Through Berkshire Hathaway, Warren Buffett has been a long-time investor in the US’s big banks.

He shrewdly bought into, and in some cases, rescued, a number of banks that were on the brink of disaster in the wake of the 2008 Global Financial Crisis (GFC).

And he’s even owned Wells Fargo stock since as far back as 1989!

Yep, there’s no doubt Buffett has loved US banks for a long time.

And as a leveraged bet on US growth and ongoing global dominance, it’s worked out very well for him.

Which makes his recent moves very interesting…

You see, Buffett has been selling down a lot of his US banking holdings.

Last quarter he sold down holdings in JP Morgan, Goldman Sachs, Bancorp, Bank of New York Mellon, and almost completely exited the regional bank space.

He even continues to trim down his holdings in a long-time love affair, Wells Fargo.

So, why the change of heart on big US banks?

As reported:

‘The famed investor and Berkshire Hathaway CEO told CNBC on Wednesday that several banks engaged in misleading accounting to artificially inflate their profits.

‘He gave the example of banks valuing their long-dated bonds at their par value instead of their market value, which hid the fact their value had fallen on paper.

‘“I don’t like it when people get too focused on the earnings number and forget banking principles,” Buffettt said. “Some of the dumb things that banks do periodically become uncovered during this period.”’

I don’t trust Buffett’s judgment on everything, but I definitely trust him when it comes to valuing banking stocks.

So if he’s wary here, you should be too.

To me, it suggests the recent banking drama is far from over, despite the current lull.

However, here’s what I think Buffett is missing…

Don’t trust Buffett on tech…or this

A common mistake is to assume all investors are playing the same game.

Nothing could be further from the truth.

There are a million ways to make money in markets…and 10 times as many ways to lose it!

So when it comes to your own investing, always remember you are running your own race.

It doesn’t matter what Buffett, me, or anyone else is doing. The key is to find a strategy that suits you.

That’s not easy, and it takes time to find out what that strategy is, but it truly is the only investing goal worth worrying about.

That’s not to say you can’t learn from others, though.

People like Buffett are a mine of valuable information. You just need to know where his limitations are.

Like I said before, I’ll listen to Buffett all day when it comes to banks.

But when it comes to something like technology stocks, his opinion is almost worthless.

Before you think this is pure arrogance on my part, bear in mind he says this himself.

Buffett has long conceded that most technology plays are outside his circle of competence; therefore, he doesn’t invest in them.

For example, in 2014, he told Fortune Magazine ‘Bill Gates is a good friend, and I think he may be the smartest guy I’ve ever met. But I don’t know what those little things do.’

Those ‘little things’ he’s talking about are smartphones — probably one of the most disruptive trends of the decade.

Think about that for a second…

Despite having direct access to the likes of Bill Gates and Steve Jobs, Buffett missed most of the fastest-growing tech stocks of the past two decades, including Google, Amazon, Meta, and Apple.

Though to his credit, he did eventually start investing in Apple in 2016 — and it is up around six times over since then.

But his lack of tech knowledge meant he missed out on the earlier exponential phase of Apple’s growth from 2008 onwards.

If he’d caught that wave, he’d be up closer to 60-times by now…

This brings me to one huge investment Buffett doesn’t just ignore but completely hates.

And yet, in my opinion, it’s the only hedge to the potential big bank run he clearly sees coming.

Not only that, but a small allocation here over the past nine years, say, around about the time he said his quote about not understanding those ‘little things’, would not only have increased his returns but also reduced his risks.

Let me show you how…

Compare the pair

Buffett’s partner Charlie Munger famously called Bitcoin [BTC] ‘rat poison squared’.

He’s right, just not in the way he thinks.

It is rat poison to the big banks because it takes away their natural advantage in creating money. It also does away with their costly and slow networks.

It’s a completely new form of money that lives on its very own decentralised network.

And as an alternate financial system, it’s ready for anyone locked out of the current financial system (or more likely locked into a failing one).

For example…

In countries like Argentina, Turkey, Lebanon, and Pakistan, bitcoin is already back at new all-time highs this year.

There are nearly half a billion people in just those four countries alone.

But in my opinion, bitcoin is also an ideal hedge against the growing possibility of widespread financial failures in Western countries too.

Even for people like Warren Buffett!

Indeed, a small bitcoin allocation would’ve already paid off for most investors.

Consider this…

Take the following hypothetical ‘rat poison’ portfolio:

|

|

| Source: Swan Bitcoin |

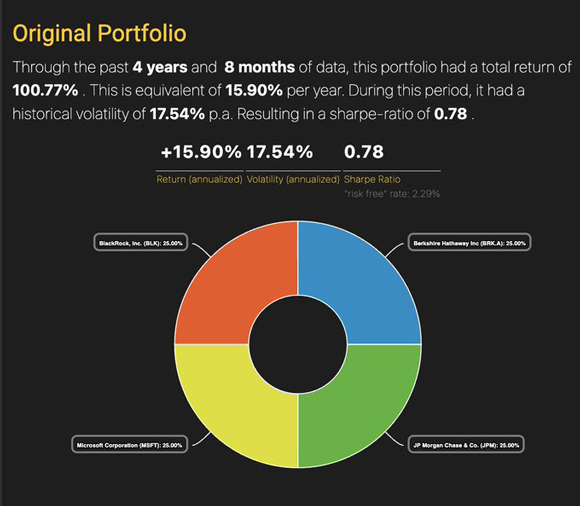

This is an equally weighted portfolio of Berkshire Hathaway, Microsoft, JP Morgan, and Blackrock.

From 2014–19 the portfolio has returned 16% annually (assuming quarterly rebalancing).

A pretty good result.

Now, what would’ve happened if you’d added a small 2.5% bitcoin allocation to this portfolio over that same five-year period?

This would’ve increased the annual return to 20% per annum.

But get this…

It would’ve reduced the max drawdown — the risk — of the portfolio too!

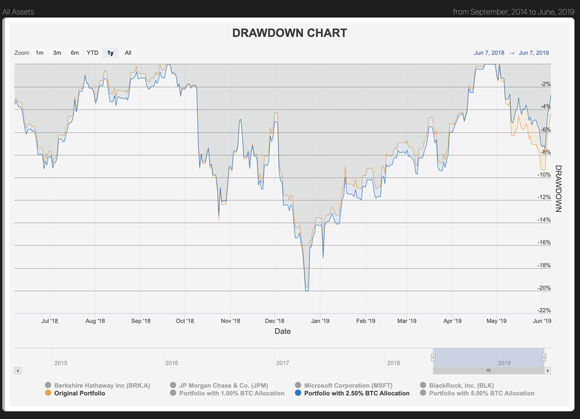

You can see the relative performance of the two portfolios here:

|

|

| Source: Swan Bitcoin |

The blue line (with BTC) tends to do better, both on the way up and the way down, than the orange line (no BTC).

And in case you think I’m cherry-picking a time period, bear in mind 2014 (well, late 2013) is when I first got into bitcoin, and this time period ends in the depths of the 2018/19 crypto bear market.

Anyway, as they say in bitcoin, don’t trust me, verify!

You can run your own scenarios here.

The point is…

A 1 or 0 outcome

Don’t be distracted by possibilities because investing is always a game of probabilities.

Yes, bitcoin could fail.

But it could also succeed.

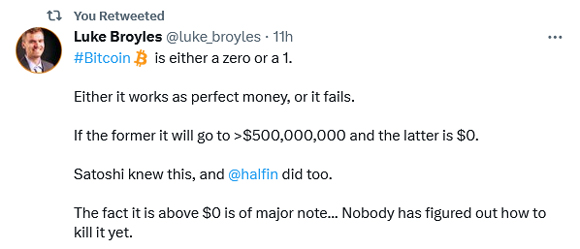

And as this tweet puts it:

|

|

| Source: Twitter |

If I’m right about the future of bitcoin, can you afford not to have a small allocation to this?

A small allocation to bitcoin would even work for Warren Buffett.

And in my opinion, it can still work for you…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: There will be no Money Morning published tomorrow due to the ANZAC Day public holiday. We will return to our regular publishing schedule on Wednesday, 26 April.