What does that control look like in practice? What actual steps will be taken that impact asset values and investor returns (in addition to the obvious lifestyle changes)?

The answers to those questions are on vivid display in the chart below.

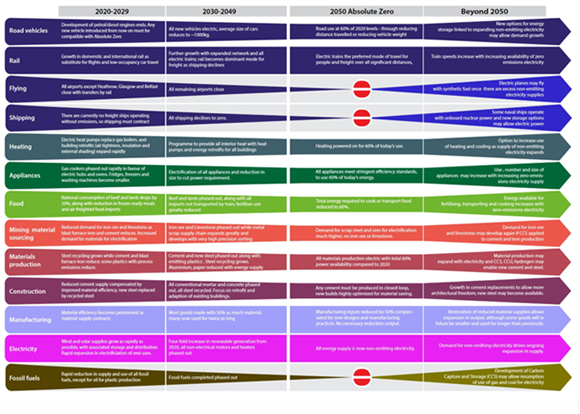

The chart has a left-hand scale that shows particular industries and activities such as Road vehicles, Flying, Manufacturing, Construction, and other key sectors. The top line scale shows time periods for implementation, such as 2020–29 out to beyond 2050, with intermediate periods included.

By selecting a particular activity from the left-hand scale and a particular time period from the top-line scale, and looking at the intersection of the two, you can see what this playbook expects the future to be.

When the horizontal bar narrows through the passage of time, it means that activity is being phased out. When a red circle with a white bar appears, it means that the activity has ended. The material to the right of the red circle (in a slightly different hue) shows the replacement for the discontinued activity.

Some of the projections are simply impossible to achieve. That doesn’t mean the elites won’t try, nor that they won’t cause enormous economic harm in the process. Other projections are possible but frightening in their implications. Again, that doesn’t mean the elites won’t try, or that they won’t destroy certain parts of the economy. If you want to know what dystopia looks like, study this chart.

It’s important to know the source of this chart. If you were an opponent of the Green New Scam and wanted to raise awareness of the craziness to come, you might produce this chart as a wake-up call to everyday citizens. That’s not what this is.

This chart was produced by a group of academics called UK FIRES, which is a collaboration of faculty from Oxford and Cambridge Universities and other leading universities in the UK. It is funded by the UK Engineering and Physical Resources Council, a Government agency.

In substance, this is the government playbook for the Green New Scam. Note the goal is ‘Absolute Zero’. This is not the same as net zero where some emissions have been cut while others are allowed. Absolute zero means no emissions whatsoever. None.

|

|

| Source: Engineering and Physical Science Research Council |

To understand how threatening this vision is, look at some of the details. Under the heading of Flying, the plan says all airports in the UK except Heathrow, Glasgow, and Belfast will be closed by 2029. Those three remaining airports will be closed by 2049. Flying in the UK will come to an end beginning in 2050. Beyond 2050, air travel may resume in electric planes with synthetic fuels assuming there is ‘excess’ electricity produced with zero emissions — an unlikely outcome.

In the category of Food, the plan is to cut consumption of beef and lamb by 50% before 2029. In the period 2029–49, beef and lamb and eliminated completely. Bugs, anyone?

In the category of Road vehicles, the elite plan calls for an end to the development of internal combustion engines by 2029. After 2030, cars will have to be electric and cannot weigh more than 2,200 pounds. (Today, the average midsize car weighs 1,497 kilograms, and a large car or full-size SUV weighs between 1996–2722 kilograms.) By 2050, road use will be reduced by more than 40% compared to 2020 levels by reducing vehicle weight and distances that motorists are allowed to travel.

You can review the remaining categories at your leisure. One is more extreme than the next. What is not included in the chart are the coercive measures that will need to be applied in order to achieve these goals.

Citizens will be confined to small towns or cities for extended periods. Travel will be tightly restricted. Appliances will be downsized with no consumer choice allowed. Taxes will be imposed on targeted activities to discourage use. Education will be turned to indoctrination to raise a generation who believe in the climate lies needed to gain support for these measures; (that kind of indoctrination has been underway for some years).

Welcome to the world of the green elite. It’s coercive, restrictive, arrogant, and apparently not much fun. It’s a world where the elites control everything, and you do as you’re told. It’s a world based on lies and fear. It’s coming sooner than you expect unless citizens can join hands, reassert the truth, and push the elites back into a corner where they belong.

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia