The island of Manhattan was famously sold off by indigenous inhabitants for US$24 worth of beads and trinkets.

Not a bad deal for the wily Dutch.

But it wasn’t obvious for a while.

The US’s agricultural resources — grains, tobacco, dyes, and cotton — were mostly produced inland or in the southern states.

And New York had no vast gold deposits like South America, either.

The main advantage it had was its natural harbour — a harbour that provided the initial gateway to trade with Europe.

But New York made the most of it.

In 1810, some clever financiers cooked up a scheme to build a canal from the Great Lakes at Buffalo to New York’s Hudson River.

As you can see here, it opened up New York City by ship to the country’s vast interior:

|

|

| Source: Quora |

The risky plan paid off.

Commodities from all over the young nation were shipped to Europe through the Erie Canal, with New York collecting the ‘toll’ on the way through.

On the return trip, empty cargo ships would offer cheap passage to immigrants from Europe looking for a better life.

And they came in droves.

The idea of the US and particularly New York — a land of individual freedom and economic opportunity — appealed to millions shut out from such opportunity in their own lands.

But what these immigrants found on arrival was often disappointing.

Greedy robber barons, Wall Street reptiles, corrupt politicians, riots, and civil wars awaited them.

And yet they kept on coming.

Over time, the city adapted to each and every new group and each and every new challenge.

This melting pot of nations, drawn together for a chance at the American dream, became battle-hardened to anything the world could throw at it.

If you could make it there, you could make it anywhere.

During the Gilded Age of the late 1800s, the city became a cultural icon too. The new world’s centre for art, music, and philanthropy.

And by the time the 20th century arrived, New York was in the perfect position to take over the world.

Thanks to its role as a trading centre, it also became the financial centre of the US. It was home to the New York Stock Exchange and all the major banks.

And over time, as US dominance grew, it became the global financial centre too.

The two World Wars, which bankrupted the European powers, only sped up this process.

In short, control over money is how New York became the city we know today.

But could this era of dominance be coming to an end?

And what will take over?

There’s only one candidate…

Their hatred runs deep

In a way, the story of New York reminds me of the story of Bitcoin [BTC].

People get into bitcoin and crypto for many reasons.

Sure, to get rich and make a fast buck is one. And yes, there are scammers and frauds to contend with.

But, like those early immigrants to New York, people are also drawn to it for many more noble reasons too.

The idea of financial self-sovereignty is the main one.

While that appeals to some people in Western countries, it’s especially inviting to those in developing nations.

Locked out of the global banking system or forced to use currencies prone to radical devaluation, the benefits of bitcoin are often more blatantly obvious to such people.

To them, bitcoin is a chance to fight back and take back control.

There’s a great little list here of 13 human rights use cases for bitcoin put forward by New Zealand environmentalist (not some ‘crypto bro’) Daniel Batten.

He finishes the list by adding:

‘Most technologies (cell phones, the grid) roll out in the West first, the developing world first. Bitcoin flips that on its head.

‘This time, the West will feel Bitcoin’s value last.

‘But don’t assume that because you can’t see value — because you may have taken for granted the freedom, affluence and human rights other don’t have that value doesn’t exit. It does. And it has been a lifeline for millions.

‘And don’t assume the rights you enjoy today have cannot be taken away. They can. Bitcoin protects us also.’

I’d echo this sentiment.

But for some reason, it’s not a feeling the mainstream press shares. Right now, they’re basking in the schadenfreude of the current crypto price woes.

Here’s an actual Thanksgiving tweet put out by Bloomberg:

|

|

| Source: Twitter |

Funny?

Perhaps…

But definitely telling.

I mean, I don’t see them publicly gloating about Grandpa losing his nest egg in the worst bond market in history?

Their hatred of bitcoin runs deep…

The funnier thing about what’s happening right now is that it was actually ‘their man’ in crypto that was the biggest fraud.

The truth of this may shock you…

Money and power

The current crypto carnage stems from the failure of a crypto exchange called FTX. It was run by an American named Sam Bankman-Fried (SBF).

You might know a bit about this, and I won’t go into the depths of it today.

[Editor’s note: For a full rundown, this excellent piece explains how it started and, in turn, unravelled.]

But Michael Saylor got to the long and short of it:

|

|

| Source: Twitter |

Bitcoiners — true proponents of decentralised money — have been calling out scams like this for years.

The inconvenient truth?

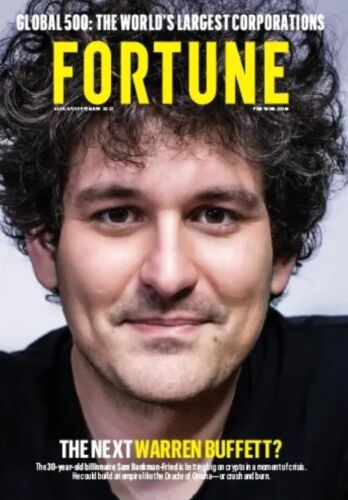

It was mainstream publications like this one that were giving legitimacy to SBF:

|

|

| Source: Fortune |

So, are such publications offering apologies now?

Fat chance!

In fact, they’re rushing to protect SBF, explaining it all away as an unfortunate business mishap.

|

|

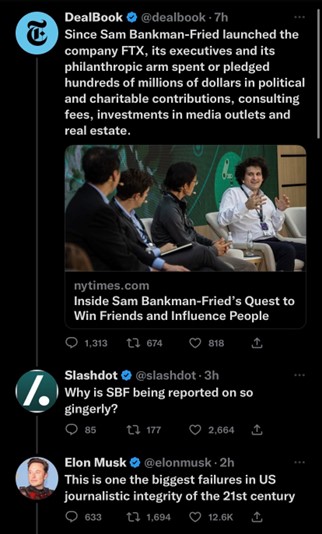

| Source: Twitter |

I kid you not — this was the headline in The Wall Street Journal.

What a joke!

Think about it…

The mainstream has waged war on bitcoin and crypto for as long as I can remember, taking any opportunity they could to take a potshot.

And yet when an obvious fraud like this is exposed, they run puff pieces?

Elon Musk put it best in response:

|

|

| Source: Twitter |

But there’s more…

Here’s another one, this time from The New York Times:

|

|

| Source: Twitter |

This is an unbelievably bad take on someone who essentially just stole other people’s money.

Again, you can see Elon Musk’s scathing response below it.

Which begs the question…

Why is he getting such protection on this?

Some think SBF’s links to the New York establishment run deep. And that this is a concerted effort to protect people higher up the chain.

There’s no doubt he’s connected.

Both his Mum and Dad are Stanford law professors, and his Mum was a big Democrat campaign fundraiser.

SBF himself gave US$39.8 million (of stolen customer money) to mainly Democrat candidates before the recent mid-term elections.

The whole thing stinks.

And some people think this was all actually a front for a deeper State plot:

|

|

| Source: Twitter |

There’s definitely more to this story than meets the eye.

Let’s see what develops…

The only alternative

I started off today’s piece by talking about the rise of New York.

New York’s story is about many things.

Diverse people, new ideals, social and economic challenges, new technologies, and massive trade all helped shape it.

Every chaos New York had to survive set it up for its eventual success.

But underneath it all, New York is also the story of modern money.

Don’t forget, New York is where JP Morgan famously helped set up the Federal Reserve after the Panic of 1907.

A Federal Reserve that these days has the power to create or destroy money — and whole economies — at will.

But the fact is, this centralised system of money is failing a lot of us right now.

We’re feeling it through high inflation.

We’re seeing it in the rise of unsustainable debts.

And we’re seeing it play out in some of the worst instances of crony capitalism we’ve ever seen.

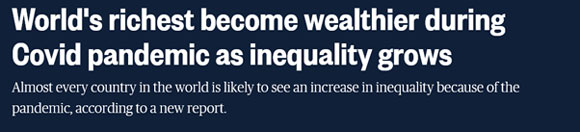

Things like this, for example:

|

|

| Source: NBC News |

Ask yourself how it’s possible that the wealthiest people in the world got richer at a time global trade came to a standstill.

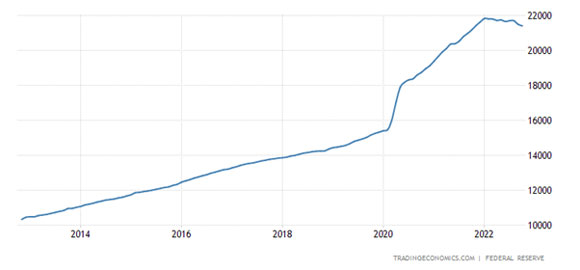

The answer is in this chart:

|

|

| Source: Trading Economics |

This graph shows the growth in US money supply over the past decade.

As you can see, the Fed threw money at COVID, which propped up the asset values of the rich. It’s pure manipulation.

Manipulation of money has reached the point of no return.

While this is hurting us in the West, it’s a lot worse for people in places like Turkey, Argentina, and Africa.

Bitcoin isn’t perfect, but it’s the only alternative that has a chance of beating the existing monetary powers.

And as a decentralised protocol, open to all, it welcomes anyone eager for economic opportunity and financial freedom, just as New York welcomed those huddled masses in days gone by.

You might not know it yet.

But bitcoin is the ‘new’ New York.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: If you’re looking for a good place to dive deeper, I highly recommend you read this article from Jeff Booth.

He uses first principles to build a case of why deflationary money (bitcoin) is actually better for humanity than our current inflationary (fiat) money.

His reasoning is worth a read, even if you’re a bitcoin sceptic.