Australian fertiliser and energy producer Strike Energy [ASX:STX] shares have taken a major hit today, nosediving over -30% this morning as it returned from a trading halt.

Investors have been dropping their positions after the company released an update on its testing of its South Erregulla (SE) Project in the Perth Basin.

Their newest SE-3 well was finished earlier this month but failed its first tests.

Strike’s 12 months before this were mixed— with shares going sideways as investors pegged hopes on its latest project bearing fruit.

Before today, its shares were up 15% in the past year. But with today’s sudden drop, they’re down -11 % in the past 12 months.

Is this an opportunity for value buyers or a trap in the making?

Source: TradingView

Well test issues

Today’s update gave us a blow-by-blow account of the testing failure. The update left many scratching their heads about what it means.

So what happened?

Upon completing the well’s production tubing earlier this month, Strike perforated the Kingia Sandstone at the well.

Instead of the expected flow, the test ‘fell short of expectations‘, and the well exhibited an ‘overbalanced state‘.

That’s when the pressure exerted on the formation is greater than the fluid pressure.

Consequently, Strike was forced to plug the area, use nitrogen to displace the fluids, and transition the well into an ‘under-balanced‘ condition.

No initial flow was observed despite removing the plug again last week to test again.

Further investigation via a slickline identified a fluid level at ~250m, potentially indicating a gas-water contact within the SE-3 well.

If all that means little to you, the key takeaway is that a gas-water contact is very bad.

Strike’s Managing Director & Chief Executive Officer, Stuart Nicholls, said today:

‘The SE-3 flow test has not matched its petrophysical interpretation, which is disappointing.

Further analysis and data collection is ongoing and Strike is reviewing the potential to return to the well.Looking forward, Strike will be drilling the Walyering-7 and Erregulla Deep-1 wells in

this half, which have the potential to add material 2P developed and undeveloped volumes on success.‘

The company will now move to up-dip the SE-2 well, which is ready for production testing and will begin testing in a week. After those tests, the company will give another update.

Strike Energy has secured gas sales agreements for around 42 petajoules from the South Erregulla gas field with AGL Energy [ASX:AGL] and South32 [ASX:S32] for a period of up to five years.

Thankfully, this is not Strikes only project.

Potential Investors will likely focus on the Walyering Project, while they look for reserve expansion in its other areas to offset this speedbump.

Strike operates Walyering after acquiring Talon Energy in mid-December 2023.

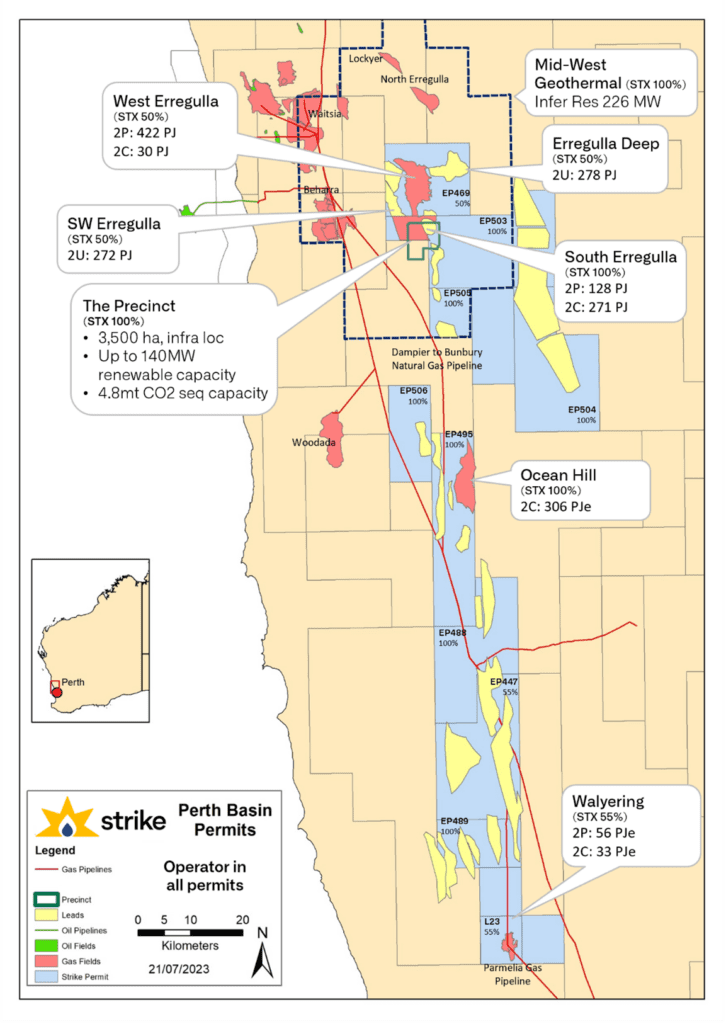

Beyond that, it also holds permits in other areas around the Perth Basin.

Source: Strike Energy

Outlook for Strike Energy

It is hardly surprising that Strike would eventually encounter this issue. Strike has drilled eight wells so far across the Greater Erregulla field.

While technology has come a long way, geo-modelling is not an exact science, and you are bound to hit water at some point.

Strike now faces the critical task of comprehensively analysing the SE-3 data and charting the next course of action.

Side drilling or other activities could remediate the issues at the SE-3 well. But nothing is guaranteed, and it’s likely to be expensive.

Success at Walyering-7 and Erregulla Deep-1 could mitigate the South Erregulla setback, but successful execution remains crucial from here.

The Ocean Hill’s project will also see a 3D survey this year that could hold promise. However, its ultimate impact on the broader project remains unclear.

For investors looking at a cheap entry from here, it will likely be prudent to await the upcoming update on both sites before considering it.

In its weakened state, Strike could become a target for a lowball acquisition, although no obvious companies are lining up.

Overall, the failure today is not a terminal one. While it is undoubtedly a large setback for the company, Strike will remain relevant as WA needs gas for its future.

The future demand for these critical fuels

Liquefied Natural Gas is a rapidly growing source of energy around the world.

Demand for LNG is expected to increase by 50% globally by 2030 as many countries attempt to shift away from heavier fossil fuels.

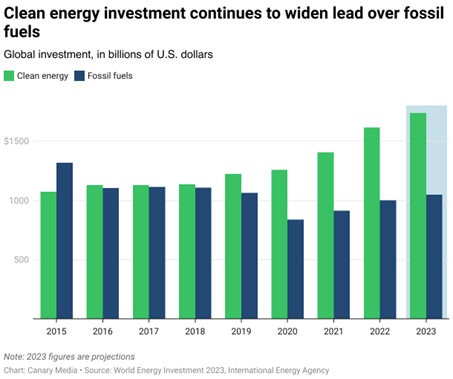

But can everyone get a slice of the pie when investment into exportation or new projects is falling each year?

Source: IEA

Our Editorial Director, Greg Canavan, has been investigating the cost and implications of Australia’s energy transition to renewables from a wide-eyed economic perspective.

He thinks he’s found a gap in the market where Australians can follow hedge fund investors and billionaires like Warren Buffett into smart investments before the market realises.

Buffett’s Berkshire Hathaway has seen the writing on the wall and is spending big, including:

- Buying 2.1 million shares of a Houston-based oil producer, one of the largest in the world.

- Increased its stake in Occidental Petroleum to 25%, worth over $13.5 billion.

- Spending $3.3 billion to boost its stake in a LNG export terminal in Maryland.

Warren Buffett is no fool, when the ‘Oracle of Omaha’ makes a move, it’s recommended you listen.

If you want to learn more about how you can position yourself in the coming Net Zero energy environment, and the potential U-turn governments will have to make, then…

Regards,

Charles Ormond

For Fat Tail Daily