Tuesday morning, SaaS (software-as-a-service) developer TechnologyOne [ASX:TNE] presented its financial results for the full reporting year.

The tech company boasted record SaaS ARR (Annual Recurring Revenue) growth of 43% with SaaS ARR totalling $274.2 million, pushing up record profit for the year by 22%.

The year’s record results has the company thinking it may surpass $500 million in ARR by 2026.

TNE shares spiked more than 6% as investors digested the news.

In the past month, shares were boosted 11%, and TNE is up 2% year-to-date:

www.TradingView.com

TechnologyOne’s FY2022 results unveiled

Today, the SaaS developer provided its financial results for the full year ending 30 September, FY2022.

TNE announce this was its 13th year of record results across profit, revenue, and SaaS fees.

These were made up of the following highlights:

- ‘Profit After Tax of $88.8m, up 22%

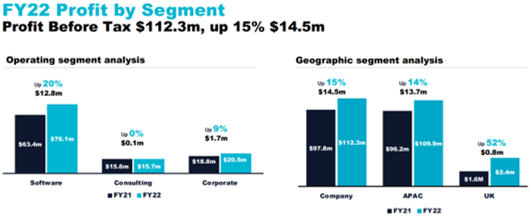

- ‘Profit Before Tax of $112.3m, up 15%, at the top end of guidance

- ‘SaaS Annual Recurring Revenue (ARR) of $274.2m, up 43%

- ‘Total Annual Recurring Revenue (ARR) of $320.7m, up 25%

- ‘Total Revenue of $369.4m, up 18%

- ‘Revenue from our SaaS and Continuing Business of $358.7m, up 22%

- ‘Expenses of $257.1m, up 20%

- ‘Cash Flow Generation of $77.2m, up 21%,

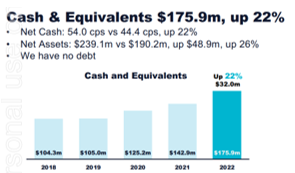

- ‘Cash and Cash Equivalents of $175.9m, up 22%

- ‘Total Dividend of 17.02cps, including a special dividend of 2.0 cps, up 22%

- ‘R&D investment of $92.2m before capitalisation, up 19.6%, which is 25% of revenue’

Contributing to these results were more than 800 large enterprise organisations accomodating millions of users.

The tech developer is a market leader in the local government sector, with 20 new deals closed in FY22, bringing a grand total of $63.9 million in contract value.

CEO Ed Chung commented:

‘Our ability to deliver these results is due to TechnologyOne’s clear vision, strategy, culture and our significant investment in R&D.

‘Our strategy is clear — we strive to deliver a compelling customer proposition, providing our customers with any device, any time access from anywhere around the globe, as well as a simple and cost-effective way to run their enterprise.

‘We also exceeded our ambitious annual recurring revenue (ARR) targets and ended legacy licences. I’m proud to announce that we have successfully completed our strategy ahead of schedule.

‘I’m thrilled to see that adoption of the TechnologyOne global SaaS ERP solution (CiA) is exceeding our expectations.’

Source: TNE

The continuing path of TNE growth

Mr Chung said that the company now has fourth-generation global SaaS ERP (Enterprise Resources Planning) and has re-engineered its code base with SaaS technology.

‘No other ERP company in the world has successfully made the transition to SaaS without impacting its customers and/or its profit growth,’ Chung stated.

‘With our SaaS business growing faster than expected, TechnologyOne is on track to surpass our target of $500m+ ARR by FY26.’

TNE is set to release new products and solutions that Chung believes will enable the business to double its size every five years.

The company ended the year on a cash balance of $175.9 million, with $77.2 million in cash flow generation for the full year and no debt.

These results saw the tech developer release a special dividend of 2 cents per share in addition to final dividends of 10.82 cents, with the full-year dividend increasing to 17 cents a share, another increase of 22% year-on-year.

Souce: TNE

Exciting fintech stocks for 2023

2022 was tough for many fintechs, with profitability seeming like a far-fetched dream.

Many fintechs suffered from overconfidence in the ‘growth-at-all-costs’ business model that caught them off guard when the markets turned.

Growing and profiting simultaneously was not a commonly harmonious partnership.

But with the right choices, some fintechs can grow into very sturdy, lucrative businesses.

Our market expert, Ryan Clarkson-Ledward, has done the necessary research required for discerning these.

He’s discovered three profitable fintech stocks flying under the radar. One of them, he says, is a start-up ‘wrestling with the big banks — and winning’.

Click here for the free report.

Kind regards,

Mahlia Stewart

For Money Morning