December is a festive month but also a reflective one. Proximity to a new year leads to reflection on the current one.

So today, we’ll reflect on the stocks that didn’t perform well this year…and what that can tell us.

We’ll canvas the 10 worst performers of 2022 on the All Ordinaries Index.

The All Ords is a market barometer containing the 500 largest ASX stocks.

10 worst-performing ASX stocks of 2022

So here are the top losers of 2022 — some of them have notched steep losses for the year:

|

|

BNPL firm Zip tops the list

‘Buy now, pay later’ (BNPL) instalments firm Zip Co [ASX:ZIP] took out the top spot in 2022, falling more than 85%.

2022 marked the end of the bull run for BNPL stocks as issues with converting large customer bases and transaction volumes into profits spooked investors.

With interest rates rising — and so, too, the cost of debt — the cash incineration quality of BNPL firms did not find mass appeal in 2022.

And ZIP took the brunt of that sentiment change.

After Block’s acquisition of Afterpay, Zip became the big BNPL fish on the ASX. With that came high expectations…and high disappointment.

Megaport tipped to soar but plummets

One of the surprises on the list is connectivity stock Megaport [ASX:MPT]. Megaport was tipped by many to feature on a different list in 2022 — the list of the top performers on the All Ords.

In December 2021, at the Sohn Hearts & Minds Conference, for instance, Firetrail’s Eleanor Swanson tipped Megaport as ‘one of the best stories on the share market because it has brought the telecommunication industry to the 21st century.’

Here is the contemporaneous reporting from the Australian Financial Review on the pick:

‘Unveiling the Bevan Slattery-backed company as her top pick at the 2021 Sohn Hearts & Minds Conference, Swanson says Megaport is solving the connection issues that have plagued businesses around the world, and by doing so, has brought the telco industry into the 21st century.

‘“Between the years 2000 and 2013, global internet traffic jumped 600-fold. The staggering increase in data traffic caused the customer experience on telco networks to plummet from average to abysmal,” Swanson says.

‘“The Megaport network is fast, flexible, and a fraction of the cost of traditional telco networks. The Megaport network is the best network, as connections go live in minutes, not months, it’s a pay-as-you-go model, and you can scale up or down as you need.”

‘The loyalty of Megaport’s customer base adds to the company’s appeal, with Firetrail expecting customer spend to grow at 30 per cent a year.

‘Megaport’s ability to innovate has enabled it to double the size of its addressable market from $7 billion to $14 billion over the past 12 months. The company operates in more than 700 locations, while its closest competitor is limited to 200.

‘Megaport has also created what Swanson describes as a “sales force army”, having expanded its sales reps from just 40 at the start of this year to 40,000.

‘“[Megaport] is now on the precipice of greatness and has the potential to grow into one of the largest telecommunication companies globally,” Swanson says.

‘While the stock is currently around $20, Swanson says it can double to more than $40 a share at a market capitalisation of more than $6 billion by the end of 2022.’

Alas, it was not to be.

Over the year, Megaport shares are down 65%, trading at a market cap of $1 billion.

Earlier this month, Firetrail doubled down on its Megaport thesis, adding to its position.

Firetrail’s Kyle Macintyre told Livewire Markets:

‘“We retain high conviction in the medium to longer-term outlook for Megaport and have added to our position in the past 6 months.”

‘“We believe higher growth companies like Megaport will provide attractive returns over the medium-term, particularly in a lower growth environment in CY23,” Macintyre said.

“In our view, the key is to be selective and invest in higher quality growth companies like Megaport that can generate earnings and cashflow within the next few years.”’

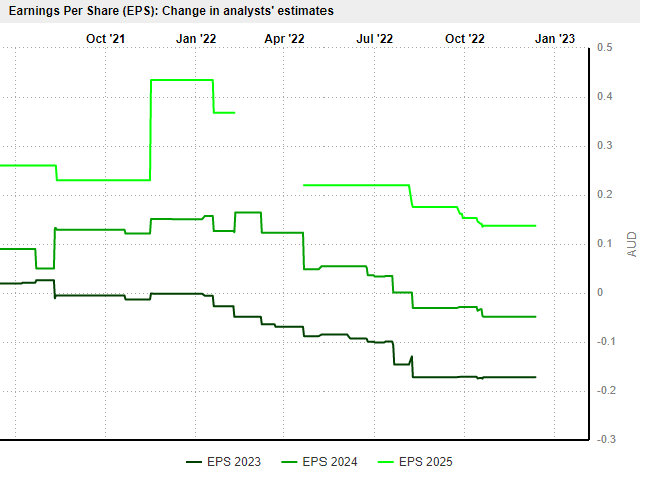

While Firetrail has doubled down on Megaport and remains upbeat about the firm’s outlook, consensus analyst EPS expectations have fallen from a peak in December 2021:

|

|

| Source: Market Screener |

FY24 analyst EPS estimates fell from 15 cents in December 2021 to minus 5 cents by December 2022.

Can it be 2023’s rebound winner?

Time will tell.

This lithium play runs out of steam

Battery materials and lithium stock Novonix [ASX:NVX] was close on the heels of Zip in terms of share price performance.

Year to date, NVX is down more than 80%. At one point this year, it was trading for more than $10 a share. Now, it’s wallowing at around $1.80 a share.

Novonix’s fall is emblematic of a wider story for lithium stocks in 2022.

After notching huge gains in 2021, many lithium stocks hit the ceiling in 2022.

In fact, Novonix was one of the top-performing stocks on the All Ords in 2021, gaining nearly 700% over that year.

But nothing goes up forever.

Covering 2021’s winners, I said then:

‘With plenty of upside already priced into stocks like LKE and NVX, how will the market treat these stocks in 2022?

‘Can the run continue, or will investors take profits and chase other themes in 2022?

‘In my view, higher valuations stoke pressure to justify the price.

‘2022 could see more scrutiny on the lithium sector as the focus shifts from ambition to execution.’

The lithium sector did have to deal with higher expectations in 2022, and some investors likely exited the play to focus on hotter themes like coal.

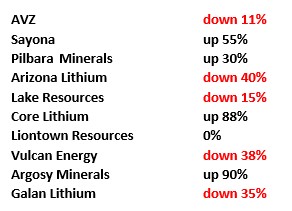

We can see the higher scrutiny on the sector by looking at the price moves of some lithium stocks between January and 13 December 2022:

|

|

Is there a lesson here?

Past success doesn’t guarantee future success. Past winners don’t always stay winners.

That’s especially the case with investing — a reflective exercise where mass expectations jostle with reality.

It’s harder for past winners to remain winners in the stock market because outperformance attracts capital and higher expectations. Both tend to work against future outperformance.

Which 2022 duds are likely to struggle again in 2023?

Zip is a prime candidate.

The scales have fallen from the market’s eyes on BNPL. The hype about the industry’s potential has curdled into pessimism.

Transaction volume and customer growth are not enough to impress investors these days. The criteria for BNPL stocks have changed.

What worked in the heyday to stoke investor enthusiasm won’t work nearly as well in 2023. Profitability is the benchmark by which BNPL stocks are now assessed.

The instalment firms have been given years to prove themselves, and they have shown they can onboard customers and merchants at a steady clip.

Now they have to show they can make a buck from this. So far, not so good.

While Zip’s management has pivoted toward profitability and free cash flow generation this year, it’s got a long way to go.

Zip posted a net loss of $1.1 billion in FY22, up from a net loss of $743 million in FY21. Cash outflows from operating activities hit $752 million.

Just yesterday, Zip tried to shore up its finances by aiming to minimise its debt obligations, launching a ‘liability management exercise’ on its $400 million senior convertible notes due 2028.

Zip announced a snap share placement to raise $12 million to redeem some of the convertible notes early, priced at 62 cents a share, a 13% discount to its last closing price.

The $12 million will serve as a kitty to dole out a cash incentive to existing noteholders to convert their notes to ZIP shares at $12 a share and receive $17,860 per $100,000 of existing notes.

Earlier this year, Zip outlined a revamped strategy that seeks to bring the firm to group profitability ‘during FY24’.

Next year will go a long way in telling the market whether that goal is feasible.

Until next week,

|

Kiryll Prakapenka,

For Money Morning