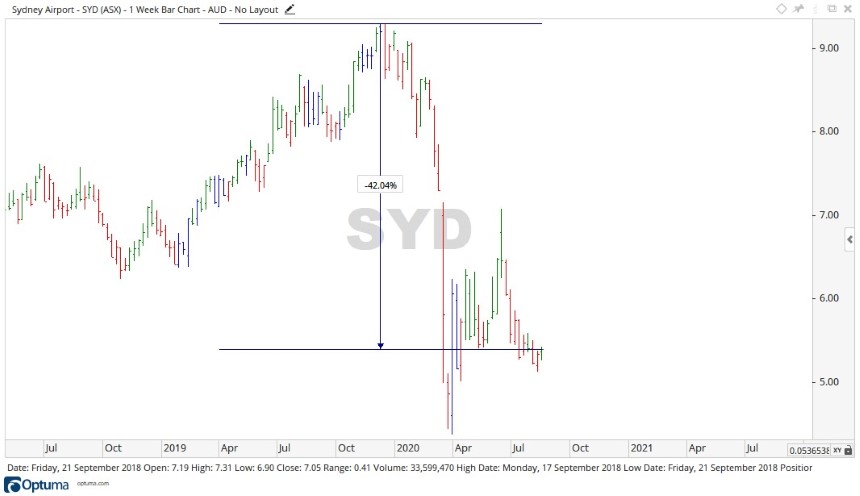

So far 2020 is not shaping up as a good year for Sydney Airport [ASX:SYD]. International travel is still at a standstill.

With no global travel, airports across the world are empty and this is reflected in Sydney Airport’s share price. Sitting at $5.39 at the time of writing, the company is in a trading halt while they look to improve their balance sheet.

Source: Optuma

What’s happening at Sydney Airport?

Recently we looked over Sydney Airport passenger numbers and the impact of the COVID-19 virus.

There is now a plan in place to mitigate the pain from the fallout from the pandemic. In a recent announcement the company released their half-yearly results and a plan to strengthen their balance sheet.

The half-yearly results for 2020 make for some sobering reading:

- ‘Loss after income tax expense was $53.6 million for the half year

- ‘Passenger volumes for the half year were materially impacted by the COVID-19 related traffic restrictions, implemented progressively from February 2020

- ‘Sydney Airport welcomed 9.4 million passengers for the half year, a 56.6% decline on the prior corresponding period (pcp).

- ‘Total passengers in 1Q 2020 was 9.0 million, down 18.0% on pcp. Total passengers in 2Q 2020 was 0.4 million, down 96.6% on pcp.

- ‘International passengers declined by 57.3% and domestic by 56.1% on the pcp

- ‘Earnings before interest, tax, depreciation and amortisation (EBITDA) was $300.4 million, down 35.4% on the pcp’

While the situation for the aviation industry and those involved looks grim currently, to the credit of Sydney Airport, they have reacted swiftly to keep the company pointed in the right direction.

With all this in mind, Sydney Airport went into a trading halt and announced an entitlement offer to raise $2 billion.

Where to from here for SYD shares?

It’s hard to underestimate the sheer size of this capital raise.

With $2 billion the company is looking to protect their long-term future, with so much uncertainty around when aviation will get back to normal, measures needed to be taken to assure the future of the airport.

Source: Optuma

The company is currently in a trading halt. As with many capital raises, a slide may be on the cards down towards the discounted issue price.

The discount comes in at 15.4%.

In the last few weeks the price continued to slide down to $5.39, should this continue then the levels of $5.13 and $4.83 may provide future support.

Should bargain hunting start to creep in, then the level of $5.82 may become the focus.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Click here to learn more.

Comments