The Temple & Webster Group Ltd [ASX:TPW] share price is up $1.06 or 12.91% today thanks to solid performance over the past two months.

At time of writing TPW shares are trading at $9.27 per share.

The TPW share price has tracked sideways since the announcement of their FY20 financial results.

Shares now look like they’ve broken past their resistance level.

Source: Tradingview

Temple & Webster keep the momentum going

The online furniture retailer has performed well thanks to the surge of online shopping during COVID-19 lockdowns.

Announcing its FY20 results last month, TPW earnings grew from $1.5 million in FY19 to $8.5 million.

That’s an earnings growth of nearly five times.

Over the past financial year, TPW hit several key milestones.

It hit its first $2 million day in June.

Completed a $40 million capital raise to strengthen its balance sheet.

And hit record levels of customer satisfaction.

Now the company looks to be in a position to set an even greater milestone.

In a business update provided this morning, TPW said it has already experienced year-on-year revenue growth of 161% to 27 August.

Earnings for July and August came in at $6 million.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Meaning if things continue to go TPW’s way, they could beat their record FY20 earnings in just three months.

CEO and co-founder, Mark Coulter had this to say:

‘As you can see from our trading update, Australians are still turning to the online channel to meet their ongoing needs. We continue to focus on customer satisfaction to ensure that customers who are trialling online shopping for the first time have a great experience and therefore will come back.

‘Our strategy of being a category specialist, with a clear customer offering built around the biggest and best range of furniture and homewares in the country, combined with the most inspirational content and services and a great delivery experience and customer service, is working.’

Is customer service the key to online success?

With online retail channels likely to experience higher volumes even after the coronavirus, is great customer service critical to the success of these channels?

Mr Coulter certainly thinks so.

Source: Temple & Webster

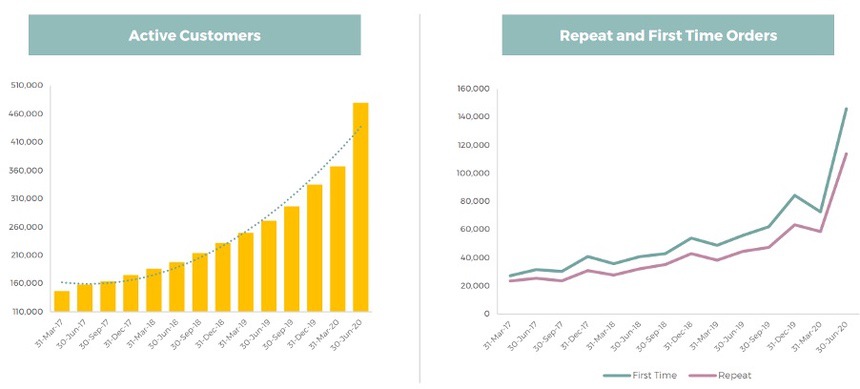

The graphs above demonstrate the success the company has had growing their consumer base.

And also retaining their customers.

But I feel that Mr Coulter might be a little too modest.

Many companies have seen boosts in revenue because of the lockdowns.

But how many will be able to continue their upwards trajectory?

Replenishing stock has been an issue for some online retailers that can hamstring profits later.

Moreover, having the cash on hand to secure stock is also an issue.

Strength of your balance sheet matters.

TPW appear to have navigated these issues well.

It currently has about $81 million in cash and no debt.

TPW also runs a drop-shipping model.

Meaning merchandise is shipped directly from the manufacture to the customer.

This enables faster delivery times and reduces the need to hold inventory thereby allowing a larger product range.

This innovative strategy has helped push the TPW share price up more than ~500% over the past 12 months with a market cap of close to $1 billion.

Adding TPW to the growing list of Aussie small-cap success stories.

But if you feel like you might have missed the boat with TPW be sure to check out these four innovative Aussie small-cap stocks set to capitalise on post-lockdown megatrends. Download the free report here.

Kind regards,

Lachlann Tierney

For Money Morning

Comments