Hey, let me share a laugh before we tuck into the current small-cap market.

There’s a scene in The Simpsons when Homer goes into Mr Burns’ office to plead for money.

Mr Burns is smiling and saying something like this to Homer:

‘Oh, please continue Mr Simpson, go on, tell me more.’

Meanwhile, under his desk, his finger is frantically pressing the buzzer for his security staff to drag Homer out the door.

| |

| Source: The Simpsons |

That came to my mind listening to a market related podcast yesterday.

The hosts organised multiple fund managers and analysts to each give a few quick forecasts for the year ahead.

One of the requests for each person was for their ‘prediction’ as to which commodity would bomb in 2024.

The ones I heard trotted out the same forecast for the projected duster: ‘Iron ore.’

The spirit of Mr Burns came into my being.

‘Iron ore, hmm, yes, indeed,’ I thought. ‘But…remind me again why I am supposed to give a toss what these guys think?’

I pressed my buzzer too — the stop button on my Spotify account. It was all a bit of waffle.

Now, I’m not having a crack at these guys. I get it.

I’ve been put on the spot like that too. Nobody listening wants to hear ‘buggered if I know what’s going to happen’.

It’s fun to have a guess too!

However…all I heard was some vague assertions like a ‘weak China’ or ‘already had a good run’…and other associated blubbering.

At no stage did I see any cohesive facts presented on why iron ore should bomb in 2024.

Let me give you some further context on this.

Most investors assumed iron ore would bomb in 2023 too. That set up a cracking rally to take advantage of in December.

And in fact, if your super fund made money last year, off the general market, you can thank iron ore for a lot of it — and, in this case, the benefit of passive investing.

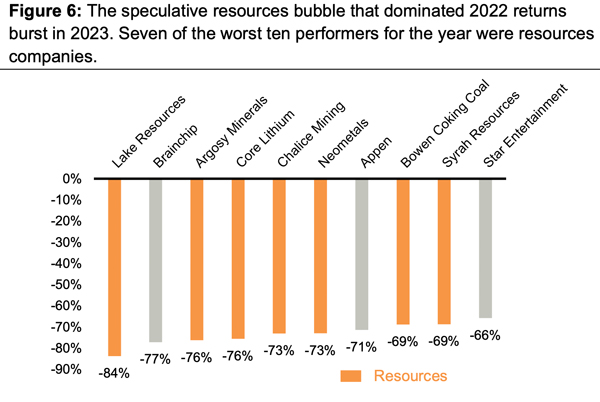

You might also recall reading a torrent of material about how whizz bang battery metals were going to be for one and all.

Here’s how that thematic went in 2023…

| |

| Source: Factset, Firetrail, January 2024 |

Forecasts and opinions can be treacherous territory!

It also doesn’t make sense. The same line of thinking — that decarbonisation and electronification are huge and important trends — can’t happen without steel. Neither can global GDP growth.

That said, 2024 is starting off a bit wobbly for commodities in general too.

Iron ore is currently retreating from its recent high of $140 a tonne to US$129.

Suddenly the bears are enjoying some respite from looking out of touch with reality.

My colleague Charlie sent me a message on Teams yesterday, asking if I was dropping my iron ore positions or holding through the turbulence.

I’m holding!

Here’s how I am currently thinking about it…

It may be that iron ore DOES bomb in 2024.

It’s a volatile and unpredictable beast. I can’t see the future any better than you can.

But I need to see more weakness or worry before I drop the ball here.

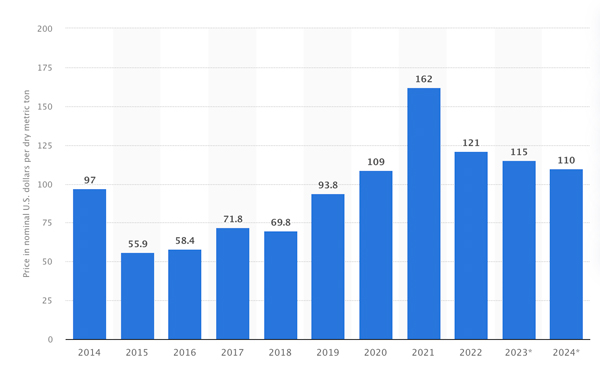

Here’s a chart I like to have at hand to keep the current price in perspective…

AVERAGE IRON ORE PRICE 2014–2024

| |

| Source: Statista |

The reality is that iron ore at current prices is a boomer. What am I supposed to be worried about?

That said, the market trades on future expectations. Will iron ore still be ‘higher for longer’ in 2024?

There’s a very good chance it may be.

Why so?

Iron ore trades in a tight correlation with Chinese liquidity. It’s Chinese stimulus that took iron ore up last year.

Here’s a relevant update on that from Michael Howell at CrossBorder Capital:

‘Both Fed and PBoC liquidity growth has slowed in the last couple of weeks. We put this down to a base effect in the case of the Fed and seasonality in the case of the PBoC.

‘As we noted in a recent update, the PBoC often tempers the pace of liquidity injections at the start of the year, ahead of a boost around the time of the Lunar New Year. This year the LNY falls on 10th February.’

I found this super intriguing. It explains, potentially, the current dip in iron ore and gives us cause to look for a potential rise around early February.

Here’s the other thing…

In case you don’t know, the biggest iron ore miner in the world — Rio Tinto — just announced the biggest iron ore development project in the world.

It’s called Simandou. It’s going to cost RIO a projected $6 billion.

RIO’s team has a direct line to iron ore buyers. They would only go ahead with such a massive project over such a timeframe if they expect to sell it at good margins.

Should we go with some waffle from some random analysts, or the company putting $6 billion at risk?

I’ve made my choice. And as of today, small-cap iron ore miners still look too cheap in my opinion.

Best,

|

Callum Newman,

Editor, Small-Cap Systems

and Australian Small-Cap Investigator