In an announcement today, both Telstra Group [ASX:TLS] and TPG Telecom [ASX:TPG] have decided not to pursue an appeal against the Australian Competition Tribunal’s decision to reject their proposed regional network sharing deal.

The decision marks a significant turn of events in the ongoing efforts to enhance mobile network coverage in regional Australia.

Shares of both companies were flat in the morning trading, with investors focused on the outcome of a proposed $6.3 billion deal with TPG to sell fibre assets to Vocus Group.

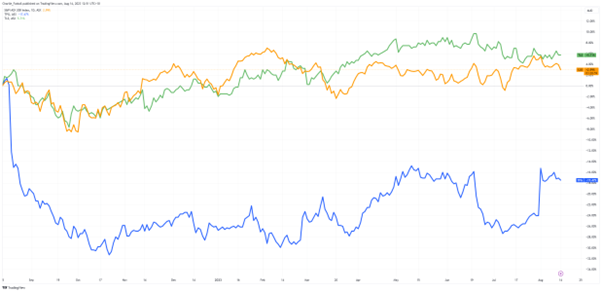

News of the talks leaked two weeks ago and sent TPG’s share price up by double-digits, recovering some of the losses it has seen in the past 12 months, with shares down 17.72% (in blue).

The deal will be seen as a broadside aimed directly at Telstra and its urban network’s market share.

Telstra has had a solid year, with shares up 6.62% (in green), as investors have maintained a steady interest in the traditionally defensive stock, known for its dividend yield.

Source: TradingView

Telstra and TPG won’t contest regional deal rejection

Australian telecom firms Telstra and TPG have said they would not appeal the ACCC decision to block an asset transfer deal between the two telco giants to improve regional mobile coverage.

The proposed multi-operator core network (MOCN) agreement, inked in February of 2022, aimed to reshape the telecommunications landscape by enabling TPG to leverage approximately 3,700 additional regional mobile sites.

This move would have led to a fivefold increase in TPG’s regional mobile network sites and elevated its mobile network coverage from 96% to 98.8% of the Australian population.

Underpinning the agreement was a strategic exchange: TPG was poised to decommission 725 mobile sites within Telstra’s coverage area.

Telstra, in turn, would have gained access to and the ability to deploy infrastructure across up to 169 of TPG’s existing mobile sites.

However, the Australian Competition and Consumer Commission (ACCC) opposed the deal, arguing that it would give Telstra an unfair advantage and lead to higher prices for consumers.

The ACCC’s concerns were echoed by the Australian Competition Tribunal, which ruled that the deal was ‘likely to substantially lessen competition’ in the mobile market.

In a statement, Telstra said it was ‘disappointed’ with the Tribunal’s decision but respected the outcome.

The company said, ‘We believe this deal would have delivered significant benefits for regional Australians, including improved coverage and choice’.

The decision to block the deal is a setback for Telstra and TPG. Both companies had hoped to use the agreement to accelerate their rollout of 5G networks in regional Australia.

It’s also a blow to regional Australians, who have long complained about poor mobile coverage and high prices.

Outlook for Aussie telcos

The decision not to pursue the deal further will send ripples through the Australian telecommunications landscape.

In the aftermath of the decision, both Telstra and TPG Telecom expressed their commitment to the regional cause, albeit through different avenues.

TPG Telecom, led by CEO Iñaki Berroeta, asserted that while the appeal had been relinquished, the company would not abandon its regional aspirations.

Instead, it would pivot its efforts toward advocating for sensible policy reforms to bolster connectivity and competition in regional areas.

Vicki Brady, CEO of Telstra, mirrored this sentiment, expressing her disappointment in the Tribunal’s decision while reaffirming the company’s dedication to driving change.

Brady pointed to the widespread support the proposal had garnered from regional communities struggling with low coverage.

This was highlighted by challenges in emergency responses during floods experienced throughout Australia earlier in the year.

The decision not to appeal will be celebrated by the second largest network provider, Optus, owned by Singapore Telecommunications.

The two telco titans have clashed before about regional coverage, with the blame being passed between each party and the government.

While the proposed deal may not have secured approval, the conversations it spurred and the aspirations it ignited remain invaluable.

The willingness of these industry giants to collaborate underscores the broader transformation underway in the telecommunications sector.

As the demands of a digitally connected world evolve, telcos must balance pursuing commercial success while delivering tangible benefits to consumers.

As Australia’s digital landscape continues to evolve, the focus now shifts to the future.

While the road to enhanced connectivity in regional Australia may have hit a regulatory roadblock, the determination exhibited by these industry giants bodes well for a future marked by increased competition and improved consumer services across the country.

In uncertain times like these, shareholders continue to hunt for defensive positions.

For investors, the bull may have already left the gate. The dividend yield from Telstra shares has fallen by 7% this year.

So where else can you look?

Finding dividends that are worth your time

The market has roiled stock investors for the past year — steady ground has been rare.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

If you think you’re overexposed or simply too defensive, you need to consider making a smart play.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For Money Morning