Gold has been one of the best performing commodities over the past three years.

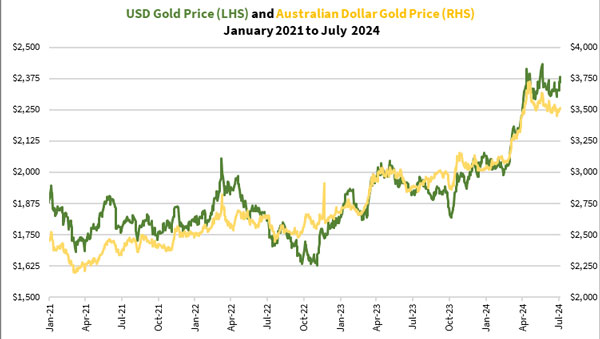

Let me show you gold’s steady and not-so-slow ascent since the start of 2021:

| |

| Source: Refinitiv Eikon |

In US dollar terms, gold rallied 25.6% since January 2021. For us in Australia, it’s even better as gold is up 42.3% during the same period. The Australian dollar weakened significantly against the US dollar.

Most people focus on the hottest investment of the year. They don’t think about the longer term.

And don’t expect the mainstream financial pundits and market commentators to talk about this either. It’s all about headlines and clicks.

Now a successful investor isn’t one that focuses on the short-term. Indeed, those chasing the hottest stocks of the year by following the headlines usually end up enriching those before them. They’re buying what the smart investors are selling.

If you’ve invested in precious metals assets during this time, it was a gruelling and rather unrewarding three and a half years. The only exception is if you’ve been buying gold bullion and ETFs.

While your results aren’t spectacular, a 40% return over these few years is solid. This is especially the case given how rough commodities were.

In the coming weeks, I want to discuss strategies for successful investing in precious metals assets.

In particular, I’m talking about gold stocks. But it’s more than gold stocks, we’re talking about mining companies that explore and produce silver and base metals as by-products.

This will become a series of articles as there are several strategies to cover.

Let’s start with the first strategy today.

The lure of risky investing –

a fundamental human nature

Human nature is an interesting thing. On one hand we’re predisposed to optimism and calculated risk-taking. On the other, we feel more pain in bearing a loss more than we enjoy the satisfaction of an equivalent gain (loss aversion).

That’s the reason why mankind proliferated. We went outside of our comfort zone, explored and multiplied.

Investing is similar. Rather than doing what our forefathers have done, innovators and entrepreneurs branch out to try something new, potentially enjoying the rewards of their ventures.

Gold: More than money,

it’s a business venture

Over time, society accumulates wealth from the efforts of those within. They store this in various forms. Gold is one of the earliest forms of stored energy, which became money.

But gold requires effort to extract. And gold mining companies became one of the thousands of ways to do business.

For generations, kingdoms and nations built their power and wealth with gold. They mined it, fought over it and hoarded it. The most powerful nations owned the most gold and controlled vast tracts of territory that could give them access to more gold beneath the ground.

In modern times, we should be thankful that we live in a more stable world. Nations do fight against each other for land and resources, but there’s less wars happening than the past.

For that reason, the pursuit for gold has become less oriented towards military conflict and more a business venture.

Gold mining companies have become a potentially lucrative form of investment. But it comes with its risks.

How I got into gold stock investing

I’ve invested in stocks for over two decades. But for the first ten years, I was a thematic investor chasing the latest macroeconomic story and deploying my funds accordingly.

It wasn’t particularly successful. As I said earlier in this article, I was more likely enriching those who saw the trends ahead of time, buying as they offloaded their holdings.

But in 2013 I decided to change my tactic. I learnt about ‘The Hidden Secrets of Money’ from Mike Maloney.

From there, I decided to go down the path of building my wealth with precious metals.

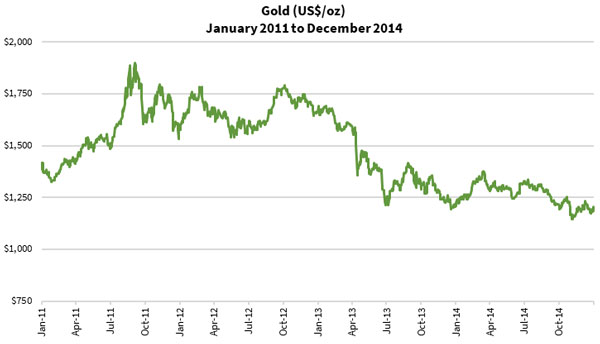

All this happened in a pivotal time for gold. The aftermath of the US Federal Reserve’s ‘Operation Twist’, a yield curve control strategy, helped pump up the long-term real yield of the US dollar and caused gold to plunge US$200 an ounce or 15% in a matter of weeks.

| |

| Source: Refinitiv Eikon |

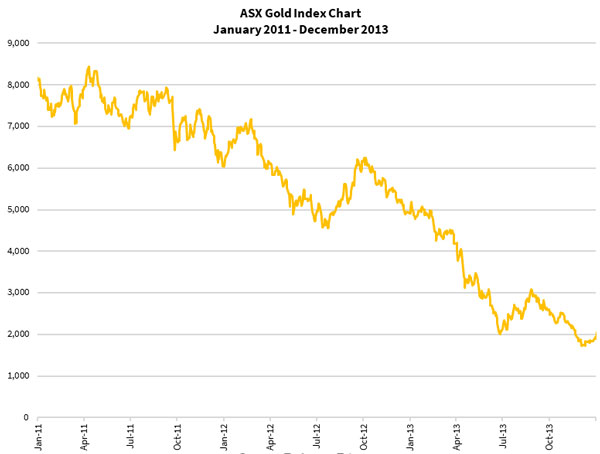

At the same time, this plunge in the price of gold caused a major selloff of gold stocks. Look at how the ASX Gold Index [ASX:XGD] fell from its highs in 2011:

| |

| Source: Refinitiv Eikon |

The biggest ASX-listed gold producer, Newcrest Mining, was trading at $44 in 2011. By mid-2013, the share price fell to just $10.

If that’s an eye-watering drop, you should look at what happened to the smaller gold producers. Mid-tier producers like Kingsgate Consolidated [ASX:KCN] was trading at $1.30 in July 2013, down almost 90% from its highs from $12 in 2010. Similarly, Perseus Mining [ASX:PRU] traded at 43.5 cents in July 2013, a far cry from September 2011 when it was $4.

Being young and ambitious, this is what attracted my attention. Gold and silver ETFs weren’t too interesting for me. I wanted something that could deliver BIG potential gains.

The momentous plunge for gold stocks was my chance to buy some deeply discounted gold stocks!

The entire gold and precious metals mining stocks space literally had the bottom fall out of it.

If I could buy these gold stocks as they recovered, the potential benefits could be huge.

Of course, it’s easy to invest with a goal. What’s challenging is the journey to get to the goal.

Successful gold stock investing strategy 1 – Size matters, but not what you think

Let me say this at the outset. Investing in gold stocks is easier said than done. These companies are sensitive to the market sentiment towards gold. A higher price of gold attracts more investors, which could float the entire space, and vice versa.

But it’s more than that.

Gold mining and exploring is a business. Their value is driven by their profits and future potential to generate the same.

Some investors are lulled into the fallacy that you can randomly buy a gold stock and make a bonanza return when gold recovers. Moreover, they’d go so far as buying the smallest companies with a market value of a few million dollars thinking these will enjoy the most leverage from gold’s gains.

So I set to work trying to identify which producers had quality mine assets and were financially viable.

Should I buy the larger companies like Newcrest Mining, Regis Resources [ASX:RRL] and Evolution Mining [ASX:EVN]?

Or should I focus on the smaller producers like Northern Star Resources [ASX:NST] (it was a junior producer delivering 100,000 ounces a year at the time), Ramelius Resources [ASX:RMS] and Silver Lake Resources [ASX:SLR]?

I researched deep and wide, searching through blogs, equity research reports and stock discussion forums.

There was one site that really opened my eyes. It was Tekoa da Silva’s Bull Market Thinking blog. Sadly, Tekoa closed that site down upon receiving an offer to work at Sprott Asset Management in early 2014.

Tekoa laid out a case that mid-tier producers delivered the best return-for-risk trade-off. These producers deliver 150,000-500,000 ounces of gold (or equivalent from by-product metals) each year. They may have more than one mine operation which could offset the risk of lower production or even none at all if a natural or manmade disaster leads to mine closure or suspension.

At the same time, these companies’ financial position should offer enough flexibility for expansion and dealing with tough times, such as a prolonged lull in the price of gold. We’ve seen that in the last 2 years when operating conditions became challenging with a rising price of oil and inflation affecting the global economy.

So why aren’t large producers as appealing?

Yes, large producers deliver more gold (500,000+ ounces of gold per annum) and may have multiple operations. Their scale of operations would help them cushion the impact of a hostile economic environment.

Given that, the market would price in both the scale of these companies and their lower risk. The potential returns will not measure up to the mid-tier producers.

Furthermore, you need more capital to keep a larger mine operation running. Therefore, management is more reluctant to suspend such operations should conditions turn hostile. We have seen large mine operations remain open while they generated losses just recently in 2022.

And what about junior producers?

A junior gold producer is likely to be a single mine operator. They may deliver a modest amount of gold, less than 150,000 ounces a year. This leads to concentration risk as a disaster could take the company’s sole-revenue generating asset offline. It could become a disaster if the company has debt outstanding, which it used to fund the building of the mine.

A successful junior producer would undoubtedly deliver much better returns than a larger one. We saw that with Northern Star Resources [ASX:NST] in 2013-16, Ramelius Resources [ASX:RMS] in 2014-18 and Emerald Resources [ASX:EMR] in 2021-23. This is because it could enjoy a bigger recovery when investors price its underlying value correctly.

All up, the risk-reward trade-off for junior producers isn’t as attractive as mid-tier producers.

So size matters with investing in gold producers. But it’s not what you’d think.

Stay tuned for strategy 2

I’m going to wrap up today’s article here. There’s quite a lot to take in, but I hope you get the idea.

With gold again on the rise, pay attention to how gold stocks move. I suggest keeping track of the ASX Gold Index [ASX:XGD].

And if you’re ready to jump on board, check out my precious metals investment newsletter, The Australian Gold Report.

But if you want to keep your options open, we have a special offer in The Decade of Decimation. Click here to find out more.

I’ll be back with part 2 of this series the Tuesday after next as I’m off to Bali for a short holiday with my family on Friday.

Till then, take care.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments