Australia is just nine days away from snapping a near 30-year streak…

Next Wednesday (on 2 September), the national accounts for June will be made public. Data that is all but certain to confirm our first technical recession in close to three decades.

What else is there to say except, we had a good run.

From dotcom bubbles, to terrorist attacks, and even a global financial maelstrom — our economy endured. Somehow managing to avoid two back-to-back quarters of negative growth through thick and thin.

That is, until the coronavirus came along.

This pandemic will finally bring an end to our incredible run. With unemployment already in tatters and many businesses on the ropes.

Because of that, Philip Lowe — the RBA governor — expects we’ll see a 7% contraction for the quarter. With Lowe also anticipating the jobless rate to reach double digits for the first time since 1994.

In fact, the only positive spin Lowe could give to Parliament on the outlook was that the ‘decline is not as large as initially feared’.

A fact that will come as little consolation for most.

But that doesn’t mean it’s time to be pessimistic. Far from it.

Because this recession is good news for investors!

Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Hard and fast outcomes

Let’s get one thing out of the way first.

This recession will bite, and it will bite hard. With the likelihood that we’re in the worst of it as we speak.

Make no mistake, 2020 will be a year to remember from a macro perspective. Just for all the wrong reasons.

However, by 2021 most forecasts allude to a strong rebound. With both the RBA and IMF estimating growth somewhere between 4 and 5%.

In other words, this isn’t likely to be some protracted downturn.

Fundamentally speaking, our economy isn’t in need of a total reset.

This pandemic is more of an anomaly. Leading to a swift and vicious downturn, that will likely be followed by an equally quick recovery.

My point is, don’t expect this recession to stick around for too long.

It will be brutal, it will be impactful, but it won’t last.

And more importantly, it means investors will only have a limited window of opportunity…

See, the real silver lining of this recession is yet to come. Because as history has shown us time and time again; small-cap stocks boom after recessions.

As extensive research has shown:

‘During recoveries, small-cap stocks quite consistently outperform the large-cap market.

‘The fears that keep investors from wanting to hold riskier small-cap stocks in recessions ultimately reward the investors who do own them as the market recovers.’

That’s why you need to be prepared for this recession.

Not just to preserve and maintain your wealth — but also to grow it. Taking advantage of an opportunity that Australian investors haven’t seen for almost 30 years! Back when chalk and blackboards were only just being phased out by the ASX.

Suffice to say, you won’t want to miss out this time.

Because it might be another 30 years ‘til the next one…

[conversion type=”in_post”]

Stirring to life

Now, like I said, this window of opportunity for small-caps is already opening.

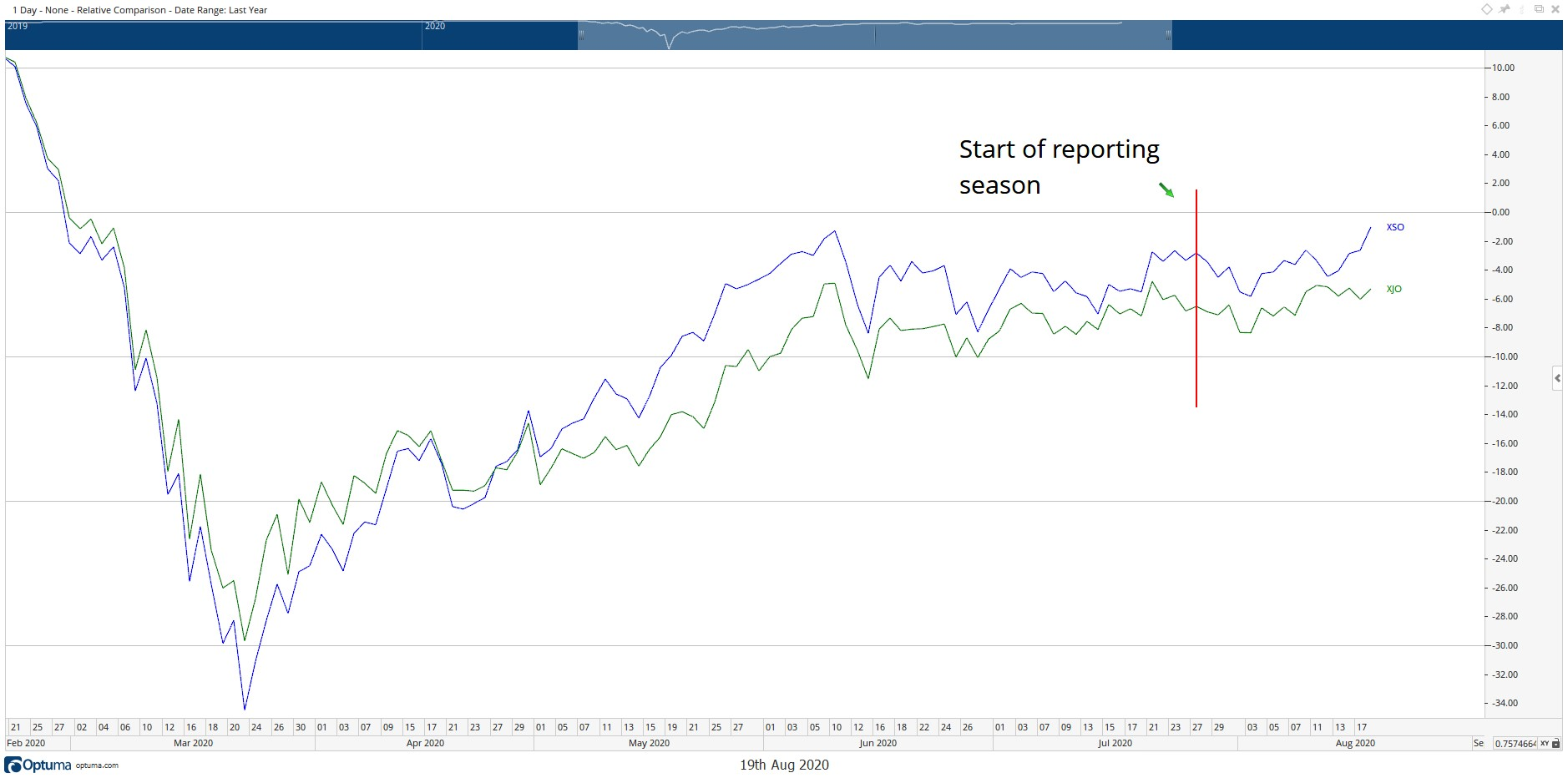

My colleague Greg Canavan even showcased this fact to our Insider readers last week. Highlighting the early divergence between the S&P 200 and the ASX Small Ordinaries:

‘The Small Ords have just managed to exceed the June peak, while the large-caps continue to move sideways.’

|

|

| Source: Optuma |

The blue line shows the clear breakout of the small-cap index. Whereas the green line (S&P 200) continues its flat run.

In other words, the momentum behind small-caps is starting. A trend that, if history rings true, should only grow in strength over the coming months and years.

We may look back at this point as the start of a very lucrative boom.

Granted, that doesn’t mean all small-caps will succeed.

Like any investment, there are no guarantees, particularly in the highly volatile small-cap space. They can fall just as fast as they soar. So, we’re bound to see plenty of small businesses succeed and fail. Just as we’re seeing plenty of big businesses succeed and fail right now.

The key difference though, is their propensity for returns.

Small-caps, by their very nature, have more room for growth. The kind of growth that can deliver life-changing returns.

So, don’t look at this inevitable recession as a total loss.

Instead, treat it as the investment opportunity of a lifetime. Because if all goes to plan, you could make a hefty profit from small-caps if you’re savvy about it.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Comments