In today’s Money Morning…intrinsic? Extrinsic? You’ve got to be kidding me…cash hasn’t been viable since the GFC…cash isn’t just trash, it’s a dumpster fire…and more…

Now you may be thinking, what business does a carmaker have investing in crypto?

But it’s part of a broader wave of big institutions ploughing money into the increasingly accepted token.

As per the Australian Financial Review this morning:

‘Other companies have made similar investments in bitcoin. MicroStrategy has spent some $US1.1 billion on the token. In October, Square, headed by longtime crypto advocate Jack Dorsey, announced that it converted about $US50 million of its total assets as of the second quarter of 2020 into the token. Proselytisers like Bill Miller of Miller Value Partners have said this was just the start of what was sure to be a trend across Main Street.’

A few days ago, Elon ‘Your Favourite Billionaire’ Musk added #bitcoin to his Twitter profile and now the BTC price sits just north of US$44,000.

What followed was even more surprising.

In the last 24 hours is it was revealed in a Tesla Inc [NASDAQ:TSLA] filing that the company had ‘updated its investment policy’ last month and now intends to invest in ‘reserve assets’ such as Bitcoin [BTC] and gold bullion or gold exchange-traded funds.

Today, they hold $1.5 billion in BTC.

What about that last bit though?

Gold?

If that’s not a sign of the times, I don’t know what is.

That’s how quickly fiat is devaluing as central banks race to the bottom.

Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.

Intrinsic? Extrinsic? You’ve got to be kidding me

Cue the comments from Bank of England governor Andrew Bailey via the BBC:

‘I have to be honest, it is hard to see that Bitcoin has what we tend to call intrinsic value…It may have extrinsic value in the sense that people want it.’

You’ve got to be kidding me.

There’s an argument out there that fiat hasn’t had intrinsic value since Nixon pulled the plug on gold.

There’s also an argument out there that even gold doesn’t have any ‘intrinsic’ value — it is after all just finite shiny stuff.

Hell, if you’re a nihilist there’s an argument going around that no human activity or creation (like money) has intrinsic value.

But I won’t wax too philosophical here.

Point is, we are on the cusp of a revolution here.

Yesterday, Ryan Dinse said the following:

‘My point today is that money has to change when it no longer fulfils its function as an equitable — without favour — store of value.

‘Of course, this process of change always threatens those currently wielding power. So, you’ve got to expect some pushback.

‘But in the end, in my opinion, better money will always beat bureaucratic meddling.

‘And more than that, this is about economic freedom too.

‘The colonists of early America recognised that without self-sovereign control over their money, they’d be economic slaves to Britain forever.

‘I think we’re at that stage with central banks.’

Couldn’t agree more — precipice or tipping point, it’s happening.

Cash hasn’t been viable since the GFC

This monetary revolution requires you to reconsider how best to go about preserving and even growing your wealth in a world of ‘late-fiat’.

I floated the idea recently that cryptocurrency could be a risk-off asset in the near future.

It’s radical, for sure. In fact, it flies in the face of what pretty much every financial planner in the world will tell you.

But conversely, what if cash became a risk(y) asset?

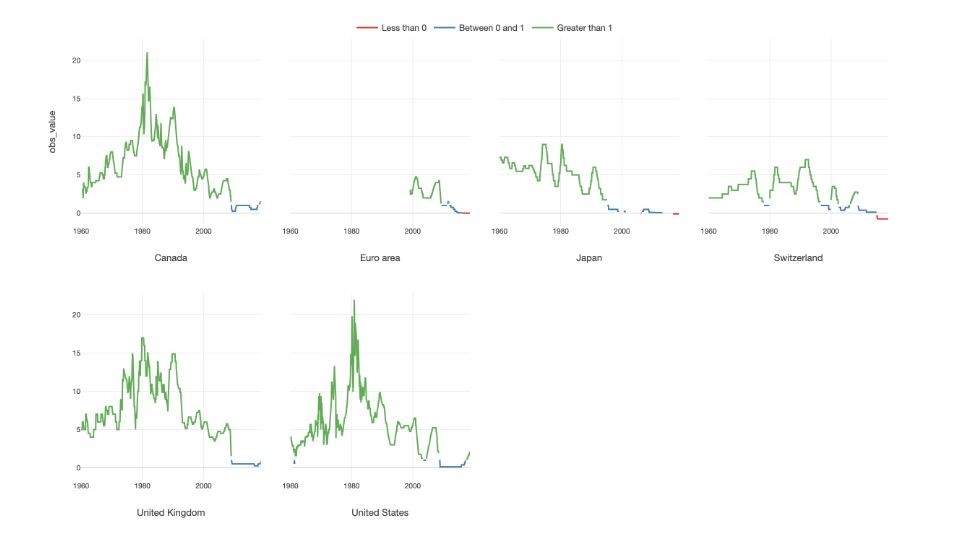

I know it sounds like heresy or outright lunacy, but consider this chart for a moment:

|

|

| Source: Exploratory.io |

Here you can see six different central banks’ rate policies going back decades.

It’s pretty much the same chart for all six.

Post GFC, rates came down sharply.

The final bit of life in cash’s ‘intrinsic value’ died that year.

It was probably crumbling earlier, say from 2000 onwards.

I was talking to a friend yesterday and he told me that one of our buddies from our old job had $100,000 sitting in his savings.

He said, ‘he’s very risk adverse.’

Fair enough.

But surely you break it up a bit — a little here, a little there? Get something for that pile of cash, because the Big Four’s deposit rates sure aren’t going to help.

Meaning, in an environment of central bank-enabled monetary madness, large fiat cash holdings could become risky if rates continue to go negative.

At this stage, cash isn’t just trash, it’s a dumpster fire.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments