After weeks of euphoric gains in crypto and equity markets, signs point towards a looming correction.

It’s harder to say whether that’s in weeks or months. But at this stage, the market is a bubble searching for a pin.

I could spend the entire article arguing that point, but the easiest sign is the speculative fever that’s hit markets this past week.

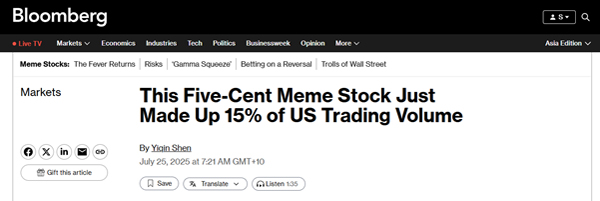

Meme stocks have dominated trading volumes in the US as retail investors throw cash at anything with momentum.

Yesterday, a penny stock, Healthcare Triangle, saw its shares jump 115% with zero news. The trading volume was almost seven times the company’s total market cap.

| |

| Source: Bloomberg |

This speculative fever isn’t confined to traditional markets — it’s bleeding directly into crypto, where the same euphoric patterns are playing out with even higher leverage.

‘Bull markets are born on pessimism, grown on scepticism, mature on optimism and die on euphoria.’

—Sir John Templeton

What I think we’re witnessing right now is the calm before a final major shakeout for this year.

Now, I’m not here to tell you to sell all your stocks and panic.

It might be a good time to tighten stop-losses for your shorter-term positions and take profits on your risky stocks.

What I am arguing here, is that any coming correction should be viewed as your biggest opportunity this year — especially when it comes to Altcoins.

This isn’t the end. It’s the beginning.

The Stage is Set

The past month has seen an incredible surge in crypto markets.

This week, JP Morgan said that net capital inflows into digital assets have hit US$60 billion year-to-date — up 50% since their May update.

That’s higher than the private equity and private credit markets this year.

This bears repeating. The largest institutions and the billionaire class (who usually invest capital into private markets) are now deep into crypto.

Much of this is thanks to the latest Stablecoin regulation changes in the US.

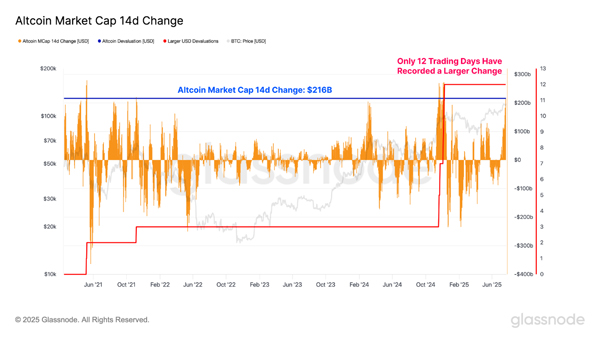

This latest stablecoin push has helped Altcoins outperform Bitcoin. As you can see below, their market cap increased over US$216 billion in around a fortnight.

| |

| Source: Glassnode |

After the passing of the GENIUS Act, institutions and retail investors alike have flooded Altcoin markets.

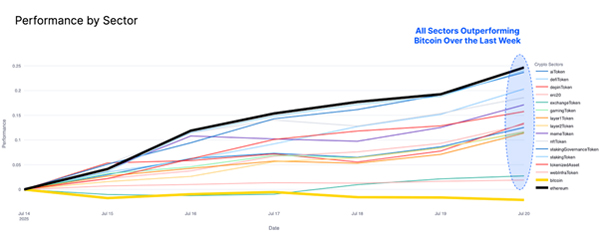

Clear regulations and huge institutional interest have lifted all boats. Over much of July, all altcoin sectors outperformed Bitcoin.

| |

| Source: Glassnode |

Ethereum led the charge, with derivatives volume hitting record all-time highs this month.

When leverage reaches these extremes, corrections become inevitable. Not because the thesis is wrong. But because markets need to take a breather.

On Thursday, the first signs of exhaustion crept in.

Ripple (XRP) crashed 13%. Solana dropped 8%. Meme-coins are retreating. Even the mighty Bitcoin couldn’t hold above US$120,000.

But here’s what the headlines won’t tell you: This isn’t panic selling. It’s a derisk moment.

The evidence is clear in the derivatives data. Open interest in XRP futures plummeted 6% in just two days. Solana positions dropped 5%. Yet funding rates remain stubbornly positive.

Translation? Big traders aren’t betting against crypto. They’re simply taking profits and reducing leverage.

This distinction matters. When markets crash because of genuine fear, you see negative funding rates. Traders pay to bet against the market. Open interest explodes as new short positions flood in.

That’s not happening. Instead, we’re seeing leveraged bulls quietly exit stage left.

They made their money. Now they’re waiting for the next entry point.

The smart money knows this pattern. They’ve seen it before. And they’re positioning accordingly.

How I see the Cycle

Every great altcoin cycle follows the same script.

First, Bitcoin leads. Then profits rotate into Ethereum and major Altcoins. Finally, the floodgates open for smaller tokens.

Many have argued that we’re firmly in Act Two of this cycle.

After all, Ethereum’s futures volumes have overtaken Bitcoin’s for the first time since 2022 — a clear sign of that phase.

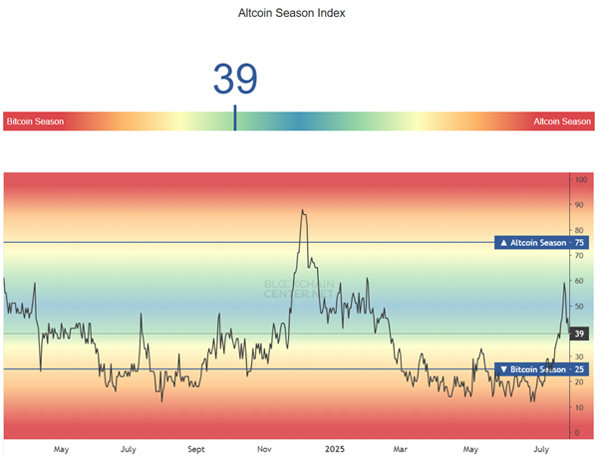

If Thursday’s moves hadn’t occurred, I might have told you we’re on a straight line to Altcoin season — a time when smaller crypto coins flourish.

But below you can see the return to the safety of Bitcoin (relative to other crypto). Capital isn’t leaving crypto. It’s rotating within it.

| |

| Source: Blockchain center |

I think this is the prelude to something larger, which could be a buying opportunity.

Remember these pullbacks serve a vital function. They flush out weak hands. It resets funding rates. It creates the breathing room needed for the next leg higher.

Think of it as a coiled spring. The more it compresses, the more explosive the eventual release.

How I see this playing out next:

- Bitcoin’s % of the crypto market continues to regain ground as markets slow and there’s a ‘flight to safety’

- Or markets continue to rip higher at an unsustainable level

- A shock drop occurs in stocks and crypto with riskier assets taking the brunt of the pain [Time to Buy]

- Recovery begins with money flowing back into Bitcoin

- Next bull run quickly shifts into Ethereum and major Alts

- Altcoins break out to new major highs for this cycle.

I won’t give an exact timeline for when this will occur. But I can imagine it happening in the coming months.

Beyond a Correction

While we may fret over these shorter-term gyrations, institutions are quietly preparing for crypto’s next chapter.

Major banks are preparing their own stablecoin offerings. JPMorgan sees the market hitting US$500 billion by 2028.

Bank of America’s CEO confirmed they’re prepping to launch their own stablecoins. They’re expecting the supply to surge by up to $75 billion in the near term. Followed by trillions later.

Stablecoins currently command a $270 billion market cap. A $75 billion increase represents nearly 30% growth — and that’s just the conservative estimate.

This will be the driver of that next Altcoin wave. Remember, every dollar entering stablecoins eventually flows into other crypto assets. It’s dry powder waiting for deployment.

But markets that go straight up inevitably come straight down. I think that drop will be the best buying opportunity in crypto for years.

Those falls become a launchpad for the next wave. And this one has all the ingredients to be an altcoin boom that could dwarf anything we’ve seen before.

But if you wait for the media to tell you when to buy — it’s already too late.

Recently, I talked about the 20-day Media Lag and how it offers a big opportunity for proactive investors.

We’re also opening a new window of opportunity into our latest picks for the coming Altcoin wave.

Remember, the last shakeout is always the hardest to endure.

It’s also the most profitable to buy.

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

Comments