Despite the new year cheer from markets recently, it seems the concerns over a global recession are still growing.

Inflation may finally be easing, but it is coming at the cost of declining growth too. Or at least, that seems to be the case as we see more huge layoffs, fewer profits, and growing discontent.

If ever there was a time to be a cautious investor, now is certainly it.

That’s why my colleague, Vern Gowdie, is spreading the word to all who will listen about how to protect your wealth. He foresees 2023 as a year that will be remembered for the ‘Big Loss’.

In fact, Vern has even put together several strategy sessions warning investors how to avoid financial ruin in the next 12 months. Because, as he and Bill Bonner explain in precise detail, the cracks aren’t just beginning to show, they’re ready to bring down the whole foundation…

That’s why you should check out what Vern and Bill have to say by clicking here.

Today, though, I want to talk about why US shale oil could be key to markets in 2023. Because for better or worse, this lucrative source of oil and gas appears to be reaching its end.

How we avoided the last ‘Big Loss’

I want to cast your mind back to 2008…

Back when the world was gripped by the global financial crisis that wrought so much investor pain. Because, as bad as it was, it could’ve been far worse…

See, in the aftermath of the meltdown, a US oil and gas revolution likely saved the global economy. Shale oil or ‘fracking,’ as it would eventually be known as, helped turn the US into the world’s largest oil producer.

As a result, the stranglehold over oil production and pricing from OPEC was somewhat disrupted. The cartel couldn’t completely dictate the market now that a new free-market competitor had come into the mix.

There is little doubt that this ensured the rebound to growth following the GFC was far faster than it would’ve been otherwise. Because with an abundant supply of new oil and gas, global production could return without the burden of higher costs.

Shale oil has been a key factor, if not the key factor, in the 15-year-long boom we’ve seen since 2008.

Even with some rocky patches in between, if it weren’t for US oil and gas, things would almost certainly be very different for markets and investors. This is why, now that the shale industry is beginning to slow down, one has to wonder what the consequences might be…

Reversion to the old order

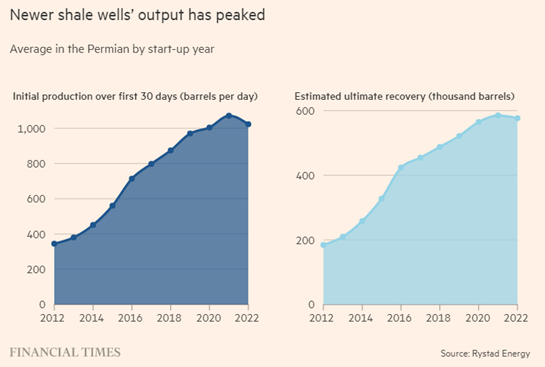

The data shows that shale output may have passed its peak. Just take a look at these charts:

|

|

| Source: : Financial Times / Rystad Energy |

In our post-pandemic era, it seems US production is finally falling. Not by all that much yet, but it is still heading in the wrong direction for anyone who relies on oil and gas.

As one consultant explains:

‘Unless activity picks up again, consultancy Energy Aspects said shale’s decline rates would accelerate next year, “possibly even leading to outright year-on-year declines” in US output.

‘“What was once considered as the supply growth engine of the world may well be nearing its peak,” says Amrita Sen, the consultancy’s head of research.’

Now, if the energy transition away from fossil fuels is successful, this may not be a big problem. In fact, I’m sure plenty of people will be celebrating the fact that the US’s oil industry is looking like it is coming to an end.

The issue, of course, is that the reality of the transition isn’t as simple as most hope. Oil, for all its pitfalls, is still a vital commodity.

Demand is already expected to break new records this year, according to the International Energy Agency. They’re predicting up to 101.7 million barrels per day could be required as China’s reopening spurs demand — a figure that represents an increase of 1.9 million barrels per day over last year.

The point is that there is no sign yet that the world is ready to give up its need for oil.

This means if US production can’t supply the market, others will have to step in. And as was the case in 2008, the most likely candidate to fill that role is OPEC.

Tune in tomorrow as I explain what ramifications this could have for investors in 2023 and beyond.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.