In today’s Money Morning…it’s only ‘crap’ if it doesn’t make you money…what tapering means for your own portfolio…well, that means small-caps then gold, then what?…and more…

Well, Jerome Powell did it again over the weekend.

A few gentle words, no rug pulls, and markets should like it over the next couple weeks.

Speaking at the Jackson Hole symposium over the weekend, this was the Australian Financial Review’s coverage of the chairman of the Federal Reserve’s speech:

‘Fed Chair Jerome Powell said that the economy has already met one big milestone the central bank had set to slow the $US120 billion in bond purchases it’s making each month to boost the economy. That could mean a paring back of purchases by the end of the year.

‘But Powell also cited past mistakes where policy makers made premature moves in the face of seemingly high inflation, and he said that the tests are “substantially more stringent” before the Fed will raise short-term interest rates off their record low.

‘“We have much ground to cover to reach maximum employment,” which is one of those tests, Powell said.’

Quick punchlines:

- QE (bond-buying) to slow down and stop this year

- Ultra-low rates to stay for the time being

‘No bombshells’ is classic Jerome Powell — something markets appreciate.

It was record highs in the US once more as a result.

Which gives credence to my theory that there’s still plenty more speculative fervour left in the ASX.

And one strategist had this to say over the weekend…

It’s only ‘crap’ if it doesn’t make you money

Bloomberg put this tweet out Saturday carrying commentary from Interactive Brokers Chief Strategist Steve Sosnick:

|

|

| Source: Twitter |

Be sure to listen to that podcast if you want to hear why you should plough your money into the most boring parts of the market.

The point here is, if markets keep on the way they are post-Jackson Hole, some incredible opportunities could be around the corner.

If you’re looking for places to park some speculative capital, money you are willing to lose part or all of — then small-caps are definitely worth a look.

Contra Mr Sosnick, it’s only ‘crap’ if it doesn’t make you money.

But also consider doing this…

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

What tapering means for your own portfolio

Gentle as the taper may prove to be, there could be a correction in the offing around the taper timeline.

The interesting thing about Jerome Powell’s comments was that the bar for increasing rates is quite high.

Some six million more Americans don’t have a job compared with the period before the pandemic.

With low rates in place for a prolonged period, the next question is…how about that inflation demon in the background?

You could look at commodity stocks — and hard assets, including one in particular.

Gold.

I expect in the coming months a number of trading set ups to form around smaller ASX-listed gold stocks given their high margins and a mining-friendly environment in Australia.

It is no doubt high-risk stuff trading these kinds of stocks.

You could bet on things like development rerates, project restarts, and catalysts like quarterly updates.

There’s quite a menu out there, and I believe there’s no better guide than Brian Chu of Gold Stock Pro.

Well, that means small-caps then gold, then what?

The thing that comes after the thing.

Second-order effects, economists like to call them.

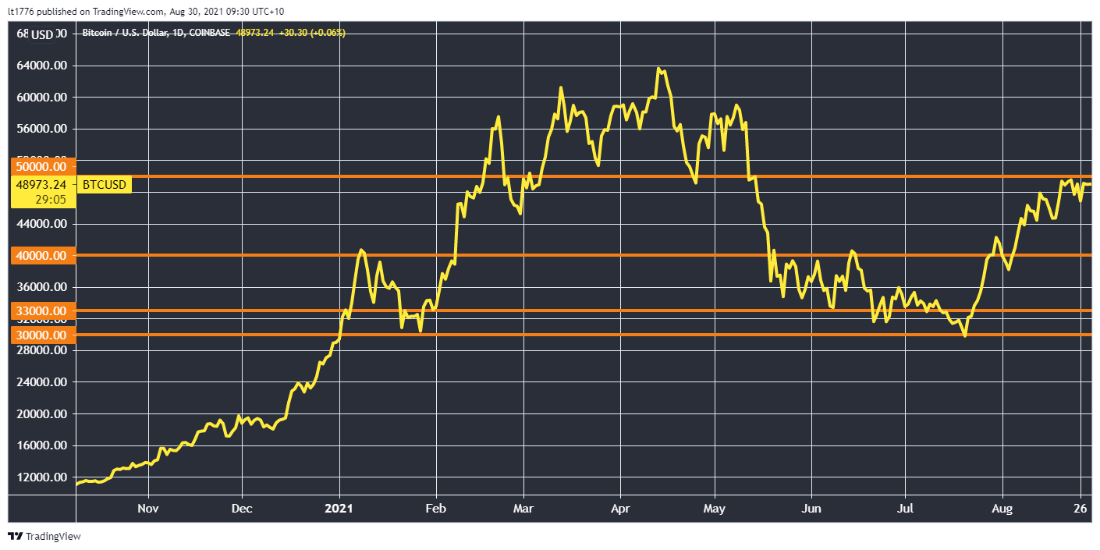

On Friday, I drew attention to crypto markets, with Bitcoin [BTC] making a move again:

|

|

| Source: Tradingview.com |

The bitcoin price is hovering just below US$50,000.

Naysayers call this move pure speculation and insignificant.

Alternatively, you can say that given what the Fed is up to — there’s a growing number of people investing in the future of money. Be that crypto or gold.

At what point does speculation become ‘legitimate investment’?

When it makes you money?

Or when a financial advisor in a suit can tell you that some asset class should be part of your portfolio?

I wouldn’t be holding my breath on the latter.

And I’d be willing to say that if an investment isn’t making you money, it’s not serving its purpose.

By all means, wait for a suit to tell you what to invest in.

I’d wager, though, that in around a decade, the suits probably won’t even exist.

Or at least, there will be far less of them than there are now.

Call it the ‘financial literacy/redundancy of financial advisors’ thesis.

As markets threaten to move higher over the next few months, remember: You don’t need to be the smartest investor in the room, just smarter than the herd.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here