Sometimes the best opportunities aren’t loud. They don’t scream at you from the headlines.

Right now, Australian beef farmers are sitting on one of those opportunities. Quiet. Compounding. Building momentum.

Australian lean beef prices have climbed to multi-year highs, while share prices remain muted. That sounds like an opportunity to me.

Growing up on a farm, I was always taught to appreciate a good season, often because it paid down the debts of all the bad ones.

What’s so good about this year? Favourable seasonal conditions in the north, a large national herd and high feedlot inventories — everything you want to see in Aussie beef.

Add to that a trilemma of international factors, and this season could go a lot further than many expect.

Factor One: Climate Pressure

The UK has just come through its driest season in decades. Crops failed. Herds shrank. Prices spiked.

This isn’t just a European story. Droughts are hitting the US herd too, leaving shelves thin.

When the major cattle producers stumble, it creates space for others. And Australia, with its export-driven beef industry, is filling that gap.

Factor Two: Tariffs and Trade Wars

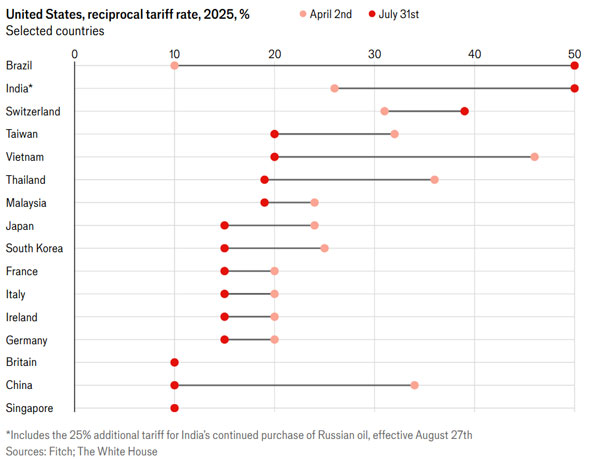

Trump’s recent 50% tariffs on Brazilian beef are reshaping global flows. Brazil is the largest beef exporter in the world. So as the US shuts them out, expect big changes.

| |

| Source: The Economist |

While this high tariff rate on Brazil is political in nature (and therefore likely temporary), it’s just enough of a disruption to make this a very profitable season for Aussie beef.

We already sell US $4 billion worth of beef a year to the US. And unlike Brazil, we don’t face a 50% tax barrier. We’re on the lowest 10% threshold.

What about the US sending beef into Australia as part of the tariff deals? It’s a headline story, not a real risk. Here’s why:

- Australians eat only a third of what we produce.

- Three-quarters of our beef is exported.

- Local consumers have little appetite for factory-farmed US imports.

The ‘threat’ of US beef in Coles or Woolies is tiny compared to the pull from US buyers hungry for our supply.

Factor Three: Asia’s Growing Appetite

China once barely registered as a buyer. Today, it’s the world’s largest beef importer by far.

In 2025, our exports to China have already jumped 30%. High end grain-fed beef shipments surged 41% to 57,524 tonnes.

And while we’re far from the largest exporter, we tend to dominate premium-grade meat.

Why? A growing middle class. Rising incomes. A taste for premium cuts that carry our name.

And it’s not just China. Japan, South Korea, Singapore, India — all want quality protein. All are buying more.

| |

| Source: ABC |

A Market on Fire

Prices are telling the story.

Australian lean beef trim hit A$11.20/kg in late August — the highest since tracking began. That’s 11% higher just since July, and up around 40% since 2020.

US buyers have been the most aggressive, with July imports of Aussie beef jumping 18% in a single month. China followed, up 12%.

Some local beef processors are even holding back supply, betting prices have further to run.

This is what strong demand meeting constrained supply looks like.

Put these forces together — climate shocks, tariffs, booming Asian demand — and you get one outcome: stronger earnings for Australian beef producers.

Two names stand out from an investing angle:

Australian Agricultural Company [ASX:AAC] The country’s largest pure-play beef producer. Runs over 6 million hectares. Known for premium wagyu and branded exports into Asia. A steady way to ride the global shift towards the premium end of the market.

Elders [ASX:ELD] is one that’s probably more familiar to readers. And while it’s not a pure farmer play, it’s still a backbone of the rural supply chain. Providing livestock services, financing, and marketing that will all directly benefit from rising prices.

To be clear, I haven’t done detailed research on these names. Don’t take it as investment advice.

But for investors who know a good season, and want to do their own research, this could be one of the most compelling quiet opportunities on the ASX today.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments