This is real now.

Italy and South Korea are succumbing to the outbreak, as well as Iran and Japan.

Fair warning: Today’s piece is long, but we think the current outbreak warrants an in-depth look at investing in this new environment.

Even with the number of cases steadily rising, markets looked remarkably bullish over the last three weeks of trading.

And then all of this changed.

|

|

| Source: tradingview.com |

From a record high of 7,197.2 points on 20 February (last Thursday), the ASX 200 [XJO] has been shedding points aggressively.

As this was written before markets open, you would be within your rights to expect the XJO to smash through the downtrend, and potentially test support at 6,675. Or even as low as 6,600 over the coming days.

Today we take you inside a two-pronged approach to the threat of coronavirus. Note these are not recommendations — think of them as starting points for your research. Our editors offer recommendations in their paid publications.

Now that we are clear about what we’re doing today, we’ll get to the heart of the matter.

There are two broad categories here: the ‘solutions’ group of specific stocks, and the ‘macro buffer’ group of assets.

It’s genuinely difficult to figure out which of these two categories is more intriguing.

So we will start the story with the solutions, because what comes later down the track is the real story.

This tiny company is up a massive amount

Leading the pack, is the once little-known company called Zoono Group Ltd [ASX:ZNO].

Where they were once trading at 6.3 cents, they are now up to more than $1.70.

Their products are in essence, souped-up hand and surface sanitisers.

These products were sent to Germany for testing, and the company hopes that its products will be effective against 2019-nCoV — the fancy name for this outbreak.

They have two products, Z71 Microbe Shield Surface Sanitiser and GermFree24 Hand Sanitiser.

At time of writing, they are expecting testing to complete in the next two weeks or so (they said the wait would be four to six weeks on 30 January).

The problem here is that their share price has burst out of the blocks already.

Might be wise to look elsewhere at this point.

This company spiked more than 60% in one day

Now we will be perfectly honest with you — this stock was one of our active recommendations on Exponential Stock Investor.

The reason we recommended The Food Revolution Group Ltd [ASX:FOD] in the first place was based on the view that Chinese consumers fundamentally don’t trust products produced in their own country.

Remember The a2 Milk Company Ltd [ASX:A2M]?

Its success spawned a number of competitors.

Well, that came on the back of scandal in 2008 when some 53,000 babies wound up in hospital due to contaminated baby formula.

Since then, the Chinese haven’t trusted their local vendors.

For instance, one of the culprits at the time was Mengniu Dairy Group — China’s second largest producer of milk products.

So it makes sense that Mengniu recently bought Bellamy’s Australia Ltd [ASX:BAL].

This is part of a larger trend we believe — more Chinese companies looking to get access to Australian products.

FOD now have a high-quality product range after the acquisition of the Original Juice Co Black Label brand.

It has been engaging with potential Chinese partners and Statista forecasts a Compound Annual Growth Rate (CAGR) of 4.3% in the China juice segment over the next three years.

We think FOD is well positioned to capitalise.

But what sent FOD shares shooting higher was a (good) opportunistic move to transform a part of their Mill Park facility into a bottling line for hand sanitiser.

They are filling a gap in the market for the APAC region at a key time and already have an order for $2 million worth of the product.

This materially impacts revenues, hence the market re-rate.

We didn’t expect this, but it carries on with the theme of the rest of our China plays — quality Aussie products for a population that is suspicious of its own domestic suppliers.

It’s certainly one to keep an eye on if they have success with this pivot.

This company has a test kit for the coronavirus

If you look at the charts you can tell this is a volatile stock that moves around a lot.

But it is really interesting to see Genetic Signatures Ltd [ASX:GSS] spike from $1 to $1.21 on 30 January.

They have a product EasyScreenTM which includes an assay for pan-coronaviruses — the company is currently ‘contacting various agencies to determine what interest may exist for the test.’

Its revenue is down 21% on the same time last year, but a breakthrough in the screening technology could improve this.

Genetic Signatures has a healthy enough cash balance of $40.4 million, and with an FDA approval targeted for later this year, it could be worth a look.

A big contract win for its testing kit would certainly be a boon.

These are just a handful of stocks that could be poised to benefit from the outbreak by providing solutions.

However, the big story I alluded to at the start, is about two types of assets that could benefit massively from the outbreak.

[conversion type=”in_post”]

These two assets are worlds apart, but the value of both hinges on trust

Gold and Bitcoin — these are the two longer term ‘macro buffer’ investment options on the menu today.

The appeal of both lies in the decay in trust of fiat currency and the central banks that dominate its supply.

If coronavirus is the proverbial economic ‘Black Swan’ event truly unfolding here, there is one thing that history teaches us.

That is, the Federal Reserve, the ECB, the PBOC, and the RBA will try and step in to avert the crisis.

They are open about the fact that they do this.

Their main job is to keep everyone in a job by keeping inflation in a ‘target zone’.

They can do this by cutting interest rates, supposedly.

And this ‘fake money’ certainly forces future generations to bear the brunt of these choices.

This is because the practice of saving via a bank account is effectively eliminated when interest rates go to zero or below zero.

A coronavirus-led downturn may prove to be the trigger for central banks to engage in yet more rate cuts.

But more importantly, what happens if the whole global supply chain, much of which runs through China, chokes up?

Western companies could be forced to shift where and how they get their goods.

All of this could drive up domestic wages in Europe, the US and Australia, as ‘re-shoring’ takes place.

Ah, great — you might be thinking, finally we will get wage growth.

Not so fast.

You could get real inflationary pressure as prices play catch up to wage growth.

More money in people’s pockets allows companies to charge more.

What happens then?

It is possible that the inflation could box in central banks — leaving them little room to manoeuvre.

It’s hard to see central banks raising interest rates in a downturn…

Will we see a further ‘melt-up’ rally once the virus passes and the stimulus/Quantitative Easing (QE) kicks in?

Whichever outcome it is, what’s currently unfolding plays into the hands of the two biggest bets on distrust in the financial system.

And it comes down to two different ways of remedying this distrust.

You see, gold has no counterparty — no intermediary determining its value.

Its value is derived from simple supply and demand.

But what’s driving gold’s current run up the charts?

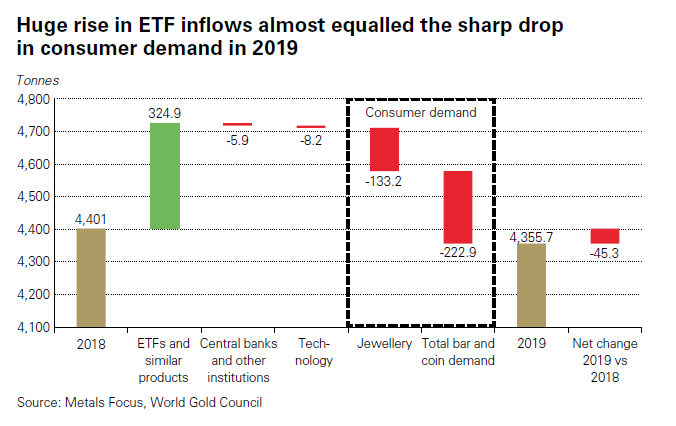

Well, despite the fact there were plenty of headlines about certain central banks (Russia and China) buying up gold, the chart below explains what’s really happening:

|

|

| Source: kitco.com |

The chart confirms to us what we already know — gold’s demand is coming from institutional investors.

As you can see, gold ETFs now have an insatiable desire for the metal.

This offsets a fall in demand from everyday consumers.

If this trend continues, luxury goods will fall away in a downturn and be replaced by people seeking a safe haven asset.

And each day the market sheds points and fear creeps in, gold generally gains.

As a result, there could be a sustained push in store for gold prices as markets de-risk.

Remember, gold doesn’t need to make sense — it just needs to be a smart investment.

Something similar can be said about cryptocurrencies…

Bitcoin’s value comes from the industrialisation of trust

You don’t need to be a cryptographer to understand Bitcoin’s [BTC] value.

Similar to gold, cryptocurrencies like bitcoin are in many ways the ultimate no-confidence vote in fiat currency.

Many people say its power comes from the fact that it’s ‘trustless‘ — you don’t put your faith in someone (politicians) or something (central banks), but you put your faith in the code.

This is not quite true.

At its core, it’s more accurate to say it industrialises trust — it turns code into a trust machine.

By its very nature, Bitcoin reduces the chances of opportunism through the competitive nature of mining.

And as an investment — you are relying on a combination of self-interest and code to keep the trust machine running.

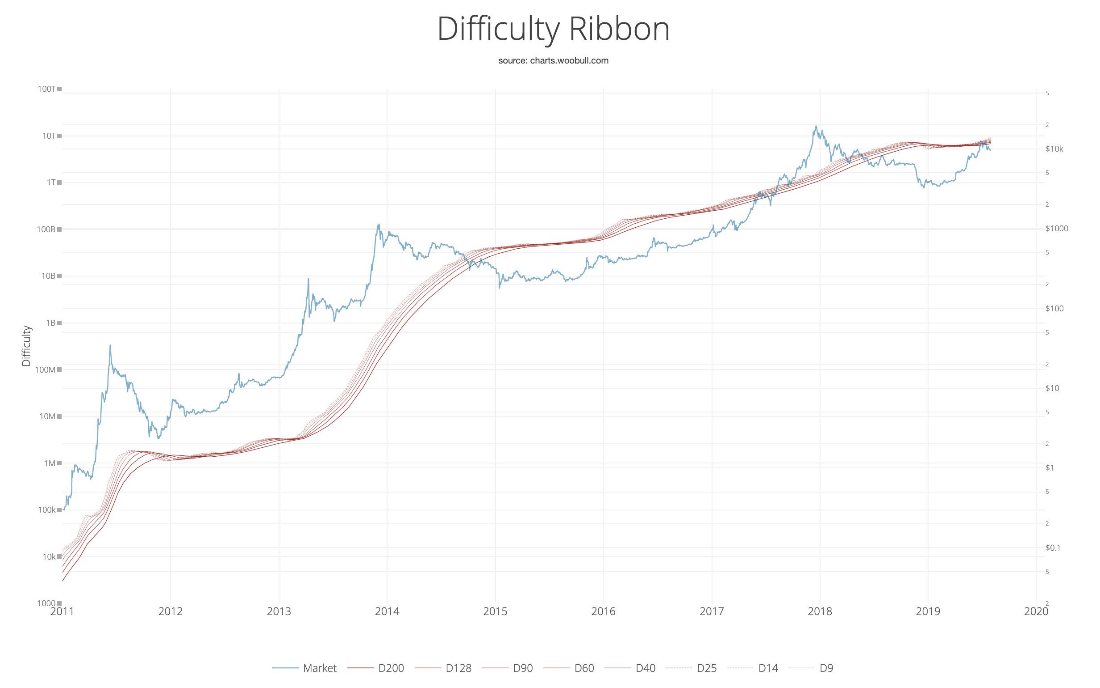

You can see how all this plays out in this very powerful chart:

|

|

| Source: woobull.com |

The idea behind the chart is simple — it matches up the difficulty of mining BTC (left) with the bitcoin price (right).

As the ribbon widens, this is when mining bitcoin gets harder.

The result of this is that it flushes out the hands of weaker miners who sell their bitcoin to remain operational.

Bitcoin bear markets cause weaker miners to fold while hashing power and network difficulty decrease — leading to ribbon compression.

If you had bought each time the ribbon compressed, you would be up significantly on your initial investment.

And the ribbon is now compressing!

It’s a sort of Darwinian ‘survival of the fittest’ explanation of how the bitcoin price works.

Moreover, coronavirus may only prove to amplify the fundamentals behind the current bitcoin price.

The even lower interest rates that come with a downturn could force people’s hands.

In 2020, crypto may turn out to be the new way for people to ‘stuff cash under the mattresses’.

Remember, from the moment bitcoin was created by Satoshi — it was all about an underlying distrust of what central bankers do to the money supply when things turn bad.

Again, like gold — it doesn’t need to make perfect sense, it just needs to be a smart investment.

Summing it all up

The ‘coronavirus portfolio’ presented today is just one way to think about your money in the midst of the current crisis.

Markets are ultimately motivated by two primal urges — fear and greed.

And based on recent events, fear is clearly dominating.

This doesn’t necessarily mean you should seize up and dump everything.

Rather, it means you need to think clearly about the companies and types of assets that will benefit in both the immediate future and whatever comes further down the track.

Regards,

Lachlann Tierney,

For Money Morning

Comments