In today’s Money Morning…inflation and stocks…why rising rates can be bad for stocks…is there anything to be done?…and more…

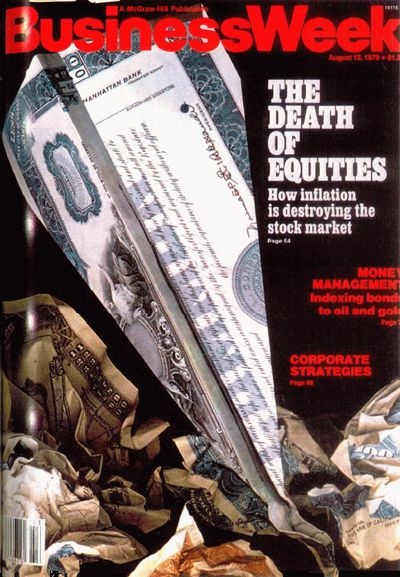

On 13 August 1979, BusinessWeek ran an infamous headline on its cover: ‘The Death of Equities: How Inflation Is Destroying the Stock Market’.

Three years after publication, the stock market cratered…before going on a sustained bull run.

Since its 1982 low, the S&P 500’s total return, with dividends reinvested, hit nearly 7,000%.

As a Bloomberg retrospective on the cover story quipped: ‘Not bad for a corpse.’

|

|

| Source: Bloomberg |

Does that infamous cover story have any relevance today?

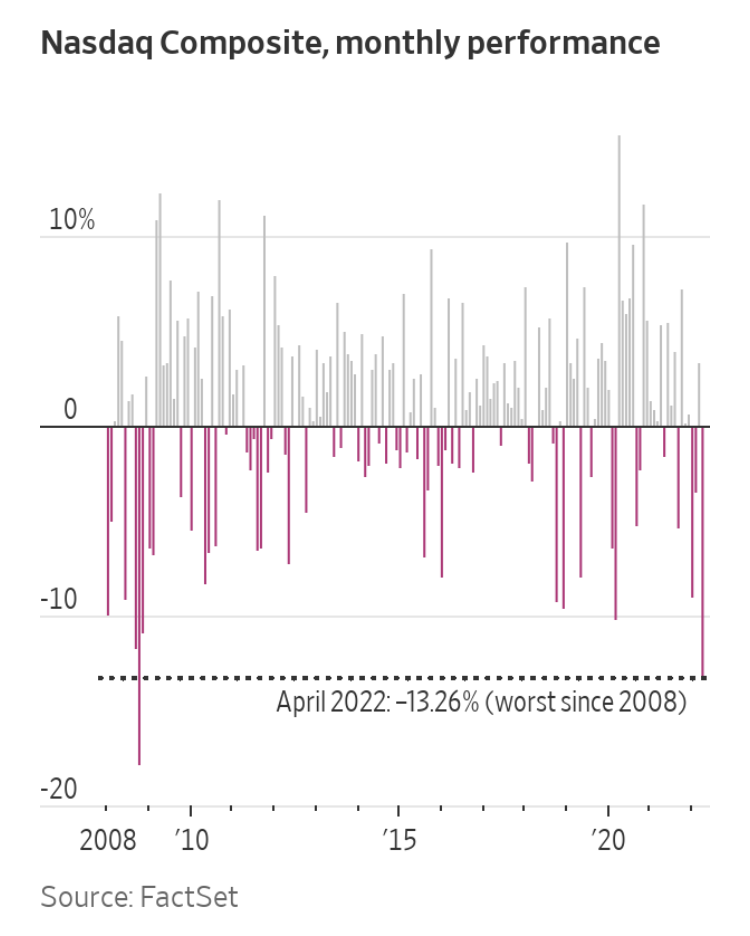

In the US, the Nasdaq dropped more than 13% in April, its worst showing since October 2008.

Year to date, the index is down around 21%, its worst start to a year on record.

The broader S&P 500 Index fell for four consecutive weeks, dropping 8.8% in April and bringing its year-to-date losses to 13%.

And the Dow Jones Industrial Average is down more than 9% in 2022. Both the S&P 500 and the Dow Jones Indices registered their worst months since March 2020.

|

|

| Source: Wall Street Journal |

All the while, inflation globally is hitting levels not seen in decades.

Australia’s trimmed mean inflation, for example, rose 1.4% in the latest quarter — the highest since the ABS began calculating the measure in 2002.

Rampant inflation is raising bond yields on expectations of hawkish central bank responses.

The benchmark US Treasury 10-year yield rose to 2.88% at the end of April, its biggest monthly gain since December 2009.

Just overnight, the yield finally hit 3% for the first time in more than three years.

Australia’s 10-year counterpart was hovering at 3.26%.

The American Association of Individual Investors survey hit its most bearish mark since March 2009, with JPMorgan strategists writing this week that ‘investor sentiment is reaching extreme weakness.’

So…

Is this a harbinger of the death of equities? Or will the death knell ring in infamy just like the BusinessWeek story?

Inflation and stocks

That 1979 cover story based its terminal diagnosis on stock returns no longer outpacing inflation.

As the article noted:

‘Stocks were a reasonable hedge when inflation was low. But they proved helpless against the awesome inflation of the past [1970s] decade.

‘“People no longer think of stocks as an inflation hedge, and based on experience, that’s a reasonable conclusion for them to have reached,” says Richard Cohn, an associate professor of finance at the University of Illinois.

‘Indeed, since 1968, according to a study by Salomon of Salomon Bros., stocks have appreciated by a disappointing compound annual rate of 3.1%, while the consumer price index has surged by 6.5%.’

While not as fatalistic as the 1979 BusinessWeek story, plenty of market players today are pessimistic about equities in the near term.

Eerily, some are even echoing BusinessWeek’s point about the meagre real returns of stocks pitted against inflation.

In a research note this week, Morgan Stanley equity strategist Mike Wilson wrote (emphasis added):

‘S&P 500 real earnings yield is the most negative since the 1950s.

‘With inflation so high and earnings growth slowing rapidly, stocks no longer provide the inflation hedge many investors are counting on.’

And Peter Costello, chairman of Australia’s sovereign wealth fund Future Fund, said:

‘As we have been saying for some time, investors should expect lower returns than in the past over the long term.’

Backing his colleague, Future Fund chief executive Raphael Arndt noted:

‘Looking ahead, we expect returns will be harder to achieve, with ongoing fragility and disruption to global markets and economies combined with rising inflation continuing as key themes for some time to come.’

Why rising rates can be bad for stocks

But inflation eating into real returns isn’t the only worry.

The inflation cure itself poses issues.

In Australia, the bond market is wagering on a series of hikes taking the cash rate to 2.5% by the end of the year.

Quite the turnaround after years of steady, low rates.

But rising rates boost bond yields, which impact equity valuations.

For one, bond yields set a floor on corporate borrowing costs. Higher yields lead to higher debt expenses.

And higher cost of debt is bad news for growth stocks with profitability a distant marker.

As one fund manager told the Australian Financial Review this week:

‘If an idea needs time to become fully realised, and it usually does, “the problem with a very levered balance sheet is time isn’t your friend.”’

The Wall Street Journal reiterated this point yesterday (emphasis added):

‘Shares of companies whose strongest returns appear far into the future also suffer because higher Treasury yields reduce the appeal of long waits for future profits.

‘Some businesses that analysts place in that category, such as plant-based-food maker Beyond Meat and space-tourism firm Virgin Galactic, have endured bruising rides in markets this year, down 43% and 44%, respectively.’

Take the local BNPL industry, whose past highs and current lows embody the Wheel of Fortune’s full cycle.

The industry has struggled to turn its rising transaction volumes into profits, sustaining itself on equity and debt.

But the tin rattles hollow when share prices collapse. Zip, for example, is down 85% in 12 months.

So BNPL stocks are forced to tap debt markets for funding. But rising rates will only steepen the cost at a time when margins are already thin.

Just this week, for instance, Splitit reported a net transaction margin of 1.6%. In a frank admission, SPT said the sector is fronting stern headwinds.

‘Escalating shopper installment plan write-offs and growing merchant acquisition costs is putting into question the path to profitability for legacy BNPL providers.’

Rising interest rates will only add further potholes in BNPL’s interminable path to profitability.

Is there anything to be done?

Some think we’ve entered a barren period for investing.

Morgan Stanley equity strategist Mike Wilson thinks stocks have ‘entered a phase when virtually no strategy works, not even defensives.’

True to their name, contrarians disagree.

When the Mike Wilsons of the market zig, contrarians tend to zag.

Contrarian fund manager Anne-Christine Farstad told an Australian Financial Review profile this week about how her fund tackled the turbulence of COVID in 2020:

‘We need despondency and we need fear, and COVID was interesting because it was a crisis of epic proportions.’

Similar to when COVID first ravaged markets in March 2020, high expected inflation coincides with periods of elevated risk aversion and economic uncertainty.

But does that offer opportunities…or traps? How do you approach the current environment?

For Farstad, a probabilistic attitude is enough. That, and an appreciation for the resilience of excellent businesses.

‘The point is, Farstad admits, that to be a successful contrarian you don’t need to be right about the future.

‘With a probabilistic approach, she only needed to conclude that “these companies will be fine, whether the recovery is next year, the year after or the year after that”.

‘In fact, she doesn’t understand how growth investors can pay top-of-market multiples for businesses where the implied margin of safety is so thin.

‘“I don’t know how the growth guys do it; I don’t know how they say, ‘I’m going to pay 30 times earnings for this because I’m absolutely certain that this company is the winner at the end of the road’. I can’t do that.”’

The trick is to have a portfolio of excellent, durable businesses that can leverage the good times and hold steady in the bad.

Regards,

Kiryll Prakapenka,

For Money Morning