News is full of talk about vaccine passports.

According to Dan Andrews, the only time you may not need a vaccine passport is to leave your front door.

Everything else is up for debate.

We’re told that without them, we’ll have a ‘pandemic of the unvaccinated.’

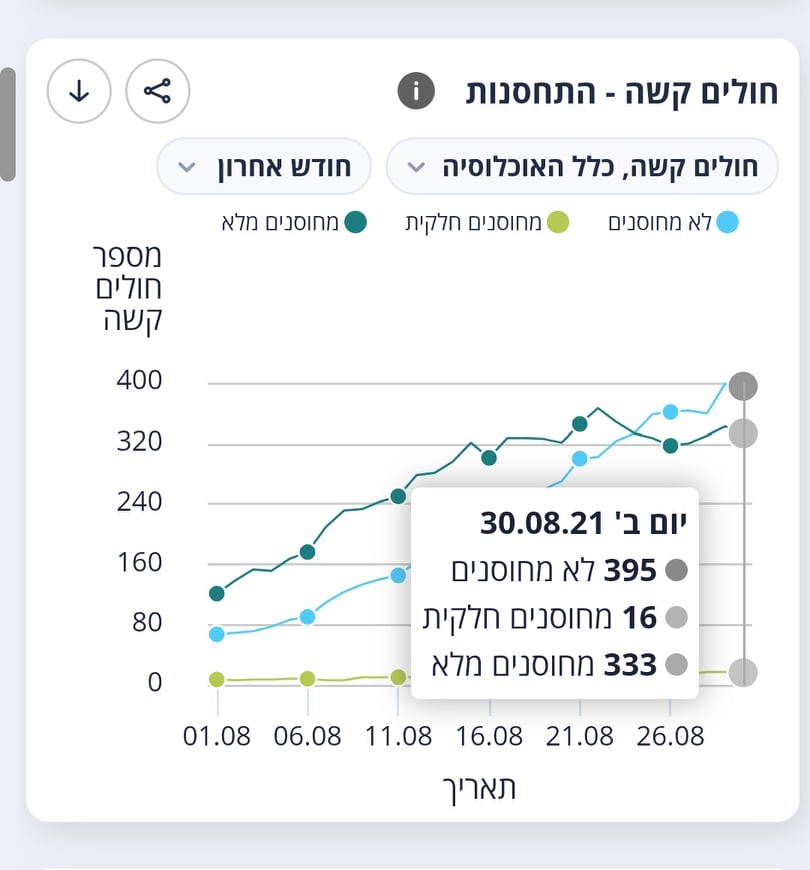

Yet, Israel’s latest figures show that the number of patients severely ill in hospital, is fairly evenly split between fully vaccinated and unvaccinated.

|

|

| Source: health.gov.il |

The dark green line = fully vaccinated.

The blue line = unvaccinated.

Still, let’s face it; most got the jab because they thought it would buy them a ticket to freedom.

Anything to avoid lockdown.

The bottom line is that location matters.

And this is what drives the real estate cycle.

Take the US.

I have a mate who’s lived in New York all his life — Simon.

He’s pretty miserable.

New York was locked down longer than any other state in 2020.

Now they are about to legislate vaccine passports. You need one to enter any public establishment — including cafes.

That’s pushed Simon (and many others) over the edge.

The city is dead, and scores of people are leaving.

We were having a chat the other day and he mentioned he was thinking of moving to South Florida.

Florida has committed to no lockdowns and no vaccine passports.

Freedom!

No surprise then, that despite soaring COVID infections, Florida was the No. 1 destination for relocating Americans in 2020.

In fact, in the year to April 2021, well over 300,000 new residents moved there.

Check out this report…

‘Sara Guando, 34, originally from Ridge, said the COVID-19 pandemic prompted her to make the move to Tampa in February….

‘“New York was closed, New Jersey was closed,” she said.

‘“There were people who were saying, ‘I really want to come down to Florida. I want to accelerate my plans.’”’

And you guessed it — that’s produced a real estate boom.

Lakeland and Winter Haven, Florida, have recorded the biggest US median home price gains among US cities in the 12 months to June according to data from HouseCanary (real estate valuers).

Median prices are up more than 30% — that’s huge.

Another report says…

‘Some movers want in so bad that they’re willing to live in a spot they’ve never visited in person.

‘“Realtors we talk to have said many people are buying property sight unseen,” says Colin B. Exelby, a certified financial planner and the president and founder of Celestial Wealth Management.’

It’s worth noting that Florida is one of a handful of states that doesn’t levy a state income tax.

Residents also pay less than 1% for property taxes (compared to other states that pay 2–3%).

In other words — areas where land is lightly taxed will always attract the greatest speculation.

Could we see a similar trend here to avoid passports and lockdowns?

REVEALED: What’s Next for Aussie Gold Stock Prices? Learn more.

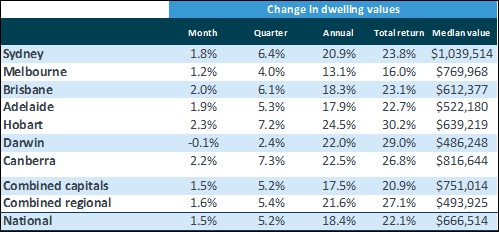

The latest CoreLogic data shows house prices Australia-wide are exploding — annually up over 18%:

|

|

| Source:CoreLogic |

[Note: Perth and WA have been temporarily withdrawn from the index while CoreLogic investigate a divergence from other housing market measurements. I suspect this may be due to lags in reporting data in Perth — we’ll see.]

However, Melbourne’s market is slowing.

The clearance rate has crashed into the 30% range.

No surprise there.

The continued lockdowns and bans on real estate inspections are affecting the whole industry. The only transactions are from purchasers prepared to buy sight unseen.

That’s why, with ongoing draconian rules promised, in any area that is highly populated, increasing numbers are fleeing to the country.

Regional dwelling values are up almost 22% up over the year.

Between January to March, more than 11,000 people left Sydney for regional NSW.

It’s the highest quarterly exodus on record.

Median house prices in Bryon Bay are up by 51%.

Kiama up 44%.

And Eden on the south coast has increased by 23%.

Increases that would have been unthinkable prior to the pandemic.

These areas have very low vacancy rates — a rental crisis: rising rents and rising property prices.

No wonder CoreLogic also reports that land prices are rising almost 11 times faster than wages growth over the past year.

The massive stimulus paid under the guise of bailing out the labourers, is pouring directly into land.

To subscribers of Cycles,Trends & Forecasts, this would not be a surprise.

Fred Harrison’s 1983 book The Power in the Land describes what happened to the US economy following the Kennedy tax cuts — cuts that were designed to reinvigorate the economy:

‘If the prospects of making speculative gains were still present — that is, if the income tax cuts were not simultaneously offset by an increase in the tax on land values — then it paid to buy land.’

Just as it pays to buy land today.

Bottom line: You can be a winner in the years ahead if you target the right locations.

Follow where the population is feeling.

Make sure that you buy in a well facilitated established suburb.

Focus the bulk of your budget on the land and locational component of the block, rather than the property value.

Always remember: Properties depreciate — it’s land and location that appreciates.

Best ,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: You can access the latest Cycles, Trends & Forecasts report when you subscribe here.