Enterprise SaaS stock TechnologyOne [ASX:TNE] has released its half-year results, notching its 13th year of ‘record first half profit’.

Profit after tax rose 18% to $33.2 million.

Despite the profit announcement, TNE shares dropped 4% in morning trade before recovering somewhat by the afternoon.

At the time of writing, TNE shares were down 1.5%. TechnologyOne is down 20% year to date:

Source: Tradingview.com

TNE’s record profit and revenue

TechnologyOne reported the following highlights from its half-year results:

- Profit After Tax up 18% to $33.2 million

- SaaS annual recurring revenue (ARR) up 44% to $225.1 million

- Total Revenue up 19% to $172.5 million

- Cash and Cash Equivalents up 16% to $116.4 million

- Expenses up 21% to $129.9 million

- R&D expenditure up 20% (before capitalisation) to $41.5 million (24% of revenue)

- UK segment profit up 100% to $2.3 million

Why is the discrepancy between total revenue and SaaS ARR?

TNE defines ARR as future contracted annual recurring revenue at period end.

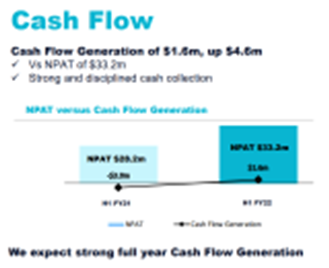

Despite profit after tax rising 18% to $33.2 million, TNE’s free cash flow was more modest.

TNE ended the half with breakeven free cash flow, as cash inflows from operating activities were offset by cash outflows from investing activities of equal amount.

A distribution of $32.5 million for dividend payments meant TechnologyOne ended the half with reduced cash holdings of $116.4 million, down from $142.9 million at the beginning of the period.

Regarding its cash flow generation, TechnologyOne commented:

‘Traditionally, cash flow generation for Technology One is weighted to the second half, aligned with customer payment anniversary dates, resulting in negative cash flow in the first half. This half-year, we delivered a breakeven cash flow generation result, with cash and cash equivalents up 16%.

‘Cash flow generation will be strong over the full year, and we expect it to represent approximately 85% of net profit after tax. Cash flow generation will progressively align to NPAT by FY24.’

Despite the negative cash flow this half, TNE still declared a dividend, increasing its dividend for the half year to 4.2 cents, up 10% on the prior year:

Source: TechnologyOne

TNE provides FY22 outlook and guidance

TechnologyOne was confident in its ability to deliver strong growth, despite the current economic climate.

TNE revealed SaaS ARR is expected to grow more than 40% within the coming year.

TNE CEO Edward Chung commented:

‘As we continue to win more customers and our SaaS Platform continues to scale globally, our profit margin will continue to expand.

‘Cash flow generation will be strong over the year, and we expect it to represent approximately 85% of net profit after tax.

‘Cash flow generation will progressively align to NPAT by FY24.

‘The company is well positioned to deliver continuing strong growth over the year, expecting Net Profit Before Tax growth for FY22 up 10% to 15% on FY21.’

Mr Chung noted concerns in the financial press about worsening global economic outlook due to inflation and rising interest rates.

However, Mr Chung remained upbeat about the direction of the company, arguing:

‘Over the past 35 years we have continued to grow strongly in challenging economic environments such as this. We will do so again because of the following reasons:

-

‘The markets we serve such as local government, higher education and government are resilient

-

TechnologyOne provides mission critical software with deep functionality for these markets

-

In times like this, these customers turn to ERP software to achieve greater efficiencies in their business. They save 30%+ by using our global SaaS ERP

-

Our subscription revenue contracts pass on inflation

-

We continue to benefit from improving margins because of the significant economies of scale from our single instance global SaaS ERP solution’

TNE said it was on track to deliver its goal of reaching total ARR of $500 million by FY26, from its current base of $288 million.

The scale of its expected FY26 ARR target means TechnologyOne anticipates its profit before tax margin to expand to 35%.

TechnologyOne is not the only firm to address concerns about the wider economic outlook and rising inflation.

Just yesterday, Aussie biotech stock Imugene addressed shareholders, aiming to quell recent share price performance concerns.

Businesses and investors alike are on high alert.

But while everyone is worried about rising rates and persistent inflation, some are also planning how to take advantage.

One of them is veteran strategist Jim Rickards.

Jim recently partnered with us on an investment portfolio geared to these turbulent times.

To hear more about his ideas for the current times, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning