‘I cannot forget the follies and vices of others so soon as I ought, nor their offences against myself…My good opinion once lost is lost forever.’

This eloquent statement from Darcy FitzWilliam, in Pride and Prejudice, best sums up what many people feel about the elites after they realise the extent of the abuse they suffered.

2024 is soon coming to a close.

I hope you’re feeling hopeful for 2025. Common sense and sanity may soon win against its enemies who have laid siege to them for so long.

We’re watching the parasitic class of elites expose and humiliate themselves openly.

These are the powers that be and their puppets in governments, non-profit organisations, corporations and media/entertainment.

They hid behind the façade of power, prestige, and polish. They dressed finely, spoke smooth words, and performed public acts of decency to court our admiration.

They peddled the Green Agenda as the economy faltered. Meanwhile they flew in corporate jets, bought waterfront properties and skimmed from the masses through their public speaking tours, charity funds and crisis appeals.

They preached tolerance and imposed woke values that stirred hatred and divided society. Several businesses lost many customers and market share for toeing the line. When they tried to turn a new leaf, it was too late.

They feigned moral outrage about conflicts flaring up in different parts of the world, asking you to pay for aid and weapons to ‘fight for democracy’. However, they not only failed to risk their lives on the front line, they instead gathered power and profits as Congress members, executives or shareholders of companies that fuel these wars.

People are waking up around the world. Many realised how these elites abused them and decided it was enough.

They voted with their voice, money and ballot.

The tide has turned and the elites know it.

2025 can’t come soon enough as the momentum builds…

The accelerating demise of elite power

Perhaps I’m moving a little ahead of myself. Or I’m not.

As the weeks pass, the elites are either running for cover.

In this month alone, we’ve seen the governments in Canada, France and Germany crack . They join the ranks of many western nations such as the US, Hungary, Slovakia, Argentina, The Netherlands, etc. where populist leaders are replacing the legacy parties.

They’re reaping the harvest of flaunting the law and abusing their people through corruption, censorship and violent force.

The failing economy and declining living standards united the people. The policies they lived through became too much to bear.

Power bills have skyrocketed, households experiencing blackouts and productivity suffered from the failed push to replace fossil fuels with green energy. This compounded the damage from the mandates during the global Wuhan virus pandemic in 2020–23. Furthermore, many Western governments sent billions of dollars of aid and weapons to Ukraine to fight against Russia, causing major deficits.

Until recently, the fight over what are the facts and truth divided the people. This changed after Elon Musk purchased X, which became the platform to expose how the collusion between governments, corporations, academia and the media to suppress facts to protect their commercial interests.

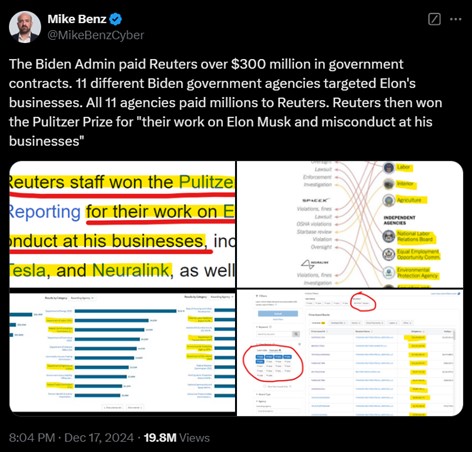

This included how the Biden administration spent $300 million to pay Reuters to publish articles seeking to undermine Elon Musk’s business interests and tarnish his credibility:

| |

| Source: Mike Benz, X |

Speaking of outgoing President Joe Biden, his decision to pardon his son, Hunter Biden earlier this month was particularly cringeworthy.

Remember him and his supporters from the Democrat Party and the mainstream media riding their high horse attacking President Trump about how ‘no one is above the law’?

A montage of clips showing how quickly these words expose their hypocrisy. This clip, and many, will outlive their existence in this world:

Hunter Biden is Above the Law pic.twitter.com/WaxAwlvcyQ

— Phantom Shadow (@Fuknutz) January 12, 2024

Source: Phantom Shadow, X (https://x.com/Fuknutz/status/1745630687238012964)

Before the internet and social media, you can hide these and preserve your public image.

Today, it’s no longer possible.

Revealing and neutralising the root of corruption

Many wonder why so many in positions of power and influence can display such open disdain for decency.

They can’t fathom it.

But once they see the missing pieces of the puzzle, they’ll understand.

The first is the US Federal Reserve, the source of what appears to be an unlimited source of funds.

What’s ludicrous about the Federal Reserve is that it lends to the government and the taxpayers repay the loan. Those in government decide how much to borrow, who to pay and what tax rates to set.

The most recent attempt for the US House to pass a bill to prevent a government shutdown is a great example.

According Vivek Ramaswarmy, incoming co-leader of the Department of Government Efficiency, who reviewed the 1,547 pages of wild spending, where the funds are going would make you scratch your head!

Can you imagine how quickly you’d turn corrupt when you have so much at your disposal, with so little to answer for?

Add to that the compromising material and dirty deals they’ve made to climb the greasy pole.

What am I talking about?

Let me drop two names — Jeffrey Epstein and Sean ‘P. Diddy’ Combs.

Their arrests in July 2019 and September 2024 have opened a Pandora’s Box that have caused many public figures to scramble for cover, die mysteriously or sentenced to lengthy jail terms.

There’s many more who are sitting uneasy wondering when they’ll face charges or public humiliation.

As those talking heads in the media love to say about their favourite enemy back in 2017–21, the walls are closing in.

Right back at them!

The Federal Reserve’s latest humiliation: The ‘hawkish’ rate cut

To wrap up my update, we woke up yesterday morning to the news that the US Federal Reserve cut the Federal Funds rate by 0.25%.

The size of the cut was expected. The rationale behind the cut was surprising.

They cut the interest rate but revised the forecast for 2025, expecting inflation to speed up under the incoming Trump administration. Hence, less rate cuts next year, or so they claim.

The market deemed it a ‘hawkish’ rate cut, which sent the US dollar higher and asset markets tumbling.

The US markets fell by more than 2.5%.

Gold took a $55 hit to trade as low as US$2,585 an ounce.

Silver corrected almost $2 and traded below US$30.

Bitcoin retreated by almost 9% and even went below US$100,000.

Is this move going to avert inflation as the Federal Reserve fears?

Haha…just kidding!

Within 24 hours, many of these assets bounced and pared back their losses. Both gold and Bitcoin regained their strategic levels.

Could the markets be shrugging off the Federal Reserve considering its track record of failed policies and poorly timed decisions?

The world’s most influential financial institution is truly a joke.

The clock might be ticking for the US Federal Reserve as the Trump administration returns. President Trump may find cause to fire the Chair Jerome Powell while Congress may pass a bill to audit the Federal Reserve.

Should these happen, it mightn’t survive the scrutiny.

That could change our financial system and the world.

2025 can’t come soon enough.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments