The US Consumer Price Index recorded its smallest annual jump in over two years.

It seems central bankers may finally be ‘winning’ their war against inflation…

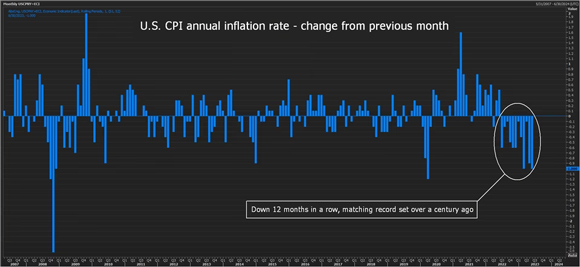

Just look at the chart for yourself:

|

|

| Source: Reuters |

As the circled bar shows, the Fed’s rate hikes are seemingly starting to kick in. US CPI has been falling consistently since mid-2022.

And while Powell is still predicted to raise rates again at the next Fed meeting later this month, there’s a possibility it may be the last. It was exactly that hope that saw markets surging yesterday.

Investors are keener than ever, it seems, to jump back into equities.

But any student of market history will know that this optimism may be out of place.

In fact, as we enter the endgame of this inflationary era, the hardest part may just be about to begin…

Friedman’s ghost

No one understood the irrationality of monetary policy better than Milton Friedman.

His life’s work was devoted to understanding and explaining the complexity of stabilising an economy. Something that, as he would tell you, is almost impossible with the monetary policy tools we still use.

That’s why now, more than ever, we should remember Friedman’s biggest concern…

The ‘long and variable’ lag of interest rate changes.

As the St Louis Fed recently reminded readers, Friedman loved to equate the lag of monetary policy to that of an unreliable shower:

‘If the shower hasn’t been used recently, the water in the pipes may initially be freezing cold (i.e., there’s a lag from cold to warm).

‘The person might respond by cranking up the hot water. The shower-taker—after another lag—may unexpectedly find themselves scalding. The person turns down the hot water, and the cycle repeats.’

The key difference between the shower and a modern economy is simply time frames.

Lag within monetary policy frameworks has typically been associated with 18–24-month cycles.

If that still holds true, things may be about to get nasty. Because if you’ve been following this rate rising cycle from the Fed (and most central banks for that matter), we’re now at month 17.

In other words, if the 18–24-month lag phenomenon is still present, the Fed’s rate rises may not have even hit the economy yet, meaning the soft landing that Powell constantly talks about may be about to get a whole lot bumpier.

Going on the defensive

Critics of this lag theory will, of course, tell you that modern markets move much quicker. Compared to Friedman’s day of chalk and paper, our digital society can process and digest change much quicker.

The Kansas City Fed, for instance, tried using data from the 2009 interest rate cycle to evaluate modern lag. And while they concluded it may only take a year for the impact to flow through now, they did issue a caveat that the result was highly uncertain.

So, if you’re looking for a definitive answer to this lag, you’re out of luck.

All any of us can do is wait and see what’s in store for markets.

But I certainly wouldn’t be dismissive of the possibility of a cold shower soon…because as tough as this inflationary cycle has been compared to most years in the past two decades, it’s nothing like the pain of other high inflationary periods.

Perhaps we have avoided it, but I fear it may be yet to come…

The good news is that like all downturns, they eventually pass.

It’s just a question of how long these tougher times will last, and what to do with your money while everyone rides it out. After all, taking your money out of the market may seem like the best possible move, but history proves that is not always the case.

Mitigating volatility is the real name of the game.

And if you’re looking for a way to do that right now, dividend stocks are a great option.

Our own investment director, Greg Canavan, is all over this income opportunity. He’s found six of what he believes are the best regular payout stocks on the ASX that also have good growth prospects.

In terms of risk versus reward, you’d be hard-pressed to find better investments right now.

Which is why, if you’re looking for a place to ride out this inflationary endgame, I’d suggest checking out Greg’s research.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning