‘I think we’ve forgotten the basics. We’ve become prosperous for so long, we took so many things for granted, we forgot how much work it took to build. We’re now faced with re-learning these things.’

Steve Jobs, 1991 interview

‘Nothing like this has happened before…but here we go again!’

Former Russian PM,

Viktor Chernomyrdin

My Grandad was an old-school banker back in a time when banking was an honourable profession.

He managed a branch in a small village in the highlands of Scotland. His customers were mostly farmers from the surrounding area.

He was an integral part of this rural community.

My Mum tells me how he used to drive long and windy roads to people’s houses for ‘business’ meetings. But really, they were mostly catch-ups with old friends, with a bit of banking on the side.

He was part banker, part trusted business advisor, and part friend.

Sometimes, in winter, he’d get caught up in a snow storm and have to wait it out at the customer’s house with a dram (or two) of whisky, staying well into the wee hours!

Driving down country roads in the dead of winter after a few whiskies seems like a fairly risky idea to us these days.

But my Grandad and his farmer friends were probably the most risk-averse people you could come across.

Farmers have always known to be ready for anything. To ‘make hay while the sun shines’, as the old saying goes.

Their profession is inherently risky. The weather, disease, rainfall, crop behaviour, and numerous other variables can — and do — go wrong.

That’s why farmers are always hoping for the best, but are preparing for the worst.

Similarly, my Grandad — who had fought in the Second World War — knew that life could throw up nasty surprises.

A lot of his friends from childhood died fighting with him in the Gordon Highlanders regiment.

Such experiences, I imagine, would drive home the fact that life is uncertain. Black swans are real.

That’s probably why, after the war, he became a banker. At that time banking was a conservative occupation and a natural fit for a cautious man.

And back then, the principles of finance revolved around the idea of managing risks…

Long-forgotten, time-honoured truths

Everyone knew them.

They’d grown up knowing them.

Aphorisms of wisdom burned into their brains.

Don’t borrow what you can’t afford to pay back.

Be fair in your dealings if borrowing or lending.

Delayed gratification is a virtue. (Every child should have a piggy bank to save up in.)

And the golden rule: Always have a stash of money up your sleeve in case something goes wrong…

These were ideas drummed down into my Mum, and in turn down to me.

When I was a financial advisor, I’d often fall back on these ideas rather than use the ‘modern’ portfolio theories of the day.

For example, when deciding how to allocate a client’s investment portfolio I’d always ensure they had at least three years’ worth of funds in cash. A ‘rainy day’ fund that would also help them ride out any bumps in the market.

My point is this…

We’ve long forgotten these basic principles of finance. The new way of things is to outsource risk to ‘someone’ else.

I mean, who’s got six months’ worth of income up their sleeves these days? Most are loaded up to their eyeballs in debt and could barely last six weeks.

Modern banks have happily encouraged this shift of debt from vice to virtue and reaped the short-term profits that came with it.

At the corporate level it’s even worse…

Today, in the midst of a crisis we’re seeing cries for help from the staunchest of capitalists — big corporations.

Cruise ship companies flagged under Bermudan jurisdiction to avoid taxes are suddenly looking to the US taxpayer for financial support.

Banks around the world demand ‘QE’ — a fancy term for access to cheap and free money — to prop them up.

Richard Branson — RICHARD BRANSON for heaven’s sake — wants a bail out for his Virgin airlines business!

It’s a cheek really…

Corporations who’ve spent years using spare cash to pump up their share prices through share buybacks and hefty dividend payments are suddenly short of a quid.

Where’s their rainy-day fund?

How can these well-paid people have so little clue about risk management?

My Grandad and his farmer friends would be turning in their graves at this short-sighted recklessness.

Profits are private; losses are social

These modern-day bastions of capitalism are all suddenly fans of big government.

And they’re sneaky in how they do it…

They’re out there using a combination of fear, blackmail, and financial complexity to eke out concessions from scared politicians who don’t want an economic disaster on their watch.

The fact is this…

We — the taxpayer — are being asked to underwrite the risks of private businesses.

In the modern world, profits are private; losses are social.

We saw this of course back in 2008 in the GFC. No sooner had the fat cats received government support, that executives were paying themselves fat bonuses again.

We can’t let that happen this time.

This might sound heartless but…

If businesses go under, they go under. I’m sure any good business will be bought over and hopefully improved upon by more prudent allocators of capital.

Capitalism only survives by rewarding risk takers and prudent alike.

My colleague Vern Gowdie has borne the slings of arrows of critics for years saying he was a panic merchant.

And yet here we are…

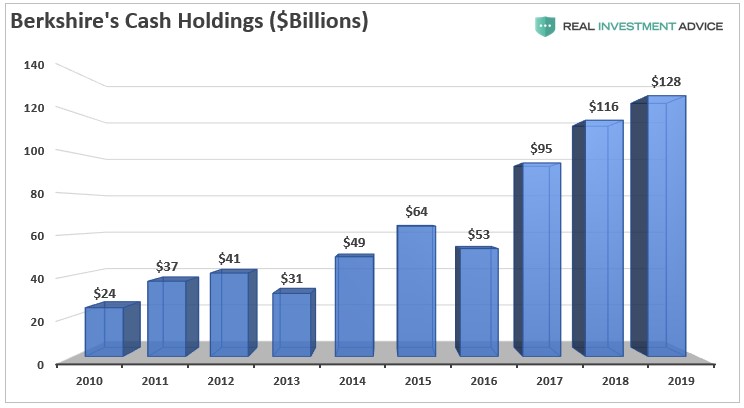

Or consider how Warren Buffett has spent years building a US$128 billion war chest of cash while other investors derided him, saying he was past it.

|

|

| Source: Market Watch |

It’s time for the Buffetts of the world to shine…

Prudent allocators of capital need to have their place for capitalism to survive.

You want people like him buying and running the banks, airlines — and even cruise ships — of the future. Not only will it probably be better for shareholders, it’ll also make future jobs more secure.

Because these people understand risk.

This is the long game you can’t lose sight of…

Don’t sacrifice the future

Look, I know if you have money in falling shares or a bunch of properties you’re worried about losing value, it’s tempting to think it’s the government’s job to prop up your investments in times like this.

After all, no one wants their wealth to fall.

I completely get that…

But the problem is actions now have unknown consequences later.

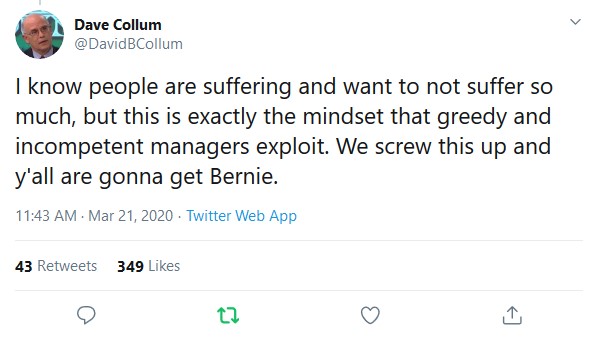

As this tweet puts it:

|

|

| Source: Twitter @DavidBCollum |

A lot of ‘crazy’ left-wing ideas are suddenly on the table. After all, if US$1 trillion can be pumped out at will, naturally a lot of people will think why not do this exact thing for their pet projects.

And you can’t blame them for thinking it. But it’s a dangerous road to go down for anyone who believes in small government and individual liberty.

Money will no longer be the reward for effort, hard work, or ingenuity. Instead it’ll be created and doled out at the stroke of a bureaucrat’s pen.

Lastly…

No one knows what the next black swan will be.

But we do know that this black swan event hit so hard precisely because we’ve spent the past few years sweeping issues of risk under the carpet.

We’ve topped up the dry powder of debt at every turn.

We’ve panicked and reduced interest rates to pump more money into the system on every small sign of danger.

We’ve ignored our frothy property bubble because it was convenient for everyone to feel rich.

Now, as a real danger hits us, we’re trying even crazier experiments which are turning into monetary madness. It’s a dangerous time.

I’ve no problem with a role for government. And some of the things they’re doing right now make sense. You have to provide a cushion of some sorts here for workers and small businesses effected by the shutdowns.

But if you don’t let the brutality of capitalism work its magic now, then the future could be a lot worse.

It’s time we got back to first principles…

Good investing,

Ryan Dinse,

Editor, Money Morning

Comments