Three days seems like a lifetime in the markets these days…

Last Friday, surprisingly good job numbers have caused a US market surge. I expect we’ll join the party today and move past 6,000 on the ASX All Ordinaries Index.

For how long?

Who knows?

The one thing 2020 likes is surprises.

But when it comes to your investing strategy, you need to rise above the headlines.

Zoom out a little and look at the big picture, and you’ll see order emerge from the day-to-day chaos.

My own investment philosophy is pretty simple…

Invest in big, paradigm changing moments as soon as it looks like they’re unstoppable.

Then hold on for the ride!

Of course, these kinds of opportunities don’t present themselves every week.

But they’re more frequent than you might think too. And I usually find at least one of these ‘big ideas’ a year.

One just happened…

Today I’m going to share with you what it is and why it’s my biggest investment idea for 2020.

But first, I want to briefly show you how my big idea of 2019 went.

Because, although the industries are very different, the exact same process is playing out.

So, if you understand that, you’ll understand the extreme gains on offer this time around in a select subsection of stocks.

If I’m right, you’ll not want to miss out…

Buy when an industry crosses the chasm

Last year I said that small tech companies were finally about to break the stranglehold of Australia’s big banks.

I called this process the ‘Great Bank Unbundling’.

At face value it was a pretty straightforward idea.

With a pretty straightforward conclusion: Invest in promising fintech disruptors.

Not such a radical idea, you might think…

But what was key to this big idea in 2019, was the timing…

You see, the finance industry was finally beginning to change.

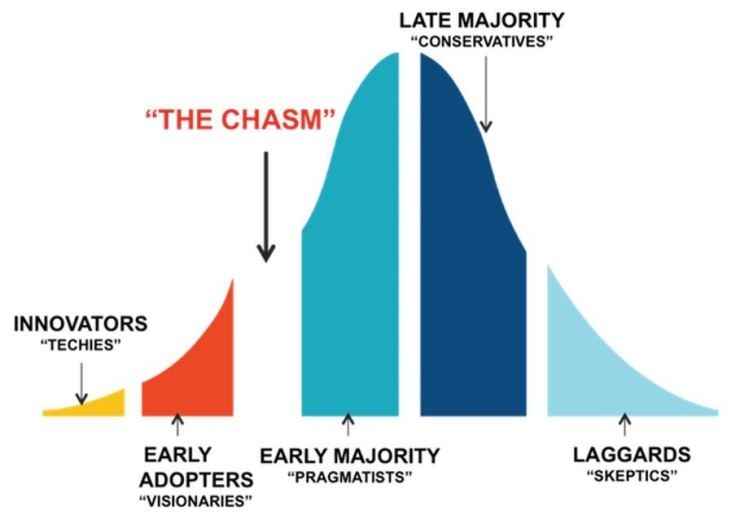

And certain fintech stocks were starting to ‘cross the chasm’ from early experiments to mainstream adoption.

Generally speaking, this is a crucial moment to spot in any exponential trend:

|

|

| Source: Market Intelligence |

Now, the fintech trend was always coming.

But in 2019 there was an added boost to this emerging trend.

The Royal Commission into banking.

This very public investigation revealed in embarrassing detail an industry hopelessly reliant on poor sales practices and outdated tech.

The time was ripe for the nimble upstarts to make their move.

Since then the Big Four banks’ shares are down between 30% and 35%, with dividends slashed across the board too.

Now look at this…

At the same time, here’s how the fintech stocks I recommended in 2019 for subscribers of my investing service Exponential Stock Investor did:

- Wisr Ltd [ASX:WZR]: Bought March 2019 — Sold February 2020 –> GAIN 225%

- CONFIDENTIAL (still live): Bought July 2019 –> GAIN 25%

- CONFIDENTIAL (still live): Bought July 2019 –> GAIN 115%

- CONFIDENTIAL (still live): Bought July 2019 –> GAIN 37%

- CONFIDENTIAL (still live): Bought July 2019 –> GAIN 3%

- Prospa Group Ltd [ASX:PGL]: Bought September 2019 — Sold November 2019 –> LOSS 46%

As you can see, five out of six of my picks are in decent profit with one dud pick that we got out of quickly.

Two are already making triple-digit gains in less than a year.

Now, let’s get to the crux of the matter…

I’m showing you these results not to blow my own trumpet. But to show you what happens when an industry goes through a big shift.

It’s the process of creative destruction playing out that’s essential to capitalism.

In my opinion, the exact same forces are playing out in my new big idea of 2020.

Let me explain what it is…

A big change is underway

Technology has a new industry in its sights.

And like with the big banks, it’s an industry notoriously resistant to change. But that’s precisely why the change will be so powerful and rapid.

The pressure builds up until the dam wall finally bursts.

The industry in question this time is the healthcare industry.

You might’ve noticed it?

How a select few technology stocks are starting to cross the chasm from early adoption to mainstream use in healthcare.

And just like what happened with the banks, this trend has just been given a huge external shock.

Not a royal commission this time, but instead a global pandemic.

It doesn’t matter that some think the coronavirus crisis is now behind us (though a second wave might change that view).

The fact is, the fuse has been lit.

Radical changes are underway in the healthcare industry.

We’re seeing ideas that have been on the healthcare drawing board for a long time — things like telemedicine, for example — now as essential innovations, not as quirky gimmicks.

And big tech is driving it.

As tech blogger Brad Anderson recently wrote:

‘Google has backed almost 60 health-related enterprises since 2009, and the company’s interest in the industry shows no signs of abating.

‘In November, the company announced the purchase of Fitbit, with Google spokeswoman Heather Dickinson emphasizing that the acquisition was “primarily about selling devices and services, not advertising.”

‘The other three members of the “Big Four” have also made significant investments in the industry. Apple devices can track diseases and provide vision and hearing tests. Amazon Web Services has gone in hard on healthcare cloud computing. Microsoft is betting on AI to transform healthcare.

‘All four companies regard healthcare as an ongoing concern, so expect to see their involvement increase in 2020.’

As an investor you’ve a chance right now to make a calculated decision to leverage yourself to this fast-growing industry too.

To join the ‘big guns’ in a trend I think is going to snowball over the next decade…

For a limited time only…

This is my big idea for 2020.

And it’s why I just dropped six new stock recommendations exclusively for subscribers of my Exponential Stock Investor service.

If you’re keen to have a speculative stake in the future of healthcare, you should hear about these stocks now.

For a short time only, we’re doing a special deal for new subscribers.

Go here now to lock in this deal and get immediate access to the extensive research for all six stock picks.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: ‘The Coronavirus Portfolio’ The two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report.

Comments