Three things from me today…

1. Back in 2023 I made the case for buying up the stock market while it was down in the dumps.

One reason was because margin debt in the Aussie market was so low.

‘Margin’ is when investors use borrowed money to buy shares. This can be very profitable on the way up…but very dangerous on the way down.

Turns out margin debt in Australia is STILL very low.

Check out this from The Australian recently…

‘Total outstanding margin lending in Australia now estimated to be about $15.6bn compared with $35bn in 2008.

‘Reserve Bank figures show that the total number of margin lending accounts in Australia has fallen from a peak of about 240,000 in 2007 and 2008 to only 77,000 as of last December.’

Lots of margin means a more fragile market. So low numbers here are a good thing, from a risk angle.

Now, it doesn’t tell us whether the ASX has bottomed out, or what happens this week.

But it does suggest a more durable market that can withstand the current tariff shock once everybody gets their head around where we might be going.

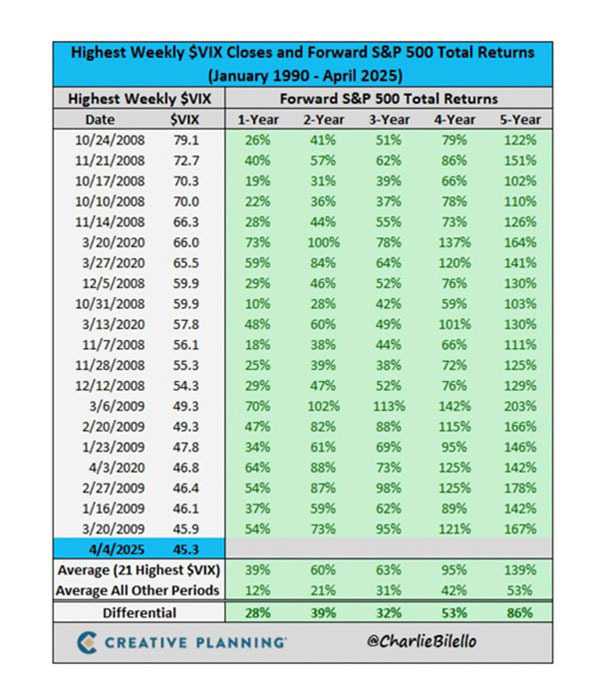

2. Then there’s the statistics around volatility…

We just had the most volatile period in the market since Covid.

Historically, buying shares when you get a big spike like we just saw shows good returns if you can look out 1-3 years.

Here’s a chart I shared with my readers last week…

| |

| Source: Charlie Bilello |

You don’t have to go crazy buying up everything in the next 5 minutes.

But now is a perfect time to kick over the market because so many shares have copped a flogging…even if they have nothing to do with the USA, tariffs or China!

My earnest suggestion is you start with these five ideas I released just as the market began to turn down.

All of them are down from the date I put out the report. My suggestion is to remember the wisdom of Warren Buffett:

“In the short term, the market is a voting machine. In the long run, it’s a weighing machine.”

Ask me in a year, and we’ll see if I was right or not. The table above suggests the odds are good.

Of course, even if I’m right about the market recovering, any of these 5 could flop because of individual factors.

I released a report around this time last year with five different ideas. Three went on to double in price. Two fizzled. I’d take that again.

Care to take a chance? Go here to get started.

3. One thing about the market sell down is that it can reveal which shares were bought back up, and fast.

There are big players in the market and there are certain names they want to own.

And don’t forget, tariffs might be a negative for most, but they do benefit for a few.

Lynas [ASX: LYC] looks to be one of these. China is suspending exports of some rare earth elements in response to the Trump tariffs.

The US will have to get them from somewhere. This is a strategic weakness because China has such a dominant grip on this market.

That puts Lynas in a strong position as a non-Chinese supplier.

I’m not telling you to buy it. It’s not a share I know deeply. But you might like to keep an eye on it.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

Murray’s Chart of the Day

— US Dollar Index Monthly Chart

| |

| Source: Tradingview |

There is so much going on in markets at the moment that I am spoiled for choice on the chart of the day.

I think the US Dollar Index [TVC:DXY] is the most compelling because it looks to me like we are about to see the US dollar selloff go nuclear.

100.00 has been a key level for the DXY since 2015. Providing resistance for seven years, before a breakout in 2022 saw it become support.

There is a clear wave to the upside that the US Dollar Index made from 89.00 to 115.00 over 2021 and 2022.

The point of control of that wave sits at 102.00 and has been providing support for the last couple of years.

Now that the US dollar Index has fallen below major support between 100.00-102.00 there is a clear target to the buy zone between 92.50 to 95.50.

The way things are looking it may not take that long to get there.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments