Lately, I’ve been preoccupied with the current disruption happening in the tin market. You’ll see why in a moment.

If you’re not familiar with this story, last week a major tin mine in Africa was evacuated after militia began moving toward it.

The Canadian owner had no choice but to get its staff out considering the escalating personnel risk.

This mine provides an important source of tin to the global market. The original estimate I saw was 4% of global tin supply. I’ve also seen as high as 6%.

Either way, it’s a lot.

But it may not sound like a lot.

Let me explain something at this point…

Before Covid I took a long and intense interest in the oil market. That included all the fascinating history up until that point.

Here’s one thing that jumped out at me as I read over old papers and books.

The famous ‘Arab embargo’ in the 1970s only accounted for a supply loss of about 3%.

That seemed tiny to me, considering the infamy of the moment.

Here’s the kicker…

The panic around it sent the oil price up over 200%.

From that study period I began corresponding with the premier oil analyst in the world – Phillip K Verleger. We’re still emailing today.

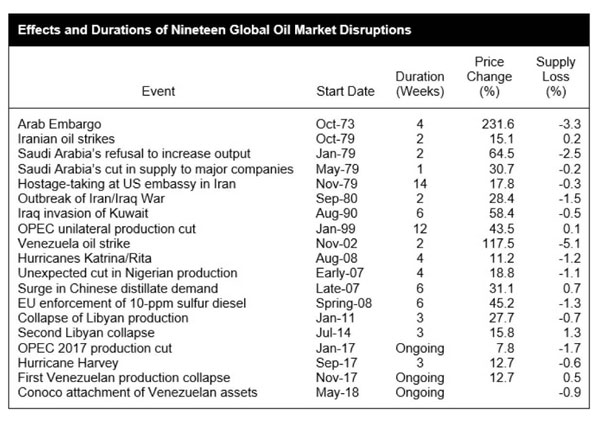

Anyway, here’s a table from Phil that shows most major oil disruptions and the impact on the oil price…

| |

| Source: PK Verleger |

You can see that even small disruptions can have an outsized impact on the price.

Commodity markets, whether oil or tin, move in a similar way.

You can also see why losing 4–6% of global tin supply may not sound like much…but could actually be rocket fuel for the tin price.

That’s the theory, but it’s not yet clear whether it’s going to play out like this.

Tin surged 7% last week but has flatlined in the last couple of trading sessions.

Of course, for now, most tin users and traders will have a modest inventory they can work through.

Tin is also less essential to the world economy than oil, and, because it’s such a small and niche market, has much less speculative money flowing through the futures market.

That said, the longer this Congolese mine stays out of action, the pressure will likely keep building under the tin price.

A quirk of tin, too, is that it’s used in such tiny quantities that the price could double or triple and the end user would not curb demand.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

We’re talking cents in costs for, say, a new washing machine.

That said…

The ASX tin producer Metals X [ASX:MLX] is turning these pennies into millions in cash flow at the current tin price of US$35,000 per tonne. That’s over $50,000 in Aussie dollars.

MLX is a single commodity, single mine operation. That comes with a lot of caveats and risks.

However, occasionally these types of shares can barnstorm their way up when it all comes together.

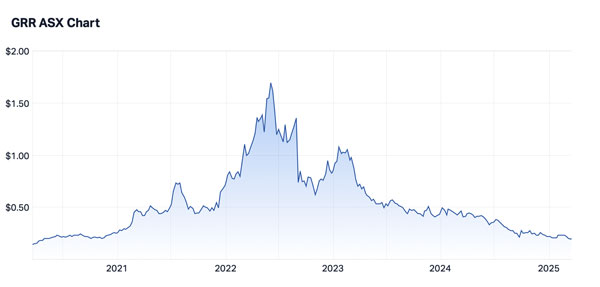

A few years ago, the single Tassie iron ore mine Grange Resources [ASX:GRR] went from 20 cents to $1.50 over the space of two years (before withering away again).

See that here…

| |

| Source: Market Index |

GRR had a lot of cash on the books at the time and every move up in iron ore went straight to the bottom line.

This big run-up included the surge in the iron ore price to US$200 a tonne, but GRR kept barnstorming its way up in 2022…even during the ASX bear market.

Could MLX do something similar?

Well…there’s no guarantee…small caps like MLX carry high risks and face a lot of unpredictable variables…but I think it’s a chance.

The one thing we can’t predict with any certainty is whether the political situation in the Congo will settle down. If the mine goes back into production, then the intensity around the tin price will fizzle out.

Metals X will likely still be generating great cash flows, but the market won’t bid it up with the same frenzy as it could if supply looks like it’s about to get choked off.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

Murray’s Chart of the Day

— Nasdaq

| |

| Source: Tradingview.com |

The weekly trend on the Nasdaq has finally turned down after 18 months of trending up.

Until a new weekly uptrend is confirmed, we should remain on a defensive footing and expecting more downside.

In the last decade, a weekly downtrend has been confirmed just five times.

In four of those instances either the market trod water for a year or sold off sharply before recovering. In 2022 the weekly downtrend signal gave you plenty of warning before the Nasdaq sold off 35%.

You often see short squeezes along the way that take traders out of short positions and tempt traders to get long, before prices turn down again and head to new lows.

Treading carefully until the weekly trend is on our side again is the way to go.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments