With the RBA expected to increase rates today, we’re told of ‘more interest rate pain’.

For whom?

Certainly not for those who have savings.

For years, savers sucked it up and tightened the belt.

Where were the media headlines on the hardship and cost of living pressures (due to the negligible earnings on their nest eggs) they were facing?

All they heard, to borrow a line from Simon and Garfunkel, were…the sounds of silence.

In pursuit of its arbitrary and irrelevant 2% inflation target, the RBA took rates too low for too long. Now, with inflation exceeding the targeted rate, this discredited institution is being forced to take rates (according to the aggrieved borrowers) too high.

For those of us who had 18%-plus housing loans in the early 1990s, this present-day squealing is a bit of a joke. Toughen up people.

Typical baby boomer. Heartless. Cruel. Insensitive. You and your ‘I’m alright Jack’ attitude can go where the Sun don’t shine.

Have I covered all the possible outbursts and insults some might be feel like hurling right now?

Good.

For many years I’ve championed the cause of the saver.

Why?

Self-interest some will say.

Sure…I would have liked to earn a little more on the savings we squirrelled away from 40 years of work.

However, the deeper and far more meaningful reason was…society’s interest.

Taking rates too low for too long was a disaster in the making.

Yes, the ability to borrow more was a great short-term boost to egos (being able to buy a bigger house and fill it with all the latest influencer-inspired furnishings) and our nation’s GDP.

But it was all false…a make-believe world.

Had the RBA (and the other brain-dead, useless, and incompetent central banks) decided to find an equitable balance between what’s reasonable for borrowers AND savers, then people would not have borrowed so much AND savers would not have been forced to go in search of higher yield (and even higher risk) investments.

The RBA is DUMB, DUMB, DUMB

And, while there’s a certain amount of schadenfreude to be had from watching the RBA governor being held to account, it doesn’t compensate for the damage you know that’s been done — to both saver and borrower — from this blindingly stupid obsession with never-ending growth.

In addition to higher debt servicing costs, households are being subjected to unnecessary increases in energy costs thanks to the climate change nutters and their blindingly stupid obsession with zero-carbon emissions.

Why is society so blind to these blindingly stupid paths we are on?

How can you pursue a policy of never-ending growth when you’re determined to take away the very energy source that was instrumental in delivering past growth in a cheap and reliable fashion?

This is madness…with a capital M

The brainwashing on climate change is relentless and becoming increasingly bizarre.

Any weather event (or, in Jane Fonda’s case, a health scare) is the fault of our always and forever changing climatic conditions.

Even central bankers feel compelled to display their woke credentials.

Because these monumental errors in policy judgement are becoming SO obvious, the propaganda departments are working overtime to create a scapegoat for the world’s inflationary problems.

If you believe the BS they spin…this has NOTHING WHATSOEVER to do with our brain-dead decisions to close down power stations and ban mining…no, it’s ALL Putin’s fault.

Sorry, the facts DO NOT support the narrative.

Commodity prices were going up well before Russia invaded Ukraine:

‘The Commodity Research Bureau Index (CRBI) acts as a representative indicator of today’s global commodity markets. It measures the aggregated price direction of various commodity sectors.

‘This commodity index comprises a basket of 19 commodities, with 39% allocated to energy contracts, 41% to agriculture, 7% to precious metals, and 13% to industrial metals. The CRB is designed to isolate and reveal the directional movement of prices in overall commodity trades.’

Investopedia

|

|

| Source: Trading Economics |

Russia’s invasion has worsened a bad situation, but climate change policies left us vulnerable to an exogenous event.

Concerns over food production BEFORE Russian invasion

Wholesale production of food was a concern I wrote about in the 13 October 2021 issue of The Rum Rebellion:

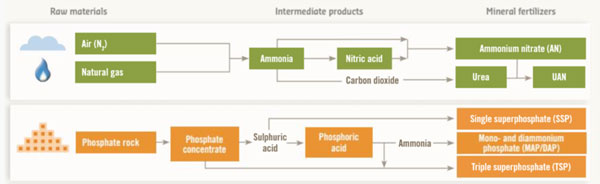

‘Fertiliser is hugely important in the production of food grown at scale.

‘And, in case the climate changers haven’t joined the dots, food is hugely important in sustaining human life.

‘China’s suspension of fertiliser exports — due to soaring raw material costs — could pose a serious threat to food supplies in countries that can ill-afford to endure such hardship.

‘Making fertiliser not only requires raw materials it also consumes energy:

|

|

| Source: Fertilizers Europe |

‘These price hikes are a consequence of demonising fossil fuels…ban coal mining, no more drilling for natural gas, cut oil production.’

Flogging a dying horse

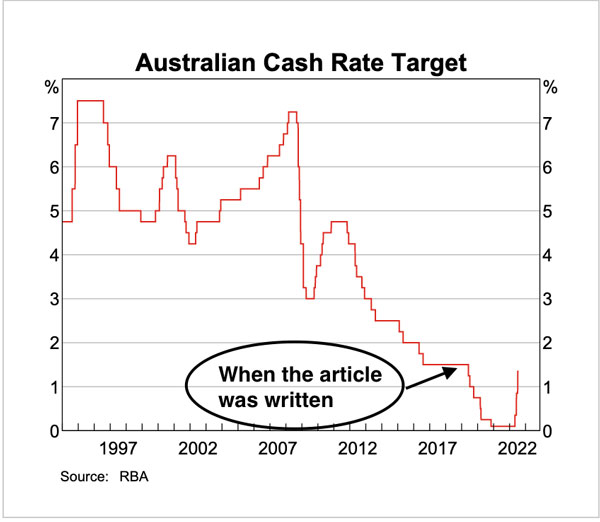

And, when it comes to warning about the perils of pursuing a policy of lower rates and climate change activism by the RBA, here’s an edited extract from Markets & Money published on 6 May 2019:

‘The horse is old. Suffers pain from a bowed spine.

‘After galloping at breakneck pace for so many years, poor old Nelly wants a rest.

‘“Not on your nelly, Nelly” says the horse’s owner as he reaches for his solar powered (the owner is on record for wanting to save the planet from climate change) electric prod.

‘If need be, the owners will beat this horse, not only into the ground, but even lower if they have to.

‘The horse being flogged is named “Interest Rates” and its owner is the RBA.

‘For more than 30 years “Interest Rates” has been whipped to the point of near exhaustion.

‘In the early years, the cuts to its flank spurred the economy on…galloping comfortably at a pace in excess of 4% per annum.

‘But the better it performed, the greater the weight it was forced to carry. The debt load in the saddle bags grew heavier and heavier.

‘“Interest rates” last major stumble occurred in 2009…the horse almost went lame.

‘But the owners — central banks — shocked it back to life. The stimulants worked a treat.

‘Old Nelly’s eyes went wide, the nostrils flared and with the bit between its teeth it took off.

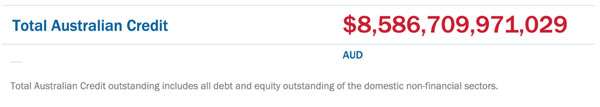

‘Australia’s debt load, which was around $3.5 trillion in 2009:

|

|

| Source:Australian Debt Clock |

‘…has more than doubled:

|

|

| Source: Australian Debt Clock |

‘What took us since Federation to achieve — a national debt load of $3.5 trillion — has been duplicated within the space of one decade.’

A brief pause…after the article was published, the RBA plunged our cash rate from 1.5% to 0.10%:

|

|

| Source: RBA |

And since May 2019, our nation’s Total Debt has risen by a further $1.4 TRILLION:

|

|

| Source: Australian Debt Clock |

OK. This is a PRIME example of making a bad situation even worse.

Anyway, back to the 6 May 2019 edited extract:

‘Growth at all cost and I told you so on energy costs

‘ANZ chief jockey, Shayne Elliot, offers an all-too-predictable “solution” [to a slowing economy]…

“…one way of getting a bit of growth into the system would be through rate cuts which would spur a bit more activity, would put a bit more money in people’s pockets, give them a bit more breathing space in terms of managing their household costs.”

The Australian, 4 May 2019

‘I read, reread, and reread again this comment to make sure this came from one of our Big Four CEOs.

‘Let’s assume Shayne Elliot is correct when he says “rate cuts…would spur a bit more activity.”

‘Then what happens after that temporary shot in the flank?

‘Another rate cut?

‘Brilliant!

‘Then what?

‘Another rate cut?

‘If you keep following this “rate cuts, spur activity” cycle, pretty soon we’ll be out of rates to cut…then what?

‘This “one-trick” horse has a limited shelf life.

‘So why would a bank CEO persist with flogging this strategy?

‘Oh that’s right, it’s out of compassion…it would put a bit more money in people’s pockets, give them a bit more breathing space in terms of managing their household costs.

‘Really? What about those who are living off the interest from deposits with the ANZ Bank?

‘Will cutting rates put more money in their pockets OR give them breathing space with their household budget?

‘How could a bank CEO forget about the needs of the other half (or maybe less) of his customer base?

‘That statement is a clear demonstration of who those charged with managing the financial system care about. To hell with the savers. Let’s reward the borrower.

‘The system is totally skewed towards an economic growth model that’s totally and utterly dependent upon debt, more debt, and even more debt.

‘Screw the savers. Reward the borrowers.

‘But the evidence (and common sense) clearly demonstrates this strategy also has an expiry date.

‘Lowering rates may provide temporary relief, but within a short space of time, households will again reach the outer limits of what they can afford…and the cycle goes around again.

‘But we are fast running out of rates to cut.

‘The once sure and trusty stead “Interest Rates” is being flogged to death. One day it will lie down, spread eagled on the track, and not even an electric prod powered by a giga-factory of Tesla batteries will be enough to spark it back to life.

‘On that solar powered electric prod owned by the RBA (emphasis is mine):

“Climate change now poses the threat of an ‘abrupt and disorderly’ blow to Australia’s financial stability, according to a stark warning from the Reserve Bank.

“In a landmark speech last night, the RBA’s deputy governor [Guy Debelle] said climate change had become a ‘key policy concern’ that’s now being factored into monetary policy deliberations.

“Guy Debelle also called for an orderly transition to a low carbon economy.”

‘Seriously, climate change poses a threat to Australia’s financial stability?

‘Personally, I would have thought a central bank that does all it can to encourage people to borrow beyond their means posed a far bigger threat.

‘Ironically, the RBA’s call to arms on climate change will put even more pressure — in the form of higher power bills — on mortgage stressed households.

‘This madness passes for responsible economic management.

‘Personally, I think it would be far kinder to society to send central banks to the knackery.’

Consequences of blindingly stupid policies cannot be avoided

Folks, if you stayed with me to this point in the article, I have one final (and again, probably too early) warning for you…we are headed into a period of significant economic contraction and a palpable level of social unrest.

These are the consequences of blindingly stupid policies.

They cannot be avoided.

The people responsible for creating this looming crisis ARE NOT the ones who can solve it.

You, and you alone, are responsible for ensuring your financial position is fortified against the inevitable economic and social upheaval coming our way.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia