Shares in telecom giant Telstra [ASX:TLS] have jumped today after the company announced widespread price increases.

As of this writing, Telstra shares are up 3.29% to $3.77 per share, their highest since April.

The surge comes as Telstra plans to raise prices on most mobile phone plans, including its cheaper Boost brand.

Some increases will significantly outpace the current inflation rate of around 4%, which was its pricing benchmark before plans were scrapped in May.

Before today’s gains, the company’s stock had been trading near multi-year lows as recently as May due to cost concerns.

So, is the recent surge a good time to invest?

Source: TradingView

Telstra’s Price Hike Strategy

The price increases, which will take effect on 27 August for postpaid plans and 22 October for prepaid plans, are a surprising shift in Telstra’s pricing strategy.

Previously, the telco had linked its annual price reviews to inflation. However, in May, Telstra abandoned this approach, citing a need for ‘flexibility to adjust prices at different times’ amid a broader restructuring effort.

Many customers had assumed this meant they wouldn’t see a price rise so soon after.

However, today’s changes seem to please investors, with analysts guessing that this shouldn’t significantly impact customer numbers.

Some key changes include the basic postpaid plan with 50GB rising to $65 from $62, a 5% increase.

The essential and premium postpaid plans will see a 4% price hike, while on the prepaid side, the monthly 35GB plan jumps to $59 from $55, a 7% increase.

While the prepaid six-month 70GB plan is soaring from $180 to $160, a substantial 12% rise.

Telstra CEO Vicki Brady emphasised the company’s balancing act, stating:

‘We’re trying to balance cost-of-living pressures with our need to continue to invest to manage technology evolution and continued strong customer demand on our mobile network.’

The company pointed to its $1.3 billion invested in its mobile network in FY24 as usage continues to rise.

Network traffic has increased approximately 3.5 times in the past five years and continues to grow by 20% per year.

Market Reaction and Outlook

The move surprised analysts, who had expected Telstra to delay price increases until next year, given recent cost-cutting measures and job cuts.

Regardless, today’s share price surge suggests investors favour price increases. While this obviously helps with revenues, the move also sees it join its competitors in similar hikes.

The telecom sector has faced challenges in recent years, with intense competition putting pressure on margins.

Telstra’s move could signal a broader trend of telcos looking to pass on more costs to consumers.

The long-term impact of these price increases on customer retention and market share remains to be seen, especially in a cost-sensitive economic environment.

With similar price increases of around 6–9% by Vodafone and Optus, this could be a case where customers grumble but accept it.

For current Telstra shareholders, today’s price jump may be a welcome relief after a period of relatively stagnant performance.

However, the company still faces significant challenges, including potential customer backlash and the ongoing need for heavy infrastructure investment.

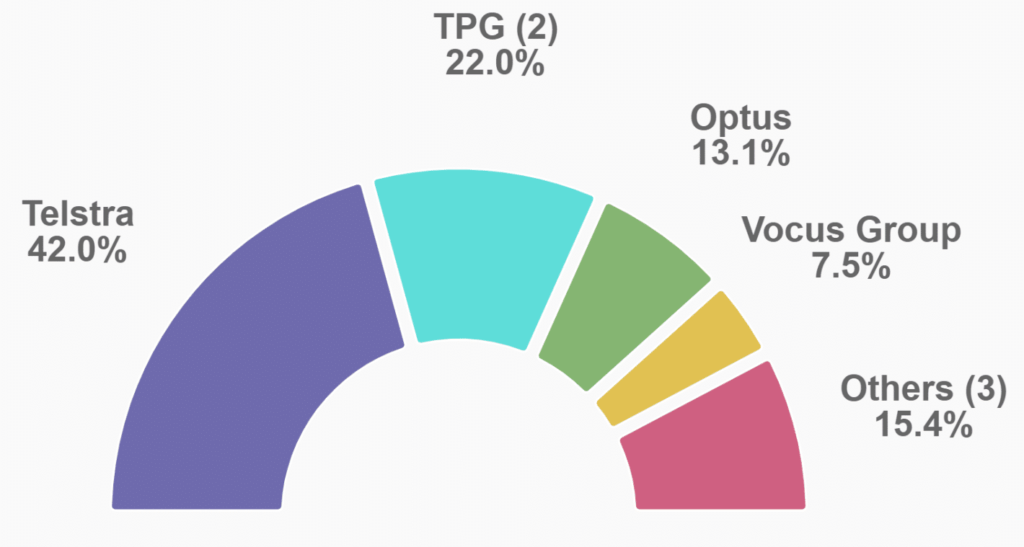

While Telstra still holds around 44% of Australia’s mobile market share, lower-cost rivals could force pricing wars at this moment.

Source: Techreport.com

In the coming quarters, investors should closely monitor key metrics such as customer churn rates and average revenue per user (ARPU) to gauge the reaction.

Consumers could become fed up as cost of living pressures continue to mount across the board.

Stocks for a Cost of Living Crisis

The economy is showing signs similar to those of a previous decade, one that left many people’s wallets and shares lost in the doldrums.

Don’t let history repeat itself at your expense; learn what you need to shift to stay on top.

Our latest report reveals the key to potentially benefiting from a world of high inflation.

We’ll show you the top investments for 2024, including cutting-edge growth assets that weren’t available 50 years ago.

Plus, learn which investments to avoid in this volatile climate. This isn’t just about survival — it’s about turning this economic flashback into an opportunity for growth.

Ready to protect your wealth from the looming ’70s-style economic storm?

Click here to learn how to access the full report and start preparing for the ‘decade of decimation’ today. Your wealth and legacy may depend on it.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments