All week we’ve been on the same mission: to tease out the implications from the AI supercycle hurtling towards us all.

Hedge fund Coatue is putting their stake in the ground. They say AI is going to improve productivity and take down the US debt to GDP ratio.

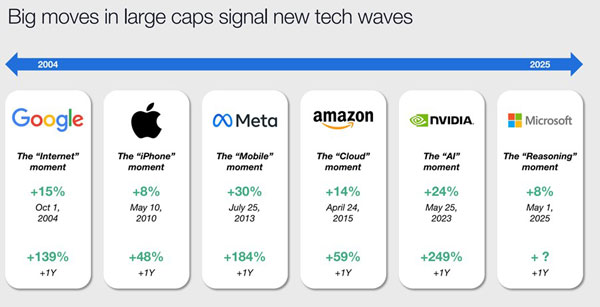

They think the Mag 7 will keep growing. But the next wave of big capital growth will come from different AI winners.

The next wave of this tech is via AI “agents”. This could be big if we tee off similar tech breakout points…

| |

| Source: Coatue |

Think of any stock you hold, or know. The central question for any analyst is how its business model interacts with the AI supercycle.

This is not something you can dismiss lightly. Just as AI will be responsible for huge wealth creation, it could cause massive destruction too.

You only need to look at how the internet in general upended the staid world of many business models.

Even a fortress like Google is getting hits to the flank here.

Information consumers are beginning to default to ChatGPT and taking down Google’s stranglehold on search.

There will be, too, a middle ground where companies can integrate some of the benefits of AI but without capturing much upside.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

Perhaps Fat Tail is an example of this right now.

I get Claude or Perplexity to spell check my articles. A copy editor used to do it. Now the other editors and myself are incorporating AI into our research methodology.

That reminds me. Fund manager David Wanis wrote back in December 2024…

“As it applies to our own work, we have been experimenting with AI models and tools of various sorts during 2024 and are likely to put some to work in 2025. We are improving our understanding of technologies, how they are changing, and discovering real use cases this technology can provide – which was not available with prior technologies – on both sides of our investment process.

“The standard line when talking about AI is it won’t replace the need for human decision-making in the investment process.

“This may be true, but it may change the number of humans needed, how they spend their time, or the make-up of skills across an investment team. Or maybe it won’t.

“But AI technology itself is so transformative and advancing so quickly on both performance (improving) and cost (plummeting) that we believe priors and biases need to be continuously challenged.

It’s easier to see all this in action over in the US markets. It’s harder to glimpse in Australia.

It’s fair to say the richest hunting ground for AI beneficiaries is in the US markets.

That’s why we are so pumped to have US entrepreneur James Altucher with us here at Fat Tail.

James and I are already putting out AI beneficiary ideas to subscribers of Altucher’s Investment Network Australia. The results are great so far.

What can I say? Get involved here.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments