You’ve likely heard the phrase ‘All roads lead to Rome’.

In Spain, all roads start in Madrid, specifically, in Puerta del Sol (Spanish for ‘sun gate’). Puerta del Sol is kilometre zero for all roads in the country’s road system.

It is also smack bang in the middle of the city. The plaza is a place for gatherings, near major transport and shopping…and where many Spanish choose to welcome the New Year.

Every year, hours before midnight on 31 December, people meet around the clock, which towers over the plaza, to hear the 12 bells ringing in the New Year.

Around the country, families gather around the TV to watch as the clock strikes 12.

And, it’s an old tradition that for each time the clock’s bell tolls, you eat a grape and make a wish. Each grape represents a month in the new year and is supposed to bring good luck.

But there are plenty of traditions worldwide to welcome the New Year.

Some of my Colombian friends run around the house at midnight with a suitcase in hand…to make sure they’ll have travel and adventure in the New Year. Or they take the first step of the year with their right foot, just to start the year right.

But as far as New Year’s traditions go, Brazil’s is my favourite. I spent some of my teenage years living there.

Each New Year’s Eve, hordes of people gather up at the beach wearing white, symbolising peace and good energy for the New Year. It’s also tradition to go into the sea and jump seven waves, making a request with each jump.

What all these traditions have in common is the belief that each new year we start anew. That once that clock strikes midnight, we start with a clean slate.

Markets seem to believe this too. Markets have started the year with plenty of optimism.

The Nasdaq is up close to 6% since the beginning of the year, and both the S&P 500 and the ASX 200 are up just above 4%.

Markets are focused on China’s reopening — that the Fed will stop its tightening cycle and achieve the much-desired ‘soft landing’ for the economy.

On the other hand, my colleague Vern Gowdie thinks optimism will be short-lived and that 2023 could be the year of the ‘Big Loss’.

As Vern has said recently, he’s ‘as worried as he’s ever been about the state of the markets’.

It’s why Vern is hosting a series of free strategy sessions for investors looking to protect their capital. If you want to hear more, click here.

It may be a new year, but many of the issues from last year have followed us into this year, so it could be a difficult year.

That doesn’t mean there won’t be any opportunities, though…

Commodities keep rising

Gold…iron ore…oil…they’ve all been rising since the start of the year.

But one bright spot has been copper.

I’ve talked on these pages before about copper and that if we are going to build solar panels, wind turbines, electric vehicles, and electrify everything for the energy transition, we will need plenty of copper.

As you can see below, the price has spiked since the beginning of the year, although prices are still below the peak from last year:

|

|

| Source: Business Insider |

A weaker US dollar is pushing copper prices higher, but so is the reopening of China. Supply could be tight this year if demand from China rises. Remember that China is a leader in renewable energy.

In Chile, copper production dropped last year because of poor ore grades, and in Peru, there have been some protests that have been disrupting copper production and shipments. Chile and Peru hold together around 40% of the world’s copper production.

And then metal stockpiles in exchanges have also dropped recently.

Here is what Bloomberg wrote on 30 December:

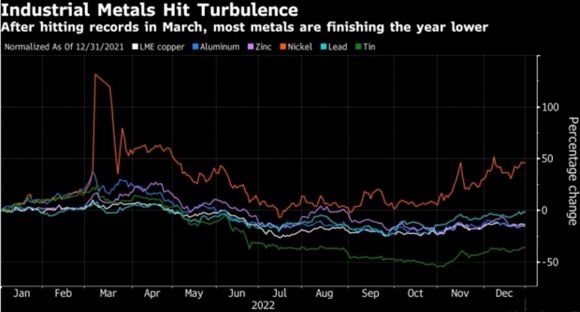

‘The London Metal Exchange will enter 2023 with the smallest available warehouse stockpiles in at least 25 years, setting the stage for future squeezes and spikes if demand turns out stronger than expected.

‘Available inventories of the six main metals traded on the LME plunged by two-thirds in 2022, with aluminum’s 72% decline accounting for the bulk of the drop, while zinc shrank by 90%. Collectively, inventories not already marked for withdrawal hit the lowest level in data going back to 1997 on Thursday, and finished the year only fractionally higher.

‘While most of the world’s metal never sees the inside of an LME warehouse, exchange inventory levels are important because every short seller who holds a contract to expiry must deliver physical metal registered in an LME warehouse.

‘The tight stockpiles also reflect a tension that has gripped metals markets for much of this year, between constrained supplies on the one hand, and worries about weakening demand due to recessionary threats in the world’s key economies on the other.’

|

|

| Source: Bloomberg |

Optimism over China’s reopening is translating into higher prices for copper stocks already…and supply could struggle to keep up with demand this year.

Central banks are raising rates, but the stimulus isn’t over

While central banks have continued to tighten, governments worldwide continue to spend on the renewable energy transition.

Two days before the end of the year, US President Joe Biden signed US$1.7 trillion in government spending. The US is pouring billions into updating its electrical grids, along with increasing its solar panel, electric vehicle, and battery manufacturing.

All this electric wiring will mean we will need more copper…and copper prices could just be starting to wake up to that fact.

Regards,

|

Selva Freigedo,

Editor, Money Morning