In today’s Money Morning…it was certainly an eye-opening event for tech stocks…the Apple of automakers…if it’s good for Tesla, it’s good for commodities…and more…

Yesterday we took a brief look at the massacre of Netflix shares.

The streaming company suffered its worst trading day since 2004! US$54 billion worth of investors’ money was wiped out in mere hours.

It was certainly an eye-opening event for tech stocks — a prelude to what may be more pain to come this earnings season…

But that hasn’t and won’t be the case for other big names in the tech sector.

Electric carmaker Tesla has proved that inflation isn’t a problem for its operations. In fact, contrary to what many may have thought, this EV pioneer is thriving more than ever.

In just the first quarter of 2022, Tesla has booked profits of US$3.32 billion. That’s a 658% increase on the US$438 million posted in Q1 of last year!

Needless to say, it seems the doubters are looking very wrong when it comes to Tesla.

So how has Elon Musk done it?

Well, the secret to Tesla’s success can be found in its margins…

The Apple of automakers

In Tesla’s results, what really stands out to me is its operating expenses.

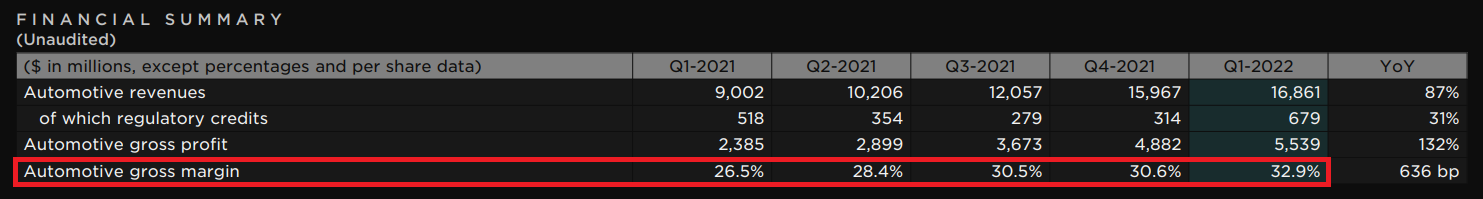

Somehow, despite rising inflation, supply chain bottlenecks, and soaring commodity prices, Tesla’s costs have only risen 15% year-on-year. Because of this, the company has managed to achieve an incredible gross margin of 32.9% on its automotive sales.

Granted, that has been helped by price hikes across its product range too — a move that has done little to dent demand for its EVs.

The point is that this gross margin is not common for other carmakers. As one analyst pointed out to Korean newspaper Hankyoreh late last year:

‘The gross sales margin of 30% is higher than those of German luxury carmakers BMW and Mercedes-Benz, and this standard is exclusive to the best luxury automakers like Porsche and Ferrari.’

In other words, Tesla is able to sell its cars at a mark-up that customers usually only pay for the most luxurious of vehicles. It’s a precedent that is not only remarkable for the industry but is also continuing to grow.

Just take a look at the margin improvements quarter-on-quarter for the past year:

| |

| Source: Tesla |

At this rate, if margins keep growing, Tesla could end up making some of the most profitable cars in history!

Of course, I do need to mention that a lot of this is possible thanks to handouts too. Tesla received regulatory credits (subsidies) in the order of US$679 million for this most recent quarter — a figure that is yet another record result for the company and translates almost directly into profit for shareholders.

It is fair to assume that at some point these handouts will be removed. Even so, it doesn’t diminish the incredible performance of this company and the trend that it has cultivated around electric car expectations.

Tesla is proof that big tech stocks still have the ability to deliver big returns and growth for investors. And not just for Tesla shareholders, I suspect…

If it’s good for Tesla, it’s good for commodities

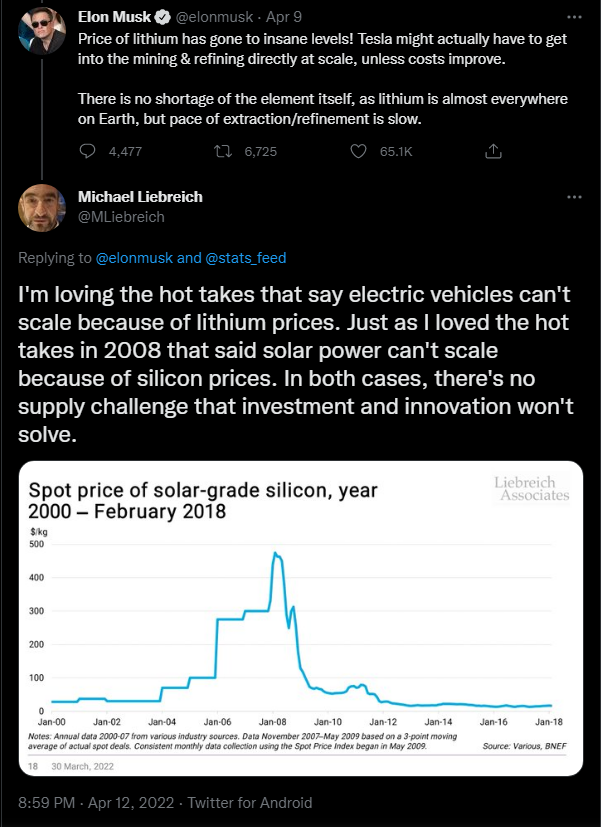

Aussie investors should know by now that Tesla’s success has helped a great deal in our local market. The incredible bull run in lithium stocks in particular is something that is hard to ignore.

Indeed, as my colleague and energy sector expert Selva Freigedo has discussed, we may be on the cusp of a lithium shortage. You can read more about that here if you missed it.

Because while a supply crunch for lithium and other battery metals is potentially bad news for Tesla, it’s great news for many Aussie miners. Rising prices could see many of the current crop of miners enjoying their own record profits. Or, for some of the smaller explorers, it could result in more interest in funding new mines and projects.

All in all, the point is that the commodities sector is booming thanks to this EV revolution. And it really looks like that won’t be coming to an end anytime soon.

As Musk himself quipped in a tweet, including a response from Bloomberg New Energy Finance founder, Michael Liebreich:

| |

| Source: Twitter |

This should tell you that the EV trend and the sub-trends surrounding it have more room to play out. And as an investor, that should have you excited about what is still to come.

Just as I concluded yesterday:

‘Growth isn’t a virtue; it is something that stems from brilliant ideas or breakthrough concepts. And if you’re looking for the best returns, you need to identify the companies with that potential.’

Tesla has shown it is capable of just that. And I can tell you right now that it won’t be the only tech stock to do so. Because despite the market sentiment, the bigger trends and narratives are still ripe for some big returns.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Due to the ANZAC Day public holiday, there will be no Monday edition of Money Morning. We hope you enjoy the long weekend with friends and family.