If you scroll down the list of the top 100 largest companies, you’ll notice that wedged in at number 81, a few spots above Netflix and BHP Group, is Contemporary Amperex Technology Limited or CATL for short.

What’s interesting is that CATL was virtually unknown until a few years back. But CATL has played a large role in the rise of electric vehicles.

Indeed, CATL is the world’s largest battery maker.

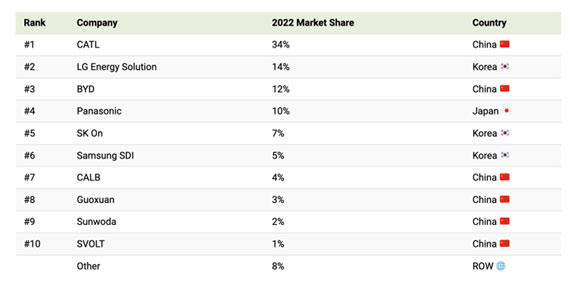

To give you an idea, CATL holds more than a third of the global electric car battery market, supplying the likes of Tesla, Toyota, and Volkswagen — to name a few.

But to lead in battery production, you also need to make sure you control raw material supply chains…and here is where CATL has also been getting involved.

For example, CATL has invested in lithium mining projects in places like China, Australia, and Argentina.

And just this week, it announced it had taken a 25% stake in CMOC Group, a Chinese producer of things like cobalt, niobium, and copper.

All this has given CATL more dominance in global battery supply chains and global battery production.

As Kevin Shang from Wood Mackenzie told Wired:

‘They were able to invest in the whole supply chain, from mining to materials manufacturing to the battery cells making and even to recycling.’

Yet CATL is just one of the six out of 10 large EV battery producers based in China, as you can see below:

|

|

| Source: Visual Capitalist |

At the moment, making an EV without involvement from China is very hard.

China dominates when it comes to clean energy supply chains

Chinese miners and battery makers like CATL have been busy securing raw materials worldwide, in particular as supply has been tight and demand for EVs continues to increase.

Not only will we need a lot of raw materials for the energy transition, but we also need to process them, and much of that processing also happens in China.

China is by far the top country in EV battery manufacturing, with nearly 80% of the global lithium-ion battery manufacturing capacity.

The US is a distant second, with a 6.2% share, and Europe has around 10% of the global lithium-ion battery manufacturing capacity.

But of course, it’s not just EV batteries.

China produces more than 80% of the world’s solar panels, a number that could reach 95% by 2025.

China is also the largest electric vehicle (EV) market in the world, producing 44% of the world’s EVs between 2010 and 2020.

As the International Renewable Energy Agency put it in ‘A New World: The Geopolitics of the Energy Transformation’:

‘No country has put itself in a better position to become the world’s renewable energy superpower than China.’

But the realisation is starting to dawn worldwide.

Those countries that first develop cleantech and manage supply chains for critical minerals will have the most influence in shaping the new energy global economy.

Governments are now racing to secure their positions in the battery supply chain, from mineral extraction and processing to battery manufacturing.

Last year, for example, the Australian Federal Government established the $2 billion Critical Minerals Facility to pledge funding for critical minerals like lithium, graphite, and rare earths.

And earlier this year, the US invoked the Defense Production Act to ramp up the mining and processing of minerals and materials used for batteries.

And then it passed the Inflation Reduction Act. The largest climate bill in US history promises billions in energy security, but one of the main objectives of the bill is to bring in more cleantech manufacturing into the US.

The bill allocates around US$60 billion to shore up local manufacturing of things like solar panels, turbines, and transport tech.

And it’s also looking to expedite electric vehicle uptake by offering tax credits to consumers…

But for the electric vehicle to qualify for these credits, there are some caveats.

The EV maker needs to finish assembling these vehicles in the North America, and a percentage of the battery materials must be extracted or processed in the US…or a country the US has a free trade agreement with, like Australia.

So you can see how the Act will be a catalyst for accelerating investment into the US EV supply chain and battery manufacturing…but it could also be a huge boom for Australia when it comes to supplying these materials.

We could be on the verge of a new mining boom

In short, we are not only going to need a massive number of critical materials to supply the energy transition but also, with geopolitical tensions rising, there’s a need to build up non-Chinese supply chains.

And this is at a time when supply for these critical materials is already tight…

So Australia, as a supplier, could be very well placed to profit from this race to secure critical materials.

Stay tuned for more on this soon…

All the best,

|

Selva Freigedo,

For Money Morning

Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.