On Friday 9 May, the global precious metals industry lost a pioneer and legend, Don Mackay-Coghill.

Don’s legacy is nothing less than amazing. He was a South African cricketer before retiring in 1974. Soon after, he entered the precious metals industry where he rose to become the CEO of Intergold. In this role, he was instrumental in bringing the South African Krugerrand to the world. The Krugerrand is one of the most circulated bullion coins today.

Don arrived in Australia in 1986 to become the first CEO of the Gold Corporation, which became The Perth Mint. He led the launch of the Australian Nugget bullion coin series and the production of the gold medals for the Sydney Olympics in 2000, among other contributions.

I got to know Don personally last July. He contacted Fat Tail Investment Research and wanted to speak to me before he signed up for The Australian Gold Report. He became a friend and mentor, sharing his vast insights and experience to broaden my horizons.

He kindly wrote the foreword to my book on investing in precious metals assets, which I’m still working on.

One story Don recounted to me about six weeks before his passing was his reaction to the decision by the Reserve Bank of Australia’s Governor, Ian Macfarlane, to sell 167 tonnes of our gold reserves in 1997.

Few people remember this blunder. But let me show you how it cost Australia around $28 billion.

Let me tell you this story today.

Our land abound in nature’s gifts, but where’s our share?

Australia boasts the world’s largest gold in-ground reserves. We have approximately 12,000 metric tonnes of gold, according to Discovery Alert. Australia and Russia share the honour of having richest endowment of gold beneath the ground. The two countries rank behind China as the biggest producers of gold – China delivering 380 tonnes last year, Russia 310 tonnes and Australia 290 tonnes.

Our similarities end there. The gold reserves that the RBA holds do not even compare to that held by China and Russia. We currently hold a measly 80 tonnes of gold compared to Russia’s 2,335 tonnes and China’ 2,280 tonnes (likely to be much higher).

Our population (~28 million) is a fraction of that in Russia (~140 million) and China (~1.4 billion). Our current gold reserves are such that each Australian owns around 3 grams of gold, or 0.1 ounces. We’re doing better than China, but well behind Russia, whose reserves equate to a half ounce of gold per person.

But you can’t trust China’s figures. China’s official gold reserves are likely a fraction of what it actually owns. The Chinese people own gold themselves, as it’s part of their culture. Russian people are similar.

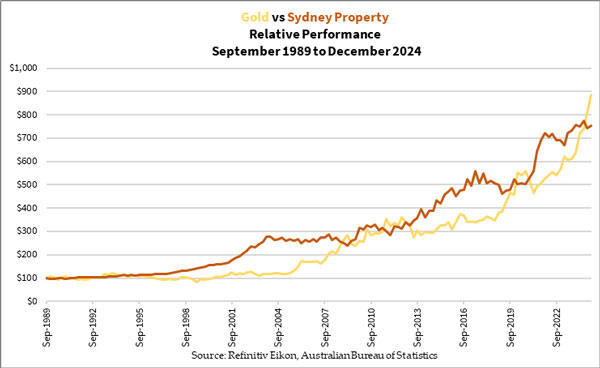

The harsh reality is Australians own a tiny amount of gold. This isn’t a good thing because it is proven to help preserve purchasing power. Look at how gold has outperformed Australia’s favourite asset class, residential property:

It’s made worse by the apathy of the ordinary Australian towards this precious metal. They put their faith in other things, like mortgages, holidays, keeping up with the Joneses, things that drain their wealth.

Our lack of interest in gold is silently impoverishing us.

The 1997 blunder that still burns a hole in our pocket

Let me go back to Don’s story.

The Governor of the Reserve Bank of Australia was Ian Macfarlane back then. The Board decided in the first half of 1997 to sell 167 tonnes of gold from the Australian reserves. The price of gold at the time was around US$350 (~$470) an ounce. This sale may have contributed to the price of gold falling to US$320-330 (~AU$420-440).

Don was furious about the decision. He even sought Ian out to explain why he did it. But Ian was dismissive.

Don also consulted the then-Treasurer Peter Costello, who patiently listened to Don’s concerns, but didn’t pursue the matter. Don kept this matter close to his heart as he foresaw that this move was against the best interests of Australia.

He was right.

One of my colleagues at GoldHub Australia calculated the impact of this sale in today’s terms. He estimated that the proceeds from the sale of gold amounted to around AU$2.5 billion at the time.

Gold rallied significantly since 1997, having moved parabolically twice from 2003-11 and again since 2019:

Gold in Australian dollar terms did just about the same thing and is now worth around AU$5,000 an ounce. This compares to AU$1,000 or so if gold increased at the same rate as the interest paid on the Australian dollar during these 28 years.

Had the RBA not sold its gold, the 167 tonnes would be worth over $28 billion today.

What is the difference between the 1997 sale of gold in today’s terms and the value of the gold today? That is what we forgo from the sale.

We estimated that the sale proceeds plus interest would be $7.5 billion. This equates to around $15 billion after accounting for inflation.

By selling the gold, the RBA shortchanged Australia by $28 billion less $15 billion, or $13 billion.

That’s around $465 per person, or around 0.09 ounces (~2.7 grams) of gold.

Had we kept that gold today, we’d have 0.28 ounces (~8.6 grams) of gold per person.

That’s almost three times more than what we have now.

Dictate your own destiny – set up your own gold reserve

I can’t guarantee that the individual Australian would be better off if we had three times more gold in our national reserves. It’s not like we get that in our bank accounts.

However, I’m certain of this: The RBA and our government, irrespective of who’s in power, haven’t acted in our best interest. We’ve seen constant budget deficits, increases in the taxes and levies paid, and cuts to our benefits.

The average Australian household feels poorer, despite having more dollars in their bank accounts and under their name. That’s because our dollar buys us less.

Our future doesn’t look bright if we continue down this path. You must decide if you want to protect your wealth and stay afloat.

The RBA doesn’t hold enough gold on your behalf. That’s your responsibility.

If you want to learn more about the power of gold, I can share our game plan with you. Click here for more information.

Finally, I hope you can join me in paying our respects to Don Mackay-Coghill:

| |

| Source: The Perth Mint |

May he rest in peace and the Lord God reward him for his contributions.

Enjoy your week!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments