On 8 November 2021, The Gowdie Letter commenced with:

‘Since 1952, the Queen has been the one constant in our lives. Presidents and prime ministers have come and gone. And boy have there been some greats she’s outlasted…JFK. Winston Churchill. Margaret Thatcher. Robert Menzies.

‘Can you imagine a world without Queen Elizabeth? While it’s hard to fathom, we know one day that will be our reality. Nothing lasts forever.’

Many, me included, thought Elizabeth II would reign over us for a few more years. Sadly, this was not to be. This permanent figure in our lives is now no more.

While we know nothing lasts forever, the mind is a strange and wonderous thing.

The more an era endures, the more inclined we are to perceive what is temporary to be permanent.

And, when a special era ends, it brings great sadness. We look back with fond memories of better times.

During the late Queen’s reign, there’s been another (now ageing and very tired) constant in our lives.

This is an edited extract from the 8 November 2021 issue of The Gowdie Letter:

‘The cycle within our lifetime

‘During the Queen’s reign, the other constant in our lifetime has been the cycle of asset price appreciation.

‘We’ve known no different.

‘There have been moments when the cycle hit a flat spot or two.

‘However, our living memory is not scarred with a Great Depression and/or World War experiences…a period when growth was on pause for almost two decades.

‘That concept is even more foreign to us then life without the Queen.

‘We have been conditioned by 70 years of constant progress. Believing this will be a constant in our lives.

‘Our belief system is a product of Ray Dalio’s “The Big Multigenerational Psychological Cycle”…specifically…

‘Stage 2: People and Their Countries Are Rich but Still Think of Themselves as Poor.

‘Stage 3: People and Their Countries Are Rich and Think of Themselves as Rich.

‘Stage 4: People and Their Countries Are Poorer and Still Think of Themselves as Rich.

‘In 1950, my educated guess is the US was on the cusp of late Stage 2/early Stage 3.

‘Now, by my reading of the generational psychological cycle, the US is now in late Stage 4.

‘Which means the next stage is…

‘Stage 5: People and Their Countries Are Poor and They Think of Themselves as Poor.

‘The prospect of that happening is beyond our comprehension. How could it be even remotely possible?

‘These charts show how this can occur.

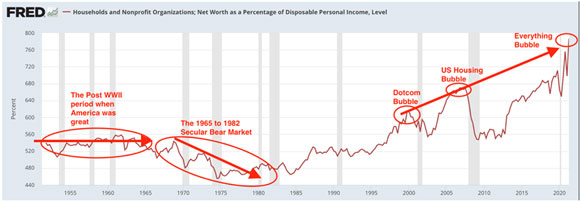

‘This chart — dating back to 1950 — shows US Household Net Worth as a percentage of Disposable Net Income.

|

|

| Source: Federal Reserve Economic Data |

‘At the start of this cycle, the Wealth-to-Income percentage hovered around the 550% level.

‘During the high inflation 1970s it fell under 500%.

‘But, after 1980, with low inflation and more expansionary monetary policy, Wealth to Income migrated back towards 550%.

‘Then came the three bubbles…artificially (and temporarily) inflating wealth.

‘After the air went out of the two previous bubbles, Wealth to Income fell back into the 550–560% range.

‘Since 2009, the Fed’s concerted effort to create the “wealth effect”, has pushed the percentage to within a whisker of 800%.

‘This next chart is what those percentages relate to in dollar terms.

‘The 2008/09 reversion to the Wealth-to-Income mean, wiped out US$11 trillion (80% of GDP) of illusory wealth.

‘That was enough to give us the worst economic downturn since the Great Depression.

‘Getting back to the MEAN from this latest bubble requires US$44 trillion (200% of GDP) to be shredded from Wall Street, US property market, and cryptos.

|

|

| Source: Federal Reserve Economic Data |

‘Loss of wealth on that scale — across all popular asset classes — will scar more than one generation.

‘Boomers. Gen X. Millennials. Centennials.

‘Each generation has (to varying degrees of speculation) participated in this massive experiment of artificial wealth creation.

‘This is…Stage 4: People and Their Countries Are Poorer and Still Think of Themselves as Rich.

‘The US Government and the Fed have created the illusion of wealth and prosperity. But, underneath it all, the country is getting poorer.

‘Lower workforce participation.

Ageing demographic profile.

Increase welfare dependency.

Record deficit spending.

Rising debt to GDP levels.‘The US economy and society (like the Queen) is no longer the same as it was in 1950s.

‘The youthfulness is gone. It is older and more fragile.

‘When the percentage of Wealth to Income eventually mean reverts, I suspect US citizens will no longer think of themselves as rich…a poor mindset is seeded.

‘That collective psychological shift robs the Fed of the willing accomplice it so desperately needs to recreate the wealth effect.

‘This will not happen overnight, but, if Japan is any guide, it will happen.

‘Given the spectacular decade in asset appreciation we’ve just had, the prospect of two decades of asset price deflation or stagnation borders on the farcical.

‘The 1920s in the US and the 1980s in Japan were also decades of truly remarkable (debt-fuelled) asset price appreciation. Yet, what would have been considered laughable at the time of peak euphoria, became all-too serious in the years to follow.

‘Nothing lasts forever.’

Elizabeth II’s 70-year transformation from young Queen to a much loved, admired, and respected Monarch — reigning over a United Kingdom — is condensed into these two photos:

|

|

| Source: Getty Images |

|

|

| Source: Getty Images |

The transformation of the world’s largest economy is not nearly as graceful.

The once United States of America is now…

The Divided States of America

In the years following the Second World War, the US was enjoying an era of productivity and positivity…‘There’s no way like the American Way…’:

|

|

| Source: Alamy |

It was a time of conformity…society (in the main) was working together for a better future:

|

|

| Source: Alamy |

After more than two decades of austerity, American consumers, with increased incomes and access to credit, lifted their standards of living:

|

|

| Source: Alamy |

Giving rise to an expanding middle class:

|

|

| Source: Alamy |

That was the pictorial history of a once youthful, vibrant, and united US of A.

Today, it is tired. Weighed down with debt and entitlements.

What’s happened to that 1950s driver of economic growth, the middle class?

According to Pew Research, April 2022 (emphasis added):

‘The middle class, once the economic stratum of a clear majority of American adults, has steadily contracted in the past five decades. The share of adults who live in middle-class households fell from 61% in 1971 to 50% in 2021, according to a new Pew Research Center analysis of government data.’

On 15 March 2022, the University of Sydney’s United States Studies Centre (USSC), published a paper titled ‘America more divided than at any time since Civil War’.

To quote (emphasis added):

‘Quite simply, the US is a house divided and partisan disagreements run deeper than ever measured. We must reach back to the Depression or the civil war to find periods of US history where the country has been more divided. Isolationism is at levels unseen in 70 years of scientifically rigorous survey research.

‘Sixty per cent of Americans say their nation’s “best days are in the past”, with even 40 per cent of Biden voters agreeing — roughly the same levels Democrats recorded during Donald Trump’s presidency.’

The American Way is no longer.

The attitude is now one of my way or the highway.

This is The Washington Post coverage of President Biden’s ‘if you’re not with us, you’re against us’ speech delivered on 3 September 2022 (emphasis added):

‘When American presidents reserve the prime-time hour to address the nation on grave threats facing the country, they are almost always focused on external forces — the Soviet Union, foreign terrorism, or even the coronavirus.

‘But when President Biden stood before Independence Hall in Philadelphia on Thursday night, he warned that American democracy stands at the precipice because of a decidedly different threat — one that, he said, comes from within the country’s borders. “Donald Trump and the MAGA Republicans represent an extremism that threatens the very foundations of our republic,” Biden said.

‘In a remarkable turn, the president of the United States was identifying his predecessor and his followers — a group that arguably includes millions of U.S. citizens — as the gravest threat to the stability of the 246-year American experiment.’

The millions of people who voted for Trump are a threat to American democracy?

Isn’t the whole point of a democracy about freely expressing your view at the ballot box?

Why do they persist in calling Biden the Leader of the Free World, when, in his own country, people who do exercise freedom of speech and choice are seen as representing an extremism?

The once United States is now in a state of divide and decline. There’s a certain Shakespearean air about a demented old man presiding over its demise.

As the Divided States of America transitions from…

‘Stage 4: People and Their Countries Are Poorer and Still Think of Themselves as Rich.’

to

‘Stage 5: People and Their Countries Are Poor and They Think of Themselves as Poor.’

…there will be an outpouring of grief for the ending of another era…one where central bankers reigned supreme and belief in the permanency of the debt-funded economic growth model was (almost) absolute.

Be prepared for this to end…very badly and with much public angst.

Nothing lasts forever.

Vale Her Majesty Queen Elizabeth II.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS (from the publisher): Remember to keep an eye out tomorrow for a crucial first look at a new era in money as we know it: Australia’s first digital currency. Unlike the money in your bank account or cash in your wallet, which you are free to spend on whatever you decide…this new currency can be much more closely controlled by central banks…and by extension, the State. Who knows if and how they will use this power to control how money is spent…what it is spent on…and what rules you are allowed to play by. Tune in tomorrow to find out!