Graphite producer Syrah Resources [ASX:SYR] said a restart of operations at its Balama project in Mozambique is underway with employees and contractors returning to the site.

Last month, Syrah announced operations at Balama came to a halt due to ‘illegal industrial action by a small contingent of local employees and contractors.’

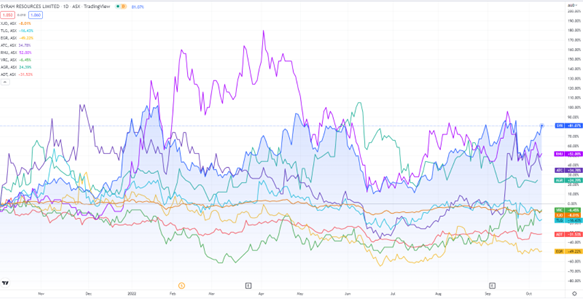

SYR shares rose as much as 6% on the news, and the company’s shares are up 65% over the past 12 months:

www.TradingView.com

Syrah’s Balama operation underway

On 26 September, Syrah revealed an operational halt at its Balama Graphite Operation, when a small group of workers went on strike.

Access to the site was blocked and operations were suspended.

On Tuesday, Syrah announced that operations will restart, with the return of employees and contractors enabling production and operational activities to resume.

SYR elaborated that it consulted with Mozambique government authorities to rectify the worker dispute:

‘Syrah has consulted with the relevant Mozambique Government authorities who endorse the Company Level Agreement (“CLA”) renewal process with the Internal Union Committee (“Union”) as the correct process for matters regarding Balama employment conditions. Syrah fully supports the rights of employees and contractors to collectively organise under Mozambican labour law. Mozambique Government authorities have committed to ensuring that illegal industrial action is not permitted to interrupt Balama operations.’

The company did tack on at the end of its update that temporary production halts at Balama may still occur.

SYR went on to explain:

‘Balama has operated on a campaign basis during 2022, and production may temporarily halt due to maintenance, inventory positions, product shipping constraints and other planned or unplanned factors.’

In June, the graphite developer provided its latest production report, revealing it produced 44,000 tonnes of natural graphite at 79% recovery sold and shipped during the June quarter.

35,000 tonnes were also sold and shipped during the March quarter and 19,000 tonnes in the December 2021 quarter, all inclusive, at a weighted average sales price of US$662 per tonne.

Lithium demand still looking strong

Have you seen more Teslas out on the roads lately?

It’s likely you have.

Tesla sales — in fact, EV sales — are continuing to rise.

Vehicle manufacturers are madly securing supply chain deals, and governments are throwing out funding programs for EV initiatives across the globe.

The US, for instance, is allocating US$20 billion in low-interest loans while Biden campaigns for the importance of renewable energy.

And yet, our energy expert, Selva Freigedo, believes the global push for EVs could lead to a battery metals supply crunch.

Can investors play this to their advantage?

Check out ‘Three Ways to Play the Great EV Battery Race’ for free, here.

Regards,

Kiryll Prakapenka

For Money Morning