In today’s Money Morning…not your typical trade deal…an opportunity like no other…this major global economy is finally opening up…and more…

While all eyes were on the RBA this week, it seems the central bankers weren’t ready to capitulate just yet.

Lowe and his cronies have decided to maintain our record low cash rate of 0.1%.

But in the coming months, that seems likely to change. June has apparently been earmarked as the next key meeting, a time when we may finally see the RBA raise rates.

And as we’ve seen already this week, that seems to have given the market a brief reality check.

Does that mean you should batten down the hatches and prepare for more carnage?

Maybe.

Beyond the short-term volatility and uncertainty, though, there is a much bigger story to consider this week. Because you see, on Saturday, Australia and India finally locked in an interim free trade agreement.

After 11 painstaking years of negotiation, we finally have a working deal in place.

And while this is still just an ‘interim’ agreement, for now, it will lead to much bigger things to come. I am almost certain of that.

In fact, you should expect this tie-up between India and Australia to become a new cornerstone of our overall trade. It’s already forecast to foster a bilateral trade value of $45 billion by 2027. And that is likely just the tip of the iceberg…

This is a partnership that will not only rival our dealings with China but likely even begin to replace it.

Not your typical trade deal

As with most trade deals, tariffs were a big part of the negotiations.

Aussie coal, wool, and rare earths are a few of the immediate winners on that front. But this agreement also includes planned cuts on tariffs for wine and a bunch of agricultural products, namely fruits and nuts.

That’s a big win for our local farmers and winemakers, particularly as these two groups have been shunned by China recently.

The Middle Kingdom has put in place a few official and unofficial bans on our local produce in recent years — barriers that have contributed to the fraying relationship between Australia and China.

It’s a story that has even begun to raise the question of whether globalisation itself might be over.

I can tell you right now, that is not the case.

Despite its many flaws, global trade is not going away anytime soon. Having said that, we can expect it to look a whole lot different moving forward.

And that is precisely why this deal between Australia and India is so interesting…

The reason this trade agreement took more than a decade to secure is because India’s leaders know what they need. Prime Minister Modi, who has been in power since 2014, has long held a nationalistic view on trade.

He understands the need to protect his local industries from overseas competition. Not because it is necessarily better for consumers, but because it retains local jobs.

After all, 40% of all Indians are employed in the agricultural industry. If Modi starts accepting too many cheap imports, those millions of jobs will be at risk. That would be political suicide — which is precisely why doing business with India has traditionally been so hard.

This new deal with Australia looks as though it will break that trend.

It’s not just about allowing goods to flow more freely between the two nations. This deal is also about cultivating interest in long-term investments and partnerships.

An opportunity like no other

Now, for investors like yourself, what this focus on investment and partnership spells is opportunity.

As Srikanth Kondapalli, the dean of the School of International Studies at Nehru University, told the AFR:

‘There will be a bit of wait and see, to evaluate how the tariff reductions impact on domestic sectors, and then we look at further opening up,

‘There is a high degree of complementarity with Australia. With the wine industry, we are hoping the reduction on duties at the premium end will result in investment and partnerships in India’s wine industry.’

Rather than just flooding the local market with our products, India is clearly looking for more. They want sustainable terms that will not only allow for healthy competition but also boost their own industries too.

For Australian businesses that can facilitate this sort of investment, I suspect we’ll see some strong uptake. After all, opening some operations in India to gain access to the market is a sweet deal. A detail that, again, is a fairly stark contrast to China with its more hostile government.

Doing business in a democratic and relatively free market economy is a lot easier.

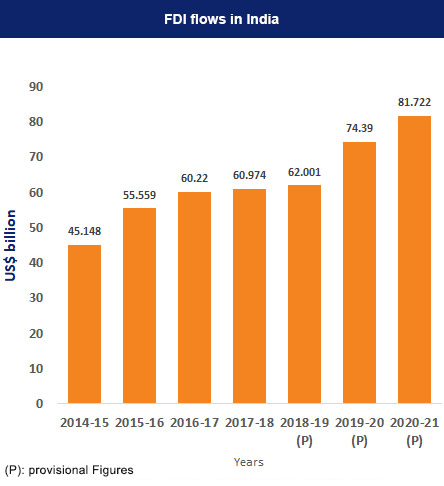

And while India has certainly been cautious until now, it seems the emerging nation is ready to make its next big leap forward. You can even see this reflected in their overall Foreign Direct Investment stats:

|

|

| Source: India Brand Equity Foundation |

This major global economy is finally opening up.

Fortunately for us, Australia is currently one of the lucky few set to play a big role in this shift, which is precisely why every investor, no matter how big or small, needs to start considering this partnership.

The next decade is looking like it may be all about India.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.