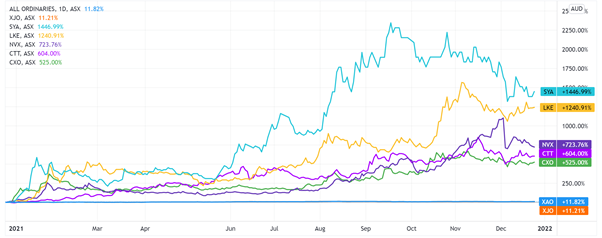

We examine the five All Ordinaries [XAO] stocks notching the largest calendar year gains of 2021.

With 2021 behind us, it’s useful to look back and reflect.

What stocks performed well in 2021? What stocks didn’t? And what does this tell us about the themes informing the markets?

Today, let’s canvas the five biggest winners of 2021 on the All Ordinaries Index.

The All Ords is a total market barometer, containing the 500 largest ASX stocks, accounting for about 85% of the Australian equity market.

| Company | 1-Year Return to 25 December 2021 |

| Sayona Mining | 1,445% |

| Lake Resources | 1,240% |

| Novonix | 695% |

| Cettire | 600% |

| Core Lithium | 515% |

Lithium juniors dominate 2021

Four of the five best performing stocks of 2021 were lithium stocks, underlining just how hot the sector was in 2021.

If we extended the list beyond the top five, we’d find that eight of the top 10 performing stocks on the All Ords were lithium stocks in 2021.

The two stocks not associated with lithium in the top 10 were Calix Ltd [ASX:CXL] and Cettire Ltd [ASX:CTT].

Importantly, the lithium stocks running up the most in price were junior, pre-production companies. The market was chasing potential, not established, producers.

This focus away from producers didn’t go unnoticed in the industry.

Eley Griffiths Group portfolio manager David Allingham told the Australian Financial Review in November 2021:

‘From this level you’ve got very good upside in the producers still, with less downside risk should the retail euphoria subside for whatever reason in the coming six to 12 months.

‘I wouldn’t say we’re overweight the sector. We’re kind of market weight. We acknowledge valuations moved aggressively. The pricing is very, very toppy in the spodumene market at the moment, but it may well stay so for a while, so we want to keep an oar in the water there.

‘The money’s cycled out of, I guess, the more mature producers into the sort of pre-development-phase stocks where there’s clearly more speculation down there.’

While the likes of Lake Resources and Sayona Mining were notching over 1,000% gains, established producers settled for more modest returns.

Allkem Ltd [ASX:AKE] — the new name of the merger between Galaxy Resources Ltd [ASX:GXY] and Orocobre Ltd [ASX:ORE] — gained 120% in 2021.

Mineral Resources Ltd [ASX:MIN] — the iron ore and lithium producer — gained 50%.

And Pilbara Minerals Ltd [ASX:PLS] gained 235%.

How will the market rate lithium juniors in 2022?

Of the four lithium stocks in the All Ords top five performing stocks of 2021, only Novonix Ltd [ASX:NVX] and Sayona reported any revenue.

Novonix focuses on battery tech, aiming to commercialise its cathode technology. NVX also offers its cell assembly and testing capabilities to lithium industry aspirants.

Coincidentally, Novonix conducted tests for fellow 2021 high-flyer Lake Resources NL [ASX:LKE] earlier this year.

In FY21, NVX received $5.2 million in revenue on a market cap of $4.2 billion, trading at a price-to-sales ratio of a heady 670.

In Sayona’s case, however, half its FY21 revenue was a government subsidy, the other a FX currency gain.

| Company | FY21 Revenue | FY21 Operating Cash Outflows | Market Cap |

| Novonix | $5.2 million | ($8.2 million) | $4.2 billion |

| Lake Resources | 0 | ($2.4 million) | $1.1 billion |

| Core Lithium | 0 | ($2.3 million) | $910 million |

| Sayona Mining | $645,000 | ($11.2 million) | $880 million |

With plenty of upside already priced into stocks like LKE and NVX, how will the market treat these stocks in 2022?

Can the run continue, or will investors take profits and chase other themes in 2022?

In my view, higher valuations stoke pressure to justify the price.

2022 could see more scrutiny on the lithium sector as the focus shifts from ambition to execution.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Cettire: the odd one out

Cettire Ltd [ASX:CTT], the online retailer of personal luxury goods, was the only non-lithium stock in the top five of the All Ords’ best performers of 2021.

Looking at the numbers, it’s hard to argue against lithium being the dominant theme of 2021, which makes Cettire’s performance last year somewhat of an outlier.

After all, online shopping was the dominant theme of 2020, as lockdowns sparked a migration from brick-and-mortar to online.

E-retailers like Kogan.com Ltd [ASX:KGN] and Redbubble Ltd [ASX:RBL] soared.

But lockdowns didn’t necessarily alter the fundamentals of consumer demand so much as bring some of the demand forward in time.

Kogan, banking on a permanent shift to online shopping, spend big only to see its inventory pile up, resorting to discounting.

KGN shares were down 55% in 2021. RBL shares were down 40%. Even JB Hi-Fi Ltd [ASX:JBH] underperformed the broader market, gaining less than a percent in 2021.

So Cettire’s outperformance in 2021 is intriguing.

But not strictly out of the ordinary if we narrow our comparisons.

While retailers like Kogan struggled, fashion and luxury retailers fared better.

City Chic Collective Ltd [ASX:CCX], specialising in plus-size women’s apparel and footwear, was up 35% in 2021.

And Lovisa Holdings Ltd [ASX:LOV], an affordable fashion jewellery retailer, was up 70%.

| Company | FY21 Revenue | FY21 Operating Cash Flow | Market Cap |

| Cettire | $92 million | $12.7 million | $1.4 billion |

| City Chic Collective | $258 million | $15 million | $1.2 billion |

| Lovisa | $288 million | $85.2 million | $2.1 billion |

Compared to some of its industry peers like CCX and LOV, however, Cettire may look overvalued, especially when you consider that, out of the three, Cettire was the only one to post a net loss in FY21.

On a trailing 12-month price-to-sales basis, CTT is trading at 13 times sales while CCX and LOV are trading at 5 and 7.7, respectively.

Can Cettire continue its run in 2022 or will its valuation settle closer to its peers?

I think Cettire’s next half-yearly will go a long way in answering the questions. Can Cettire sustain its customer growth without shrinking its margin?

If the market thinks Cettire’s model is sustainable — and profitable — it may choose to place a premium on CTT stock.

But Kogan serves as a cautionary tale. The higher the priced-in expectations, the steeper the fall.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here