon enough flying ‘taxis’.

But our belief is the first iteration of self-flying drones will be in logistics and ‘last mile’ delivery. The likes of Amazon, UPS or FedEx ensuring that products get from port to distribution centre and to the customer with minimal latency.

That means getting things from the point of sale via e-commerce to the consumer faster and more efficiently than ever before. And to achieve that you need a whole range of puzzle pieces.

Yes, it’s about the actual drone devices. But it’s also about the physical infrastructure (take-off and landing hubs) and the digital infrastructure to get them all working in harmony.

Add to this the immense software that’s needed to coordinate all this. You also need the best, most reliable connectivity to let everything ‘talk’ to everything else. And finally, you also need highly advanced AI to analyse and process all the data and information flowing through the system.

Without every piece of the puzzle the system doesn’t work.

And therein we come back to similar ideas that will keep progress turning over the next decade. Connectivity, AI, digital infrastructure…these are the core technologies that enable the world to turn in our modern future.

The stuff you see on TV like the drones, the cars, eye-catching consumer facing devices…that’s all nice and pretty cool.

But when you drill down to the real opportunity, it’s the underlying tech that is essential for this to all work. It’s this critical technology that provides investment opportunity. That’s what our future is built on and that’s what’s going to define the next decade of tech investing.

Regards,

Sam Volkering,

Editor, Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments