Melbourne’s Comedy Theatre — constructed in 1928 — is set to undergo a major redevelopment.

The $211 million plans include knocking down the rear of the theatre and expanding its stage to accommodate bigger acts — along with improving facilities to allow for disabled access.

The project wouldn’t be feasible without funding via a joint venture between LaSalle Investment Management and theatre owners the Marriner Group.

LaSalle have secured the air rights over the theatre to allow development of the office block at the rear that will cantilever over the theatre.

The 23-storey office tower will spread across 222–240 Exhibition St.

The communal spaces in the office building will be available for use by the theatre on weekends and evenings for rehearsals and entertainment.

Here’s a mock-up of the proposed design:

|

|

| Source: Herald Sun |

You might be wondering if there’s much demand for CBD office space.

The sector was trashed through the pandemic — felt most severely in Melbourne — the lockdown capital of Australia.

It was best monitored at the time via the sublease barrometre.

To survive an extended downturn, office markets need to be generating rent and tenant demand.

Subleasing is when firms unable to operate at full capacity put their offices onto the market to attempt to rent them out to someone else.

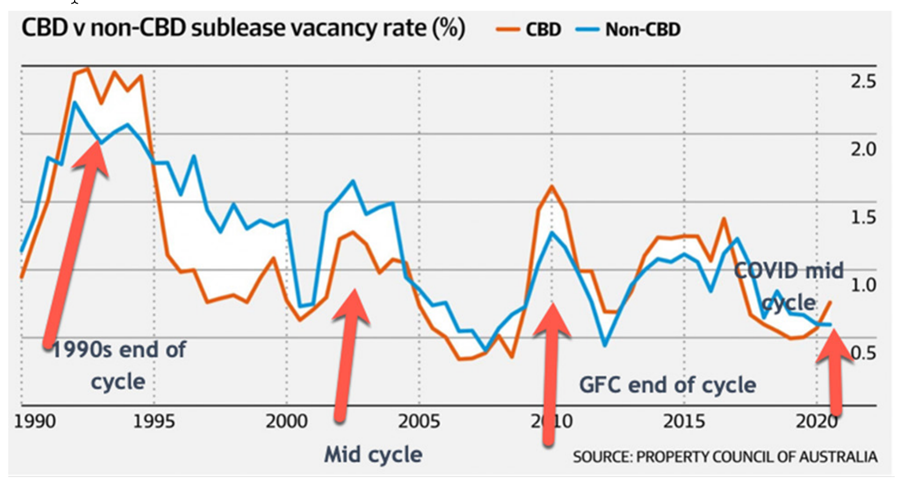

The graph below is from the Property Council of Australia.

It charts the trend of sublease vacancies over recent decades into the COVID panic.

And not surprisingly, for those that understand the 18-year real estate cycle, it charts this also:

|

|

| Source: Property Council of Australia (Edited by Catherine Cashmore) |

In the early 1990s recession, the sublease vacancy rate peaked at around 2.5%.

Lesser surges were recorded during the mid-cycle real estate recession (the 2001 dotcom bubble), the 2008 Global Financial Crisis, and the most recent 2020/21 COVID-panic.

Since the lockdowns have ended, things have improved markedly.

Hybrid work arrangements have become increasingly common.

Sublease availability in Australia’s five largest cities decreased more than 100,000sqm in the year to June 2022.

The biggest changes were recorded in Melbourne, with an 81,300sqm decrease.

Still, things aren’t looking all that rosy elsewhere.

Geopolitical fractions, supply chain disruptions, rising cost pressures — as well as the Chief Medical Officer once again advising people to ‘work from home’ — has seen office vacancy rates increase in the second quarter of 2022.

Sydney’s vacancy rate nudged up to 13% and Melbourne 15% (according to data compiled by real estate advisory JLL).

Even Perth has a high CBD office vacancy rate — topping 20%.

Alongside this, incentives are at, or close to, peak levels.

Incentives are payments or rental concessions offered by a landlord of an office building to entice new or existing current tenants to sign onto a lease.

They can give the illusion that yields are healthy. But in reality, it’s a game of smoke and mirrors.

For investors, you could be buying a property that’s showing a 6% yield. But if the tenant has secured a 50% rental incentive the reality is half that. In an inflationary environment, it doesn’t look crash hot.

We’ll wait to see whether the proposed development above the Melbourne Comedy Theatre will be able to achieve full occupancy with or without incentives.

But for commercial investors — I’d be cautioning against investment of CBD office stock in favour of other commercial markets that are showing better returns.

Sincerely,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia