What’s a $100 note worth? Clearly a whole lot less than what it was worth last year.

As we’ve been experiencing, living with inflation isn’t easy.

Argentinean artist Sergio Guillermo Diaz tried to describe it in Hyperallergic:

‘It sounds bad, but everyone tends to get used to it, live with it, and deprive oneself of things that begin to feel like luxuries. You live with the reality that an art supply you bought last week is now going to cost a little more — and not only that item, but anything you are going to pay for the following week.’

Argentina has been battling inflation for decades. With a whopping over 100% inflation rate currently, banknotes can become worthless pieces of paper fast.

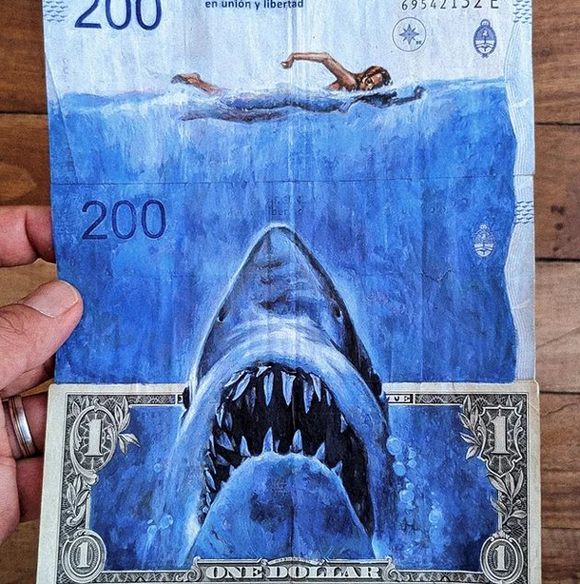

So, to create some value, Sergio has been using bills that have been devalued as a canvas for his paintings.

He draws anything that takes his fancy, from movie scenes and characters to sports personalities and cartoon characters. For instance:

|

|

| Source: Instagram Sergio Guillermo Diaz |

Or here’s one of my favourites, pointing out Argentina’s dependency on the US dollar:

|

|

| Source: Instagram Sergio Guillermo Diaz |

Inflation is a silent tax on your money, one that can rob you blind.

For me, it really puts it into perspective when you try to gauge the effects of inflation in a measure other than fiat currency.

The movie In Time does a good job of this.

In the movie, society doesn’t use the US dollar as currency but time instead. Everyone walks around with a timer inserted in their arm that tells them exactly how much time they have left to live, which is also how much ‘money’ they have. Whenever they work, they clock up time. Whenever they spend, they lose time.

Hearing that your bus fare has suddenly spiked from one to two hours of your life is certainly more painful than hearing the fare has increased from $1 to $2…

Now markets are hailing an inflation slowdown but…

…it may not be good news.

Markets have risen after the consumer price index (CPI) in the US hit just below 3% in June, down from 4% in May.

Investors are waving inflation goodbye from their rear-view mirror. They expect central bankers to pause rate hikes or even lower them in the near future.

But inflation is a tough beast to beat down, as Argentina has shown time and time again.

For one, inflation is still high. While CPI fell, US core inflation (inflation that excludes food and energy prices) remains high at 4.8%.

And here in Australia, inflation was still running at 7% in the March quarter, way above the Reserve Bank of Australia’s 2–3% target.

Central banks have been tightening aggressively, and while it takes a while to work through our system it looks like high interest rates are doing a good job at beating down demand. Yet much of that inflation has come from the supply side.

What’s more, there’s already evidence that credit is starting to dry up in the US, which would slow down demand even more.

Now central banks are at a crossroads.

Do they continue to tighten at the risk of breaking something, or do they slow the pace and risk letting inflation run higher?

Markets are betting on the latter, but a central bank pivot doesn’t mean the economy is doing well.

What’s interesting is that government officials and bankers have been coming out of the woodworks this week to say there will be ‘no recession,’ a ‘mild recession’ or mention a ‘soft landing’.

It may be.

But this should all be sending alarm bells. After all, our economy is based on maintaining confidence.

A weaker US dollar is good for commodities

While we could be heading for a slowdown, I’m still upbeat about commodities.

For one, slower inflation has been weakening the US dollar, which has been boosting some commodities.

In particular, gold and silver have been doing pretty well as the US dollar weakens. If the US Fed stops or takes a break from raising rates, then the US dollar could lower further which would help gold — and silver.

The other concern for commodities is the slowdown in China, which could affect global growth and in turn demand for commodities.

One thing to keep in mind though is that China is the largest electric vehicle and solar panel manufacturer in the world. Their Made in China 2025 plan identifies EVs, green energy and energy efficiency as key industries and is likely to continue to spend on cheap green energy for the next few years.

So, China — as well as the US and Europe — should continue to pour money into resources needed for these technologies.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments